Investor Presentation Q3 2025 As of November 13, 2025

All information in this presentation is as of November 13, 2025. Forward-Looking Statements Certain statements included in this presentation are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1996, as amended. Forward-looking statements are statements other than statements about historical fact. The forward looking statements in this presentation include, but are not limited to, statements regarding momentum and plans in the remainder of 2025 and beyond; future growth, scaling of advertising expense and operating and expense discipline; future financial results; 2025 guidance, including full year and fourth quarter 2025 guidance for revenue and Adjusted EBITDA. and future increases in products offered. These forward-looking statements are subject to a number of risks and uncertainties, and you should not rely upon the forward-looking statements as predictions of future events. The future events and trends discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Grove cannot guarantee that future results, levels of activity, performance, achievements or events and circumstances reflected in the forward-looking statements will occur. Except as required by law, Grove disclaims any obligation to update these forward-looking statements to reflect future events or circumstances. The forward-looking statements are subject to a number of risks and uncertainties, including: potential disruptions relating to Grove’s technology platform transition to third parties, changes in business, market, financial, political and legal conditions; risks relating to the uncertainty of the projected financial information; Grove’s ability to successfully expand its business; competition; risks relating to inflation and interest rates; risks relating to the technology platform transition and those factors discussed in documents of Grove filed, or to be filed, with the U.S. Securities and Exchange Commission. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. These forward-looking statements should not be relied upon as representing Grove’s assessments as of any date subsequent to the date of this presentation. See Risk Factors in our Form 10-Q filed November 13, 2025. Non-GAAP Information Grove uses certain non-GAAP measures in this presentation including Adjusted EBITDA. Grove believes the presentation of its non-GAAP financial measures enhances investors' overall understanding of the company's historical financial performance. The presentation of the company's non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the company's financial results prepared in accordance with GAAP, and the company's non-GAAP measures may be different from non-GAAP measures used by other companies. Reconciliations of these non-GAAP financial measures to the most comparable GAAP measures, may be found in the Appendix at the end of this presentation. Safe Harbor Statement/Non-GAAP Measures

home, family, planet, healthier. Your

Grove’s transformation fuels momentum for future growth Strategic Pillars - Third Quarter Summary Balance Sheet Strength ➔ Re-prioritized liquidity during the quarter through a deliberate reduction in advertising spend and disciplined SG&A actions. Sustainable Profitability ➔ Focused on protecting cash flow and profitability through lower advertising investment and reduction of corporate workforce; expecting positive Adjusted EBITDA in the fourth quarter. Revenue Growth ➔ Delivered $43.7M in Q3 revenue, down 0.7% Q/Q and 9.4% Y/Y, the smallest year-over-year decline since 2021. Environmental & Human Health Leadership ➔ Advanced product transparency and sustainability by partnering with Gravity Climate on AI carbon disclosure.

Grove’s transformation fuels momentum for future growth Other Strategic Updates Fixing the Core Customer Experience ➔ Addressing key conversion friction points through the mobile app, subscription experience, and payment improvements. Strategic Options ➔ Continuing to execute the standalone turnaround, but also assessing opportunities that could accelerate our path to scale, strengthen our competitive position, or unlock additional value for investors through additional acquisitions, partnerships, divestitures, or other strategic transactions consistent with our mission and long-term vision.

MEASURING OUR IMPACT Q3 2025 Financial results

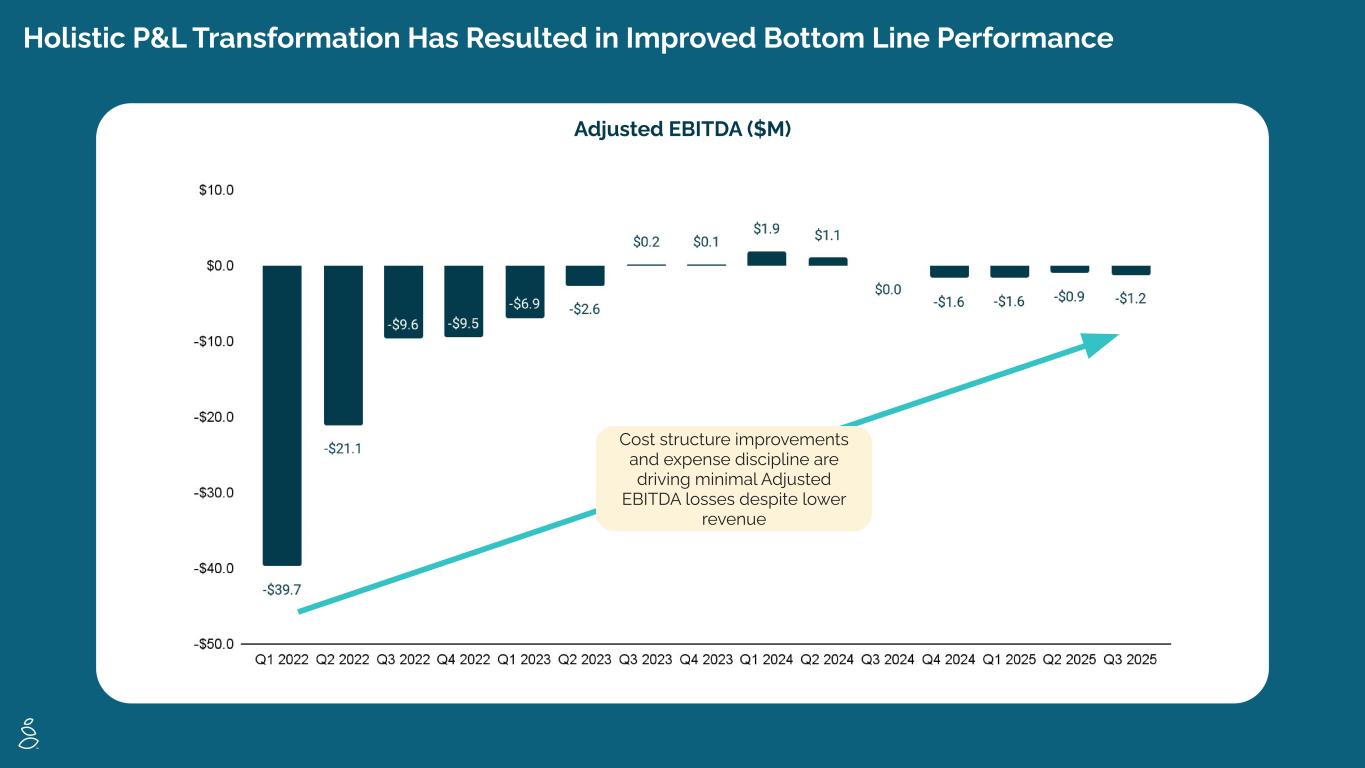

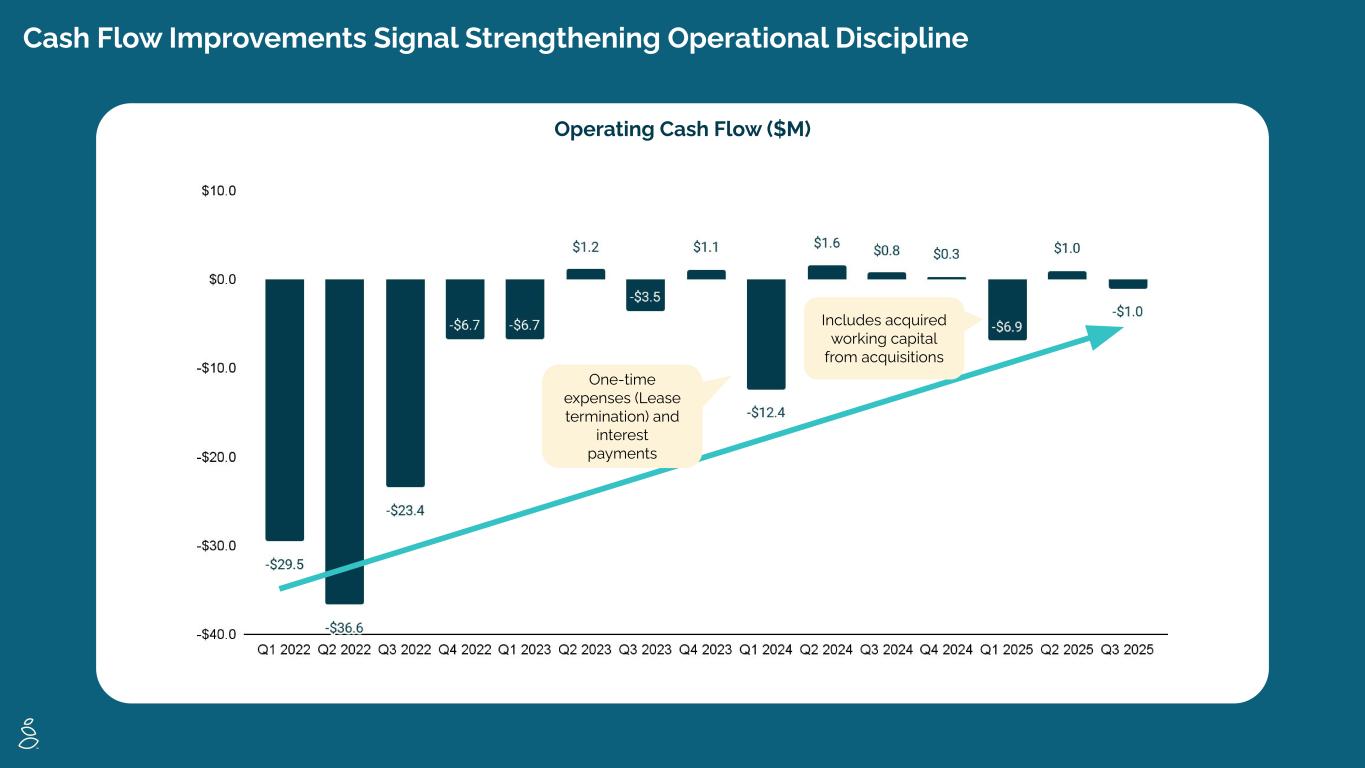

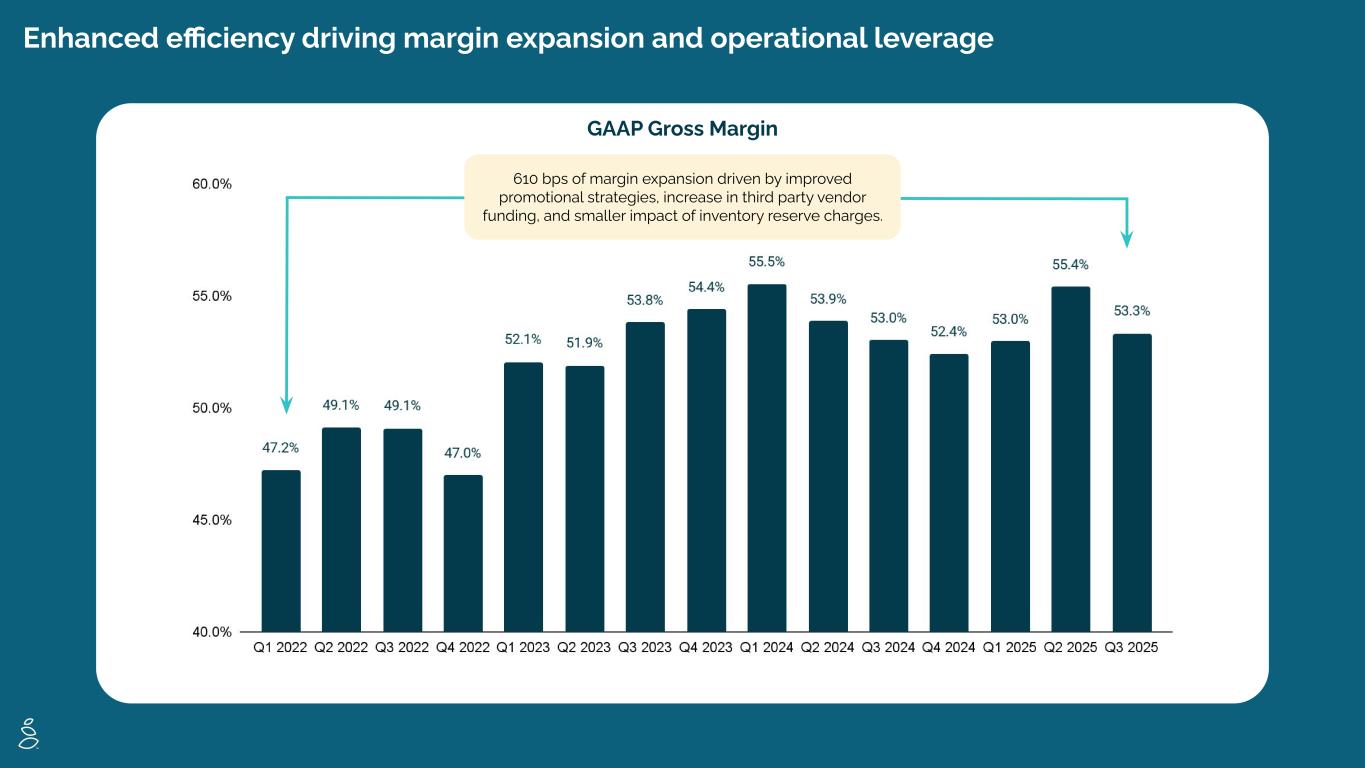

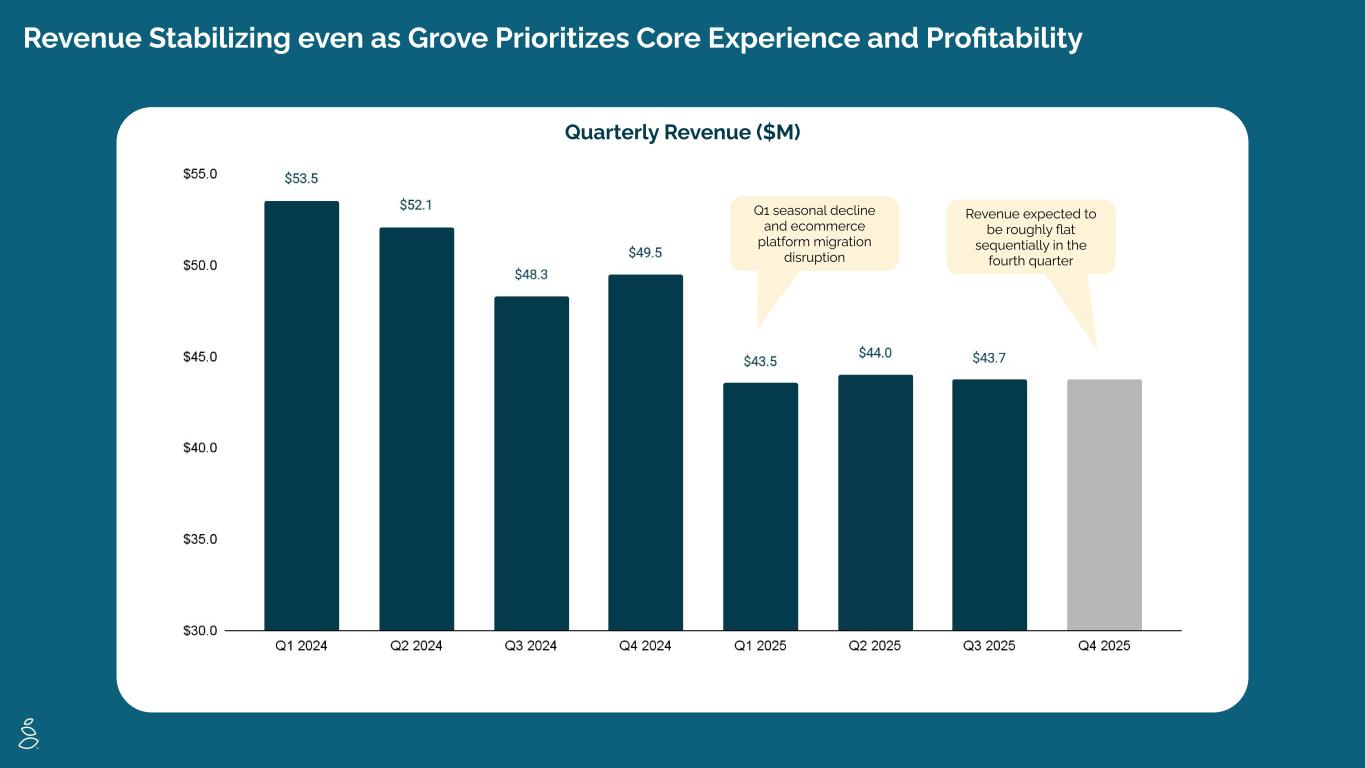

Q3 2025 Financial Results ADJUSTED EBITDA GROSS MARGIN REVENUE $43.7M -9.4% vs. LY -0.7% vs. Q2 25 53.3% +30 bps vs. LY -$1.2M, (2.7)% LY Breakeven -$1.0M LY +$0.8M Revenue performance marks our smallest year-over-year decline since Q4 of 2021. The decline versus last year primarily reflects the effects of reduced advertising investment in prior periods, which led to a smaller active subscriber base entering 2025, as well as the friction from our eCommerce migration that began earlier this year. Sequentially, fewer orders were partially offset by higher net revenue per order. Gross Margin improvement reflects more targeted and improved promotional strategies resulting in lower discounts, partially offset by a more favorable product mix. Adjusted EBITDA includes the flow through of lower revenue offset by cost structure improvements. Operating Cash Flow driven by quarterly net loss, net of non-cash expenses offset by a decrease in working capital. OPERATING CASH FLOW

Holistic P&L Transformation Has Resulted in Improved Bottom Line Performance Adjusted EBITDA ($M) Cost structure improvements and expense discipline are driving minimal Adjusted EBITDA losses despite lower revenue

Cash Flow Improvements Signal Strengthening Operational Discipline Operating Cash Flow ($M) One-time expenses (Lease termination) and interest payments Includes acquired working capital from acquisitions

