INFORMATION ABOUT GROVE

OUR VISION

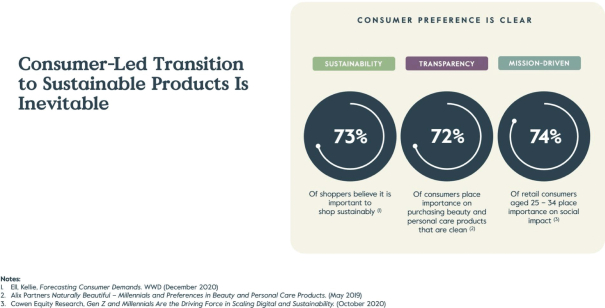

Grove is transforming the consumer products industry into a force for human and environmental good by relentlessly creating and curating planet-first, high-performance brands and products. Because sustainability is the only future, and what we do now matters.

OVERVIEW

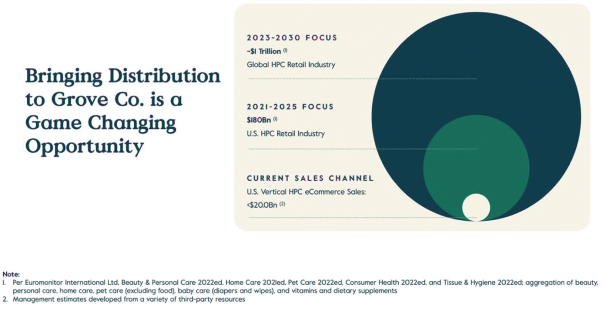

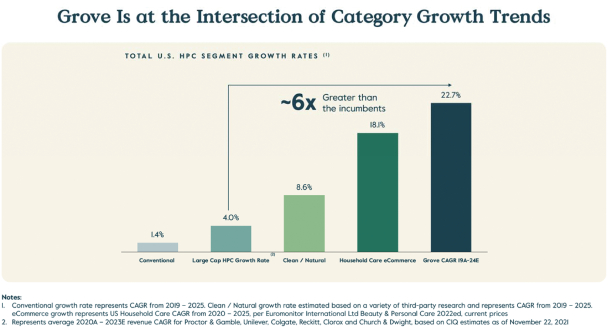

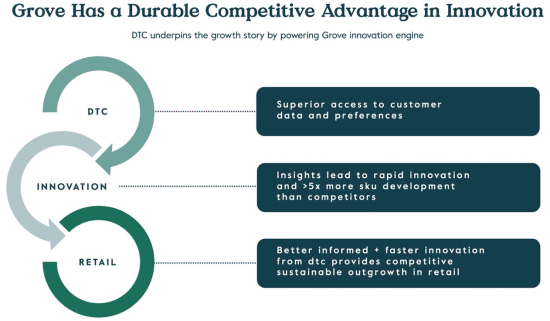

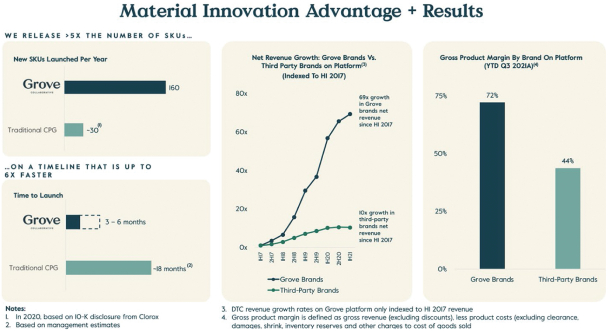

Grove is a digital-first, sustainability-oriented consumer products innovator. We use our connection with consumers to create and curate authentic, disruptive brands and products. Grove builds natural products that perform as well as or better than many leading CPG brands (both conventional and natural), while being healthier for consumers and the planet.