Enhanced efficiency driving margin expansion and operational leverage GAAP Gross Margin 610 bps of margin expansion driven by improved promotional strategies, increase in third party vendor funding, and smaller impact of inventory reserve charges.

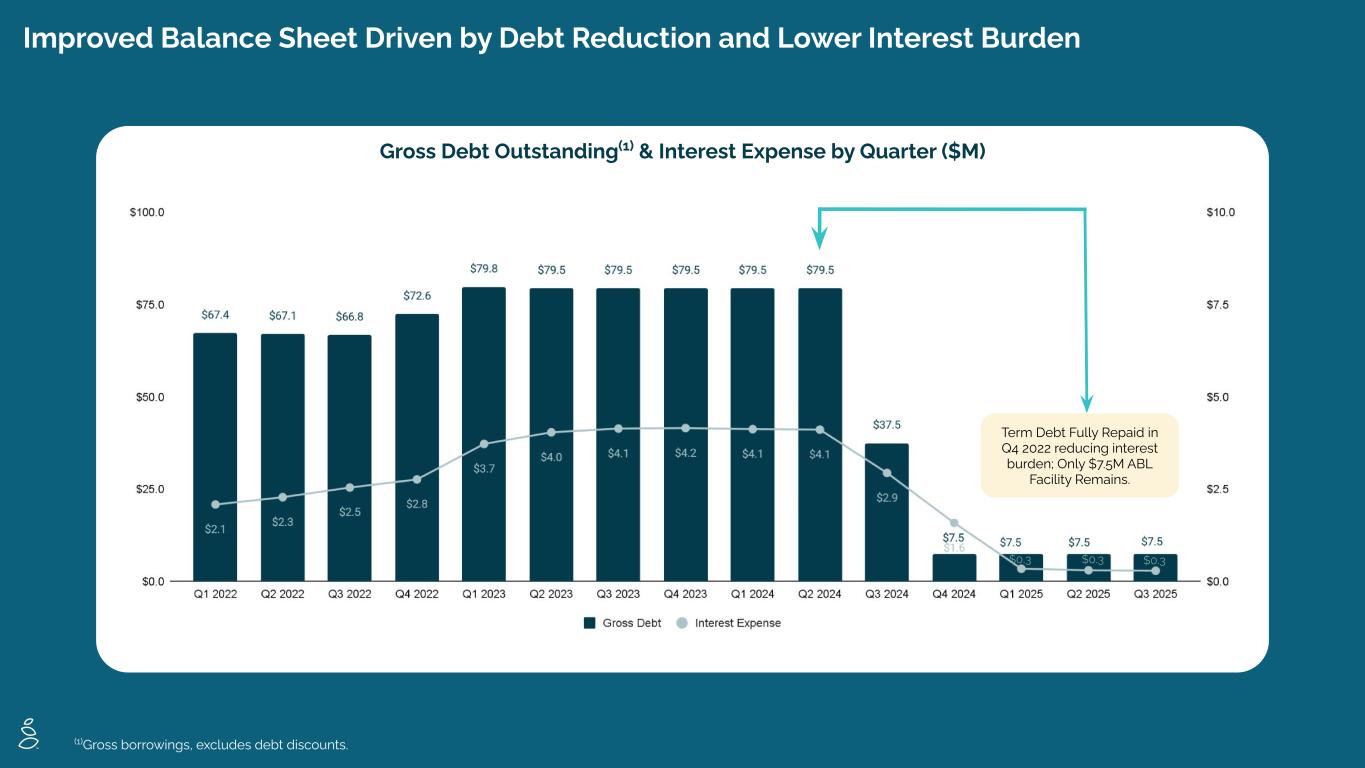

Improved Balance Sheet Driven by Debt Reduction and Lower Interest Burden Gross Debt Outstanding(1) & Interest Expense by Quarter ($M) Interest Expense Down 90% in 2025 vs. 2024 — Freeing Up Capital (1)Gross borrowings, excludes debt discounts. Term Debt Fully Repaid in Q4 2022 reducing interest burden; Only $7.5M ABL Facility Remains. $0.3 $0.3 $0.3

Revenue Stabilizing even as Grove Prioritizes Core Experience and Profitability Quarterly Revenue ($M) Q1 seasonal decline and ecommerce platform migration disruption Revenue expected to be roughly flat sequentially in the fourth quarter

13 Financial outlook Revenue ➔ Full year 2025 revenue is expected to be $172.5 - $175M at the lower end of the previously communicated full year guidance range of down approximately mid-single-digit to low-double-digit percentage points year-over-year ➔ Fourth quarter, revenue is expected to remain roughly flat sequentially Adjusted EBITDA ➔ Full year 2025 Adjusted EBITDA is still expected to be within the previously communicated guidance range of negative low-single-digit millions to breakeven. ➔ Fourth-quarter Adjusted EBITDA is expected to be positive 2025 Revised Guidance

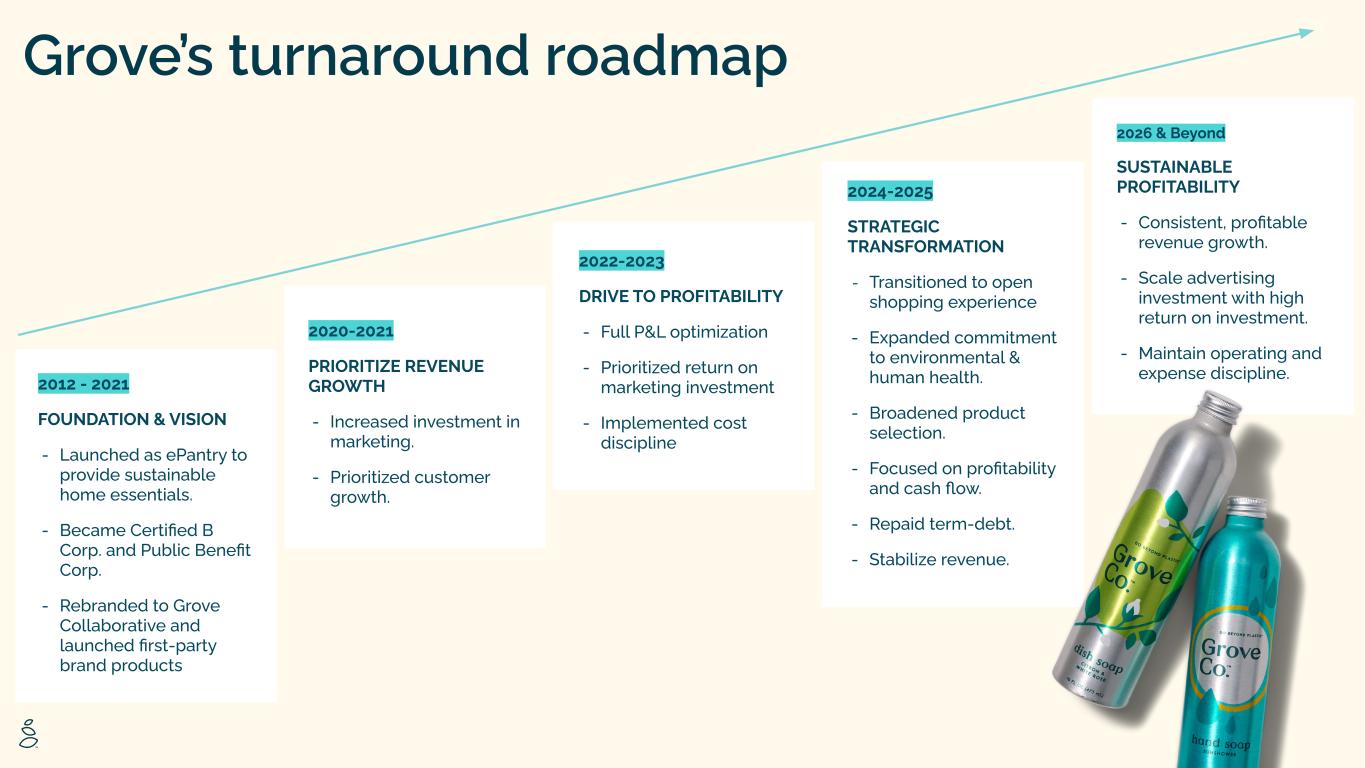

2020-2021 PRIORITIZE REVENUE GROWTH - Increased investment in marketing. - Prioritized customer growth. 2022-2023 DRIVE TO PROFITABILITY - Full P&L optimization - Prioritized return on marketing investment - Implemented cost discipline 2024-2025 STRATEGIC TRANSFORMATION - Transitioned to open shopping experience - Expanded commitment to environmental & human health. - Broadened product selection. - Focused on profitability and cash flow. - Repaid term-debt. - Stabilize revenue. 2026 & Beyond SUSTAINABLE PROFITABILITY - Consistent, profitable revenue growth. - Scale advertising investment with high return on investment. - Maintain operating and expense discipline.2012 - 2021 FOUNDATION & VISION - Launched as ePantry to provide sustainable home essentials. - Became Certified B Corp. and Public Benefit Corp. - Rebranded to Grove Collaborative and launched first-party brand products Grove’s turnaround roadmap

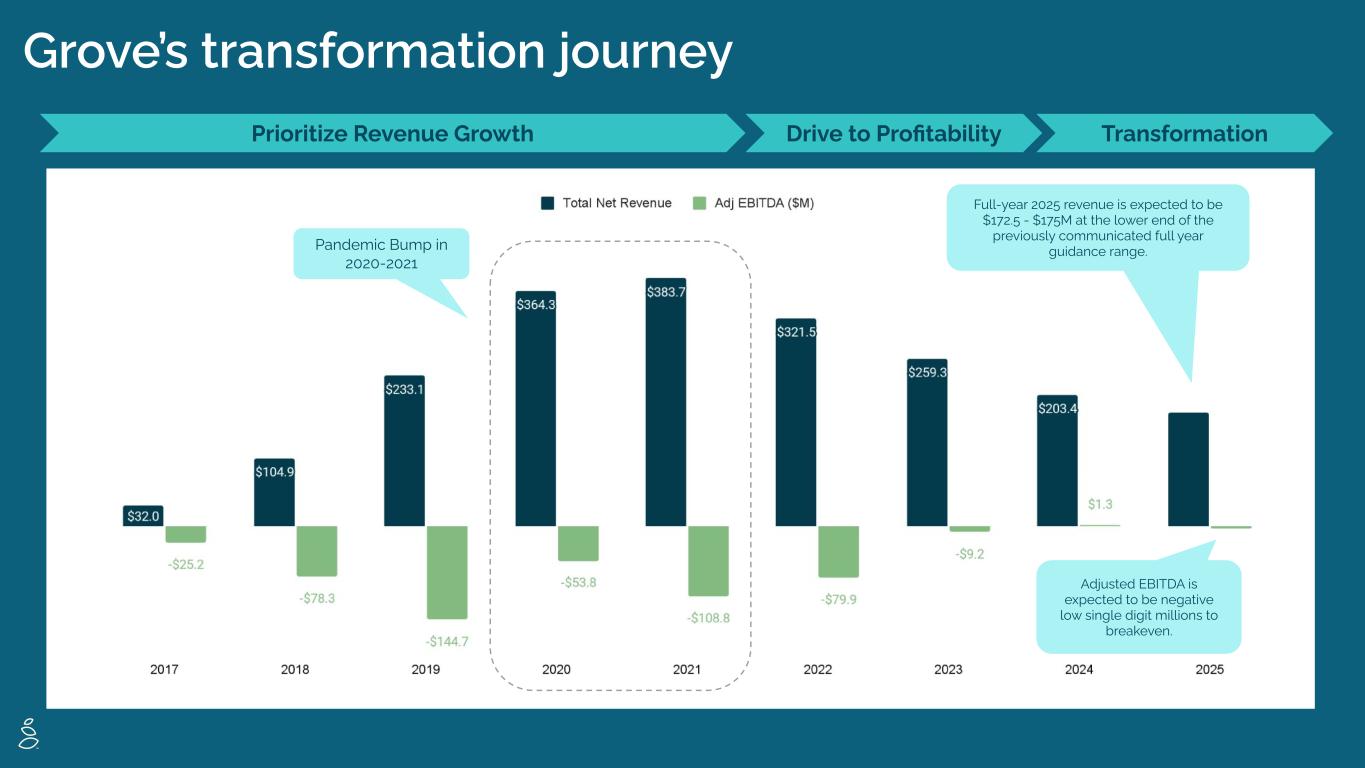

Grove’s transformation journey Prioritize Revenue Growth Drive to Profitability Transformation Pandemic Bump in 2020-2021 Full-year 2025 revenue is expected to be $172.5 - $175M at the lower end of the previously communicated full year guidance range. Adjusted EBITDA is expected to be negative low single digit millions to breakeven.

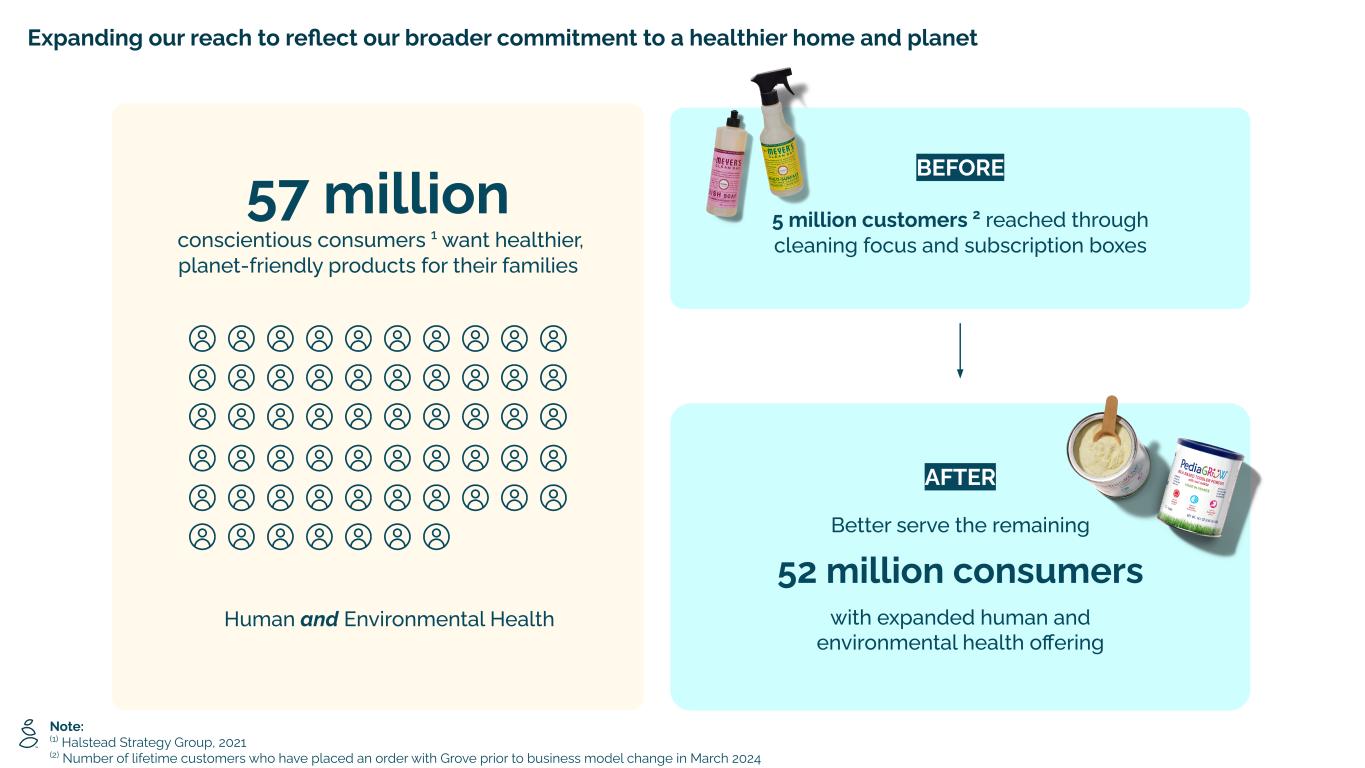

Expanding our reach to reflect our broader commitment to a healthier home and planet Human and Environmental Health BEFORE 5 million customers 2 reached through cleaning focus and subscription boxes 57 million conscientious consumers 1 want healthier, planet-friendly products for their families Note: (1) Halstead Strategy Group, 2021 (2) Number of lifetime customers who have placed an order with Grove prior to business model change in March 2024 AFTER Better serve the remaining 52 million consumers with expanded human and environmental health offering

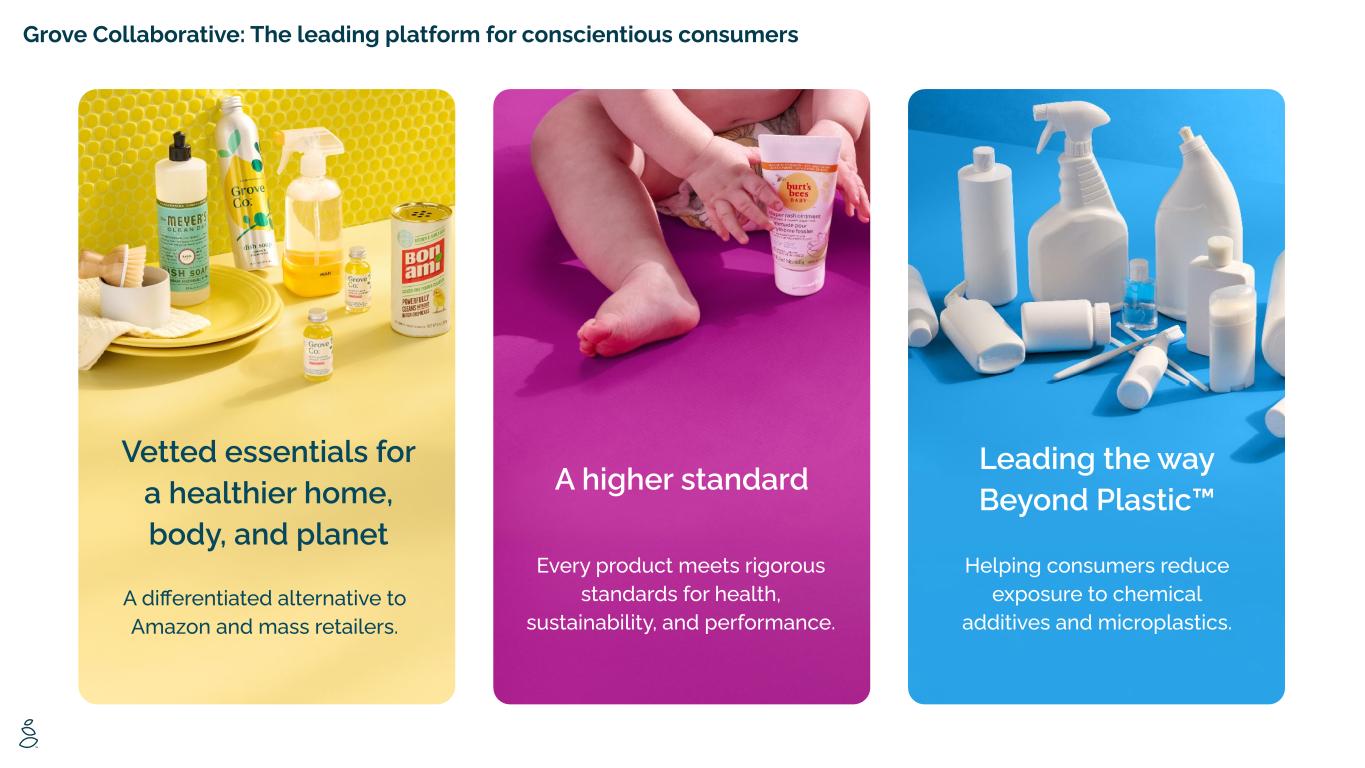

Grove Collaborative: The leading platform for conscientious consumers A differentiated alternative to Amazon and mass retailers. Helping consumers reduce exposure to chemical additives and microplastics. Every product meets rigorous standards for health, sustainability, and performance. Leading the way Beyond Plastic™A higher standard Vetted essentials for a healthier home, body, and planet

Consumers are prioritizing natural and sustainable products like never before Notes: (1) McKinsey, Consumers care about sustainability—and back it up with their wallets. (February 2023) (2) Deloitte, Creating value from sustainable products. (April 2023) cumulative growth over 5 years for products with sustainability-related claims 2 of U.S. consumers believe that living sustainably is important 1 80% +28% WELLNESS-DRIVEN PURCHASINGSUSTAINABILITY MATTERS Consumers are voting with their wallets—brands that align with sustainability and wellness are positioned for long-term growth.

CONFIDENTIAL STRATEGIC FOCUS Building a trusted marketplace with a winning product mix

Our 2025 strategy is concentrated around three strategic initiatives 20 Empowering 57M conscientious consumers to create a healthier home and planet SCALE PLATFORM TO WIN Optimize growth with leading technology and strong operations GROW PRODUCT MIX Through third-party expansion, owned brand innovation and M&A BUILD CUSTOMER LOVE Strengthening loyalty through trust, storytelling, and personalized experiences MAKING GROVE THE PREFERRED CHOICE

21 MARKETING FRAMEWORK EFFICIENT COST STRUCTURE Strategic cost optimization Streamlined workforce Skilled customer support BOX ECONOMICS 8+ units per order1 $66+ net revenue per order1 Low-cost shipping STREAMLINED OPERATIONS Optimized two-node fulfillment center network Efficient variable costs per order Guided, personalized experience Media mix informed by data science Robust mechanisms to drive repeat orders Targeted full-funnel approach Scalable technology stack Optimized User experience INDUSTRY-LEADING PLATFORM A higher standard: Where value meets values PLATFORM SCALED TO WIN Trusted, curated marketplace Note: (1) YTD as of Q3 2025

GROW PRODUCT MIX Win in human health and wellness EXPAND NON-VMS Target white space categories to aid the customer journey of building and maintaining a healthy home environment, e.g. clean cooking, water bottles, and other durables VMS GROWTH Improve customer conversion through increased selection, increased marketing exposure, and enhanced content ADVISORY BOARD Experts for credibility and trust Ongoing product vetting, ingredient standards maintenance, and input

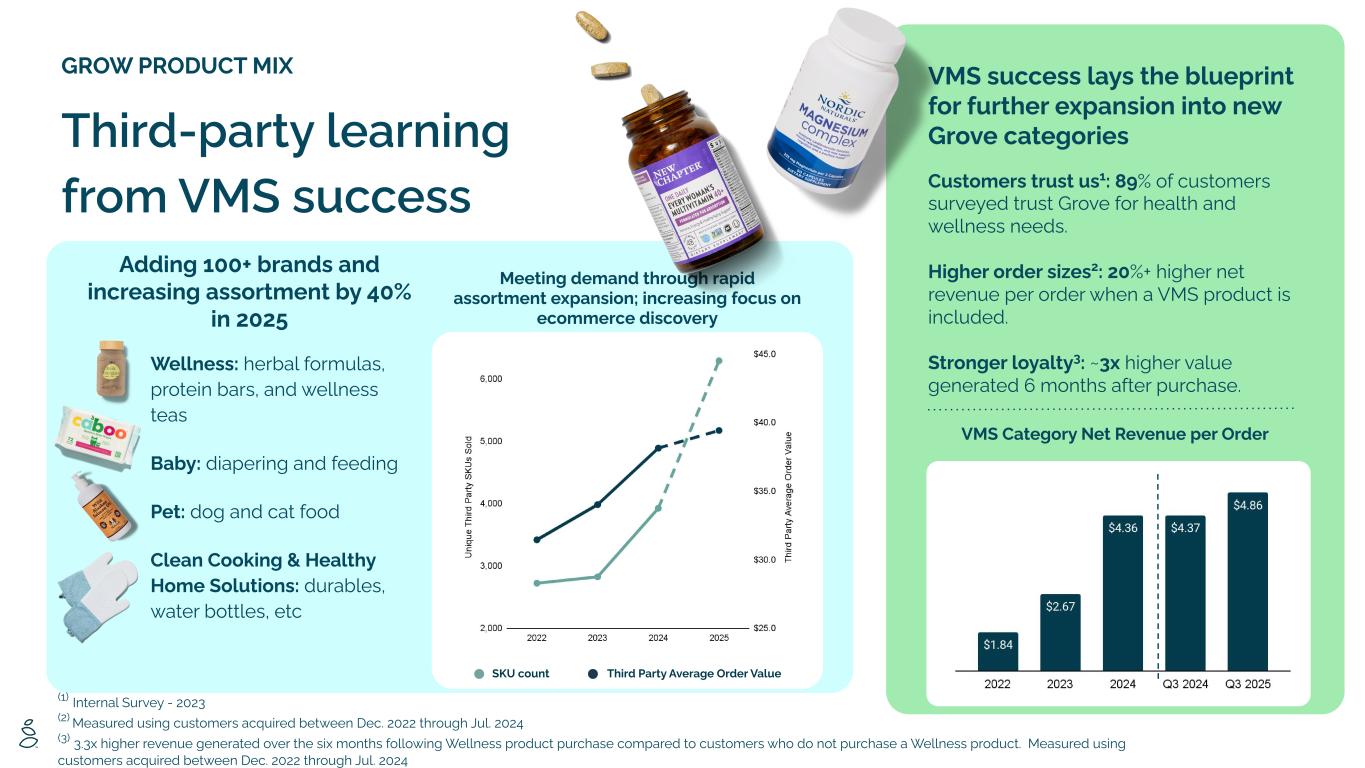

GROW PRODUCT MIX Third-party learning from VMS success VMS success lays the blueprint for further expansion into new Grove categories Customers trust us1: 89% of customers surveyed trust Grove for health and wellness needs. Higher order sizes2: 20%+ higher net revenue per order when a VMS product is included. Stronger loyalty3: ~3x higher value generated 6 months after purchase. Wellness: herbal formulas, protein bars, and wellness teas Baby: diapering and feeding Pet: dog and cat food Clean Cooking & Healthy Home Solutions: durables, water bottles, etc VMS Category Net Revenue per Order Meeting demand through rapid assortment expansion; increasing focus on ecommerce discovery Adding 100+ brands and increasing assortment by 40% in 2025 Third Party Average Order ValueSKU count (1) Internal Survey - 2023 (2) Measured using customers acquired between Dec. 2022 through Jul. 2024 (3) 3.3x higher revenue generated over the six months following Wellness product purchase compared to customers who do not purchase a Wellness product. Measured using customers acquired between Dec. 2022 through Jul. 2024

Owned brands strategy evolution Building our portfolio of exclusive products CORE CLEANING: REFILLABLES AND CONCENTRATES EVOLUTION IN THE HOME: PAPER, TRASH, DURABLES Industry leading sustainability: meeting and exceeding eco-conscious expectations Seasonal scents create excitement New formats allowing for broader reach to customers Bamboo based paper enabling unique market offering Frequently used items drive subscriptions Engaging marketing content for customer acquisition MARGIN ACCRETIVE EXPANSION High margins enabling competitive pricing Wellness assortment driving into next generation category GROW PRODUCT MIX

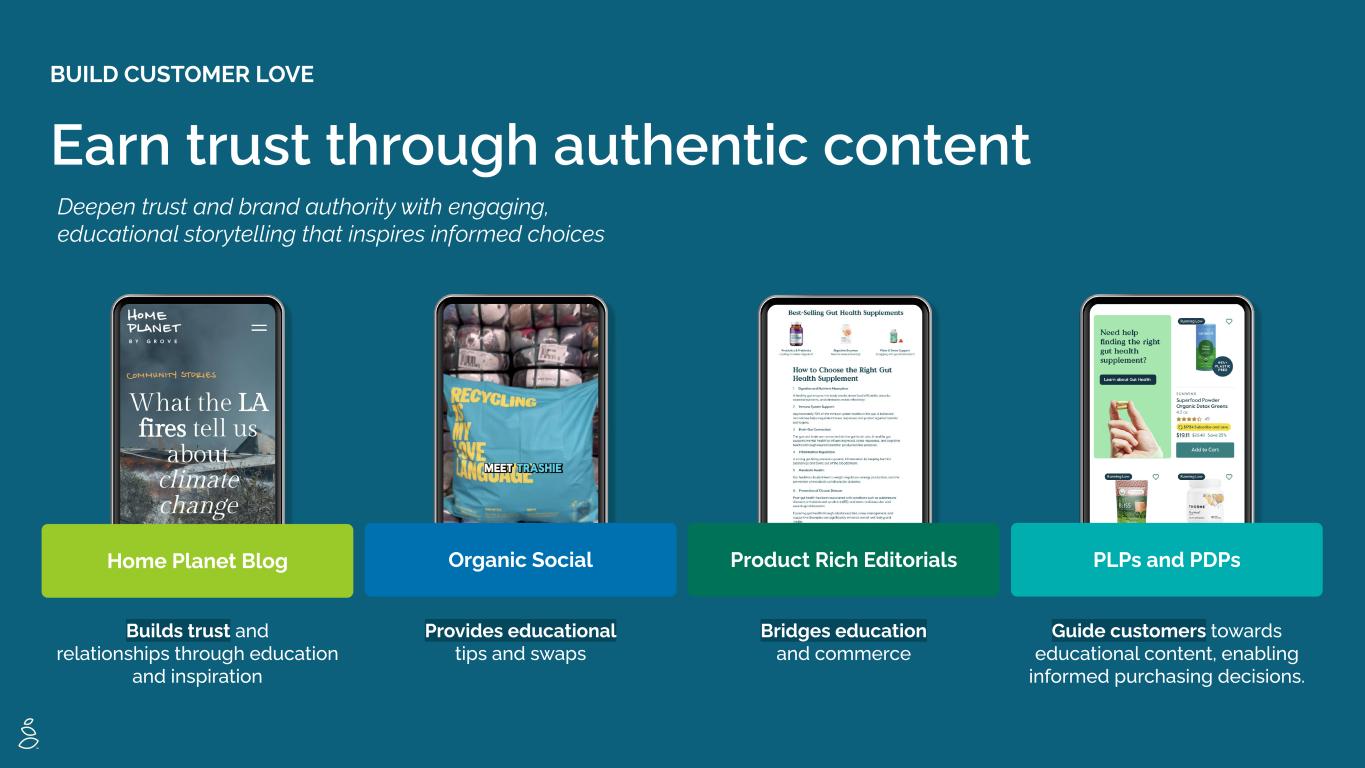

Builds trust and relationships through education and inspiration Provides educational tips and swaps Bridges education and commerce Guide customers towards educational content, enabling informed purchasing decisions. BUILD CUSTOMER LOVE Earn trust through authentic content Deepen trust and brand authority with engaging, educational storytelling that inspires informed choices Product Rich EditorialsOrganic SocialHome Planet Blog PLPs and PDPs

Supplemental

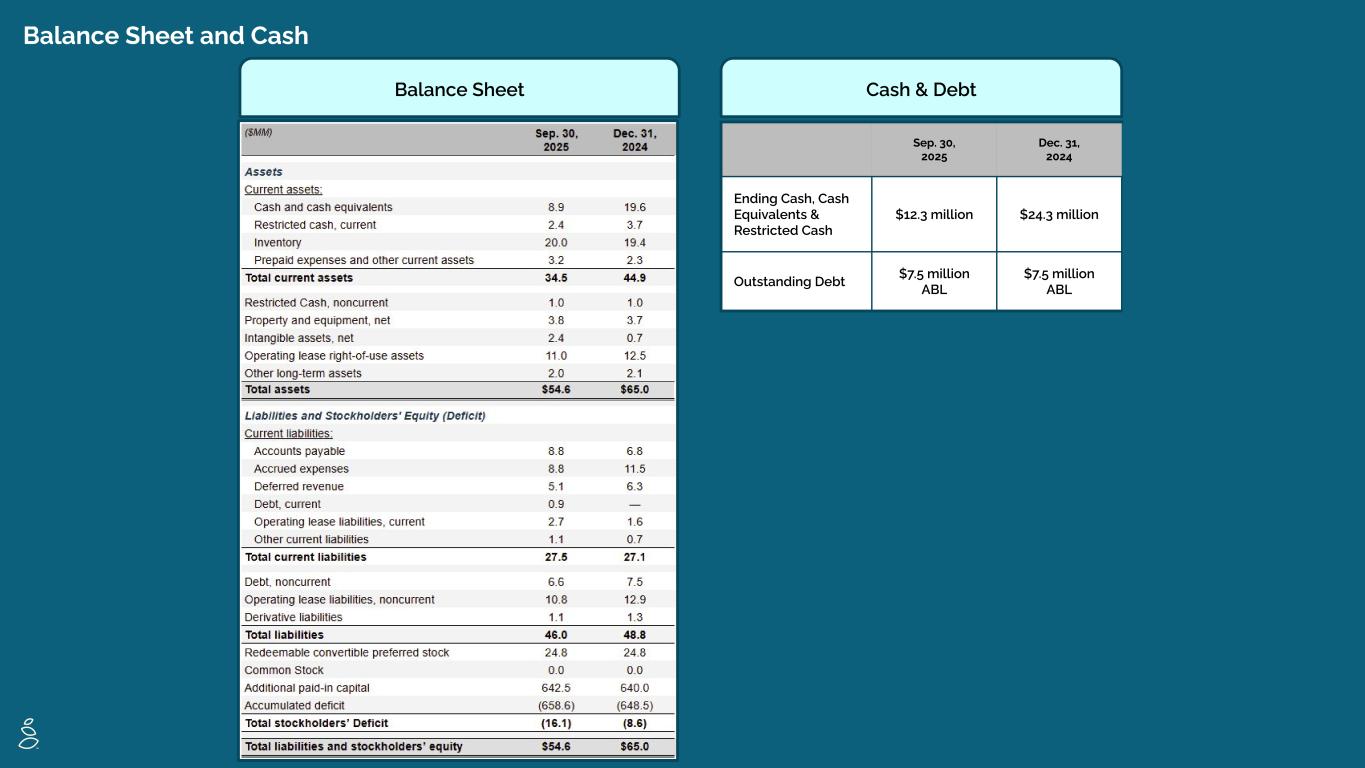

Balance Sheet and Cash Balance Sheet Sep. 30, 2025 Dec. 31, 2024 Ending Cash, Cash Equivalents & Restricted Cash $12.3 million $24.3 million Outstanding Debt $7.5 million ABL $7.5 million ABL Cash & Debt

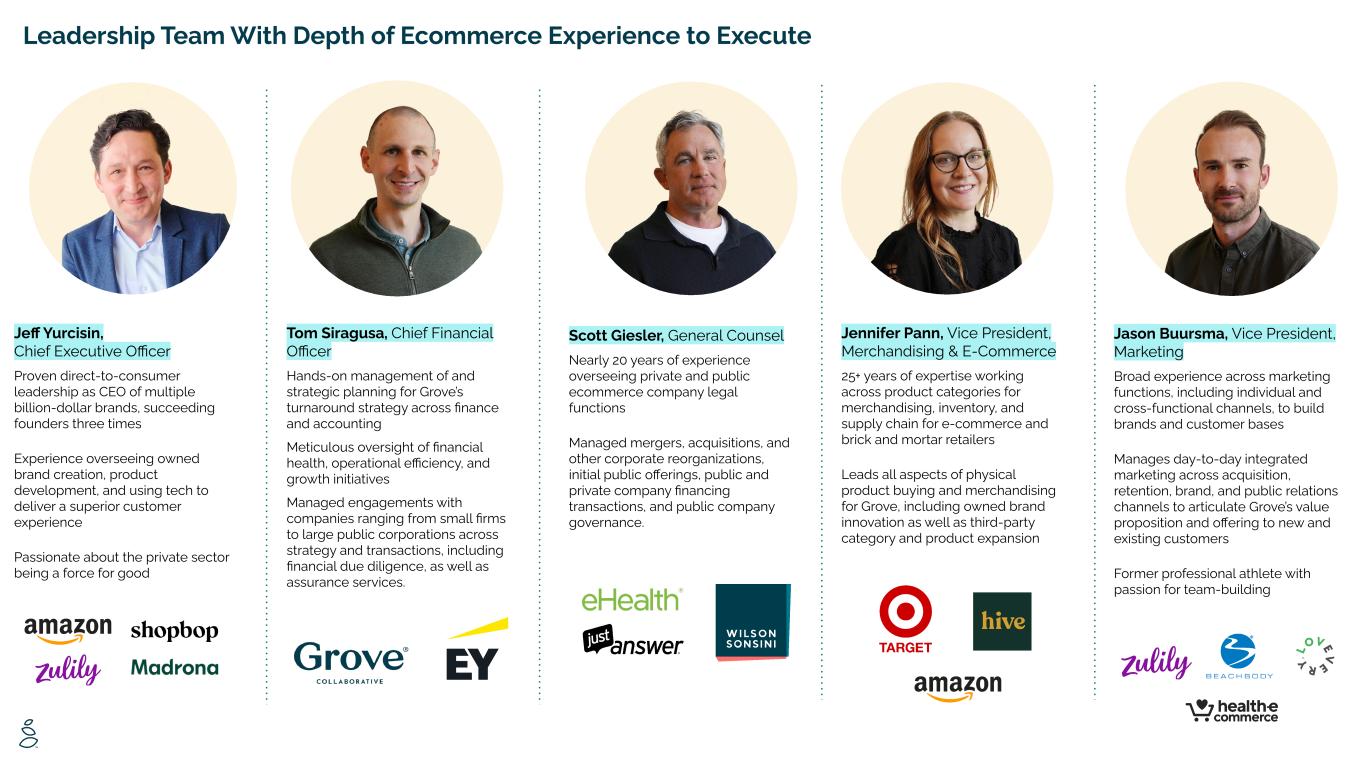

Leadership Team With Depth of Ecommerce Experience to Execute Tom Siragusa, Chief Financial Officer Hands-on management of and strategic planning for Grove’s turnaround strategy across finance and accounting Meticulous oversight of financial health, operational efficiency, and growth initiatives Managed engagements with companies ranging from small firms to large public corporations across strategy and transactions, including financial due diligence, as well as assurance services. Jennifer Pann, Vice President, Merchandising & E-Commerce 25+ years of expertise working across product categories for merchandising, inventory, and supply chain for e-commerce and brick and mortar retailers Leads all aspects of physical product buying and merchandising for Grove, including owned brand innovation as well as third-party category and product expansion Scott Giesler, General Counsel Nearly 20 years of experience overseeing private and public ecommerce company legal functions Managed mergers, acquisitions, and other corporate reorganizations, initial public offerings, public and private company financing transactions, and public company governance. Jason Buursma, Vice President, Marketing Broad experience across marketing functions, including individual and cross-functional channels, to build brands and customer bases Manages day-to-day integrated marketing across acquisition, retention, brand, and public relations channels to articulate Grove’s value proposition and offering to new and existing customers Former professional athlete with passion for team-building Jeff Yurcisin, Chief Executive Officer Proven direct-to-consumer leadership as CEO of multiple billion-dollar brands, succeeding founders three times Experience overseeing owned brand creation, product development, and using tech to deliver a superior customer experience Passionate about the private sector being a force for good

Appendix

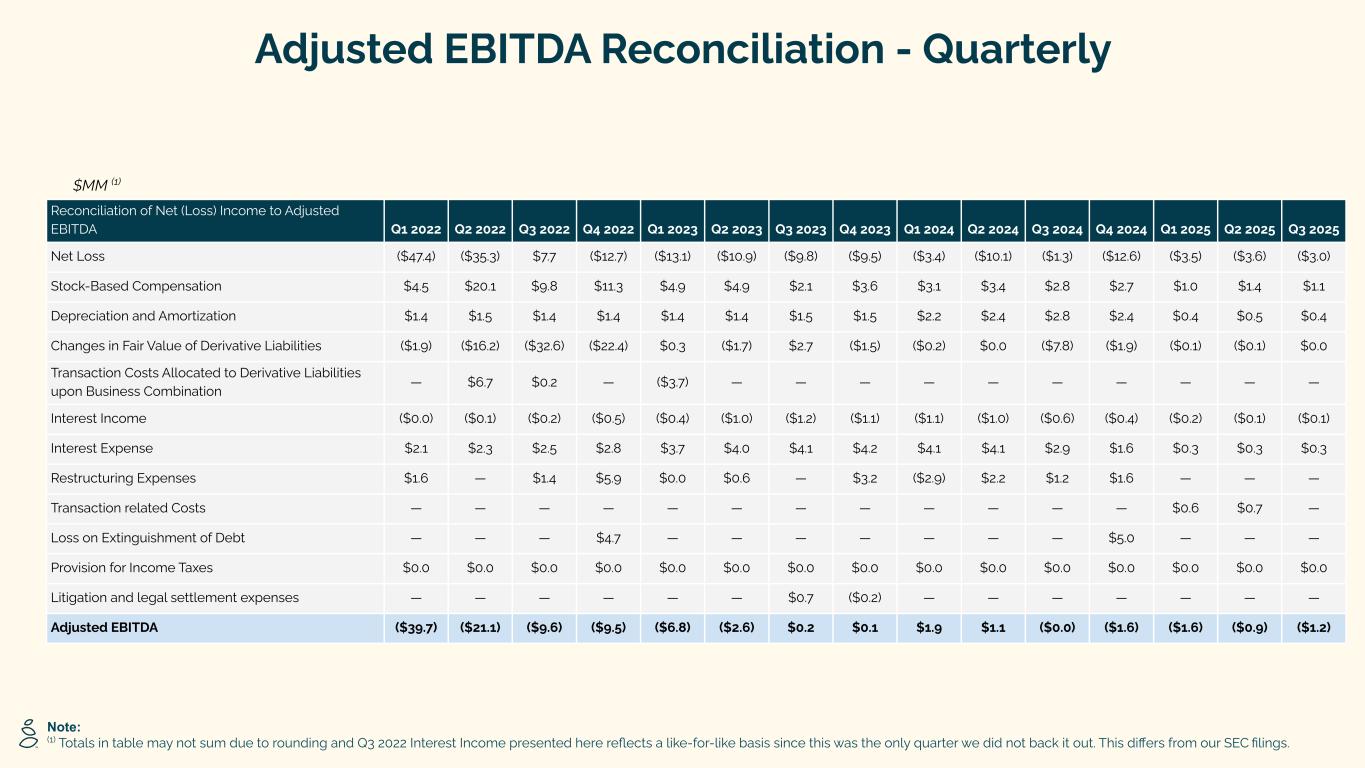

Adjusted EBITDA Reconciliation - Quarterly $MM (1) Note: (1) Totals in table may not sum due to rounding and Q3 2022 Interest Income presented here reflects a like-for-like basis since this was the only quarter we did not back it out. This differs from our SEC filings. Reconciliation of Net (Loss) Income to Adjusted EBITDA Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Net Loss ($47.4) ($35.3) $7.7 ($12.7) ($13.1) ($10.9) ($9.8) ($9.5) ($3.4) ($10.1) ($1.3) ($12.6) ($3.5) ($3.6) ($3.0) Stock-Based Compensation $4.5 $20.1 $9.8 $11.3 $4.9 $4.9 $2.1 $3.6 $3.1 $3.4 $2.8 $2.7 $1.0 $1.4 $1.1 Depreciation and Amortization $1.4 $1.5 $1.4 $1.4 $1.4 $1.4 $1.5 $1.5 $2.2 $2.4 $2.8 $2.4 $0.4 $0.5 $0.4 Changes in Fair Value of Derivative Liabilities ($1.9) ($16.2) ($32.6) ($22.4) $0.3 ($1.7) $2.7 ($1.5) ($0.2) $0.0 ($7.8) ($1.9) ($0.1) ($0.1) $0.0 Transaction Costs Allocated to Derivative Liabilities upon Business Combination — $6.7 $0.2 — ($3.7) — — — — — — — — — — Interest Income ($0.0) ($0.1) ($0.2) ($0.5) ($0.4) ($1.0) ($1.2) ($1.1) ($1.1) ($1.0) ($0.6) ($0.4) ($0.2) ($0.1) ($0.1) Interest Expense $2.1 $2.3 $2.5 $2.8 $3.7 $4.0 $4.1 $4.2 $4.1 $4.1 $2.9 $1.6 $0.3 $0.3 $0.3 Restructuring Expenses $1.6 — $1.4 $5.9 $0.0 $0.6 — $3.2 ($2.9) $2.2 $1.2 $1.6 — — — Transaction related Costs — — — — — — — — — — — — $0.6 $0.7 — Loss on Extinguishment of Debt — — — $4.7 — — — — — — — $5.0 — — — Provision for Income Taxes $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Litigation and legal settlement expenses — — — — — — $0.7 ($0.2) — — — — — — — Adjusted EBITDA ($39.7) ($21.1) ($9.6) ($9.5) ($6.8) ($2.6) $0.2 $0.1 $1.9 $1.1 ($0.0) ($1.6) ($1.6) ($