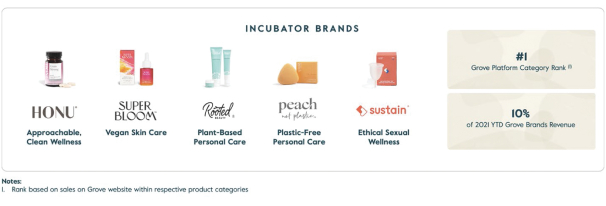

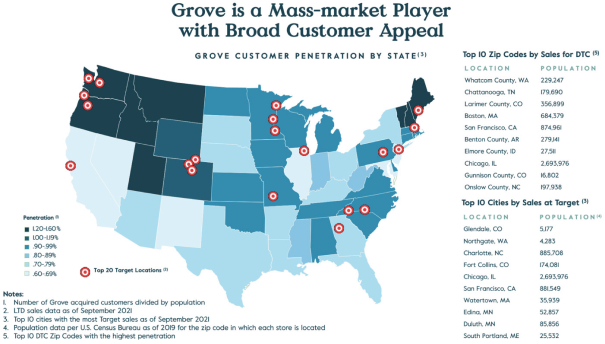

Grove’s omnichannel distribution strategy enables us to reach consumers where they want to shop. We operate an online website and mobile application (“

direct-to-consumer

DTC platform

”) where we both sell our Grove-owned brands (“Grove Brands

”) and partner with other leading natural and mission-based CPG brands, providing consumers the best selection of curated products across many categories and brands. In the trailing twelve months ended September 30, 2021, we generated approximately 56% of our gross merchandise volume from Grove Brands, and 60% from home care products. As we grow our product assortment and distribution in beauty and personal care, we expect the contribution of sales from these categories to increase. Over the last five years, our Grove Co. brand has emerged as a market leader in several important categories including sustainable home care and natural home care. Grove Co. has also quickly established itself as a leader in the hand, dish, and cleaning categories at Target.

direct-to-consumer

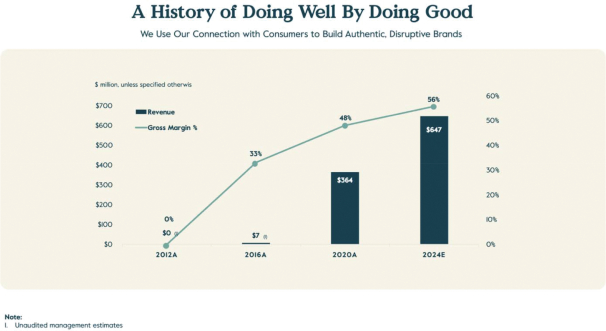

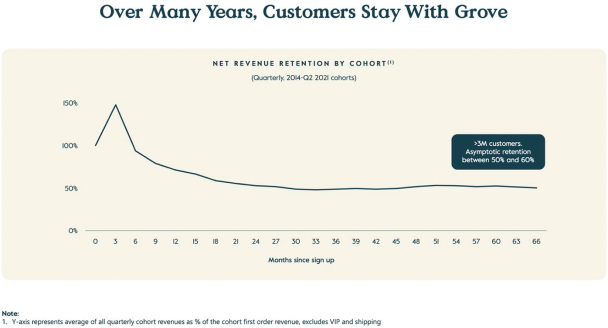

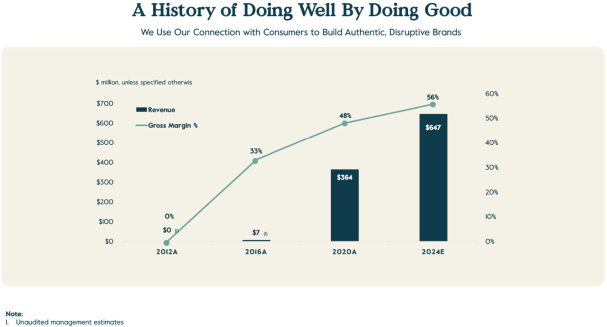

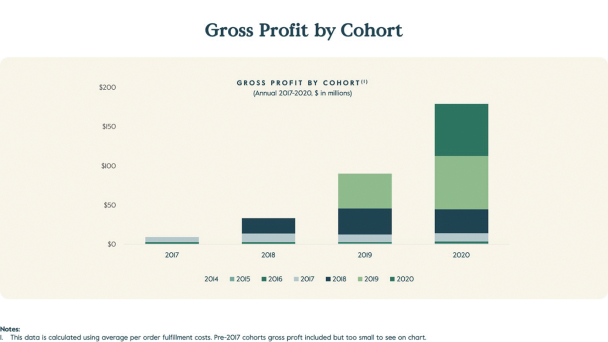

Grove is a public benefit corporation and a Certified B Corporation, meaning we adhere to third party standards for prioritizing social, environmental, and community wellbeing. We have a history of doing well by doing good, which is supported by our flywheel: as we have grown, our product development capabilities and data have improved. That improved innovation grows both topline and expands margins as our innovation tends to be both market expanding and margins accretive.

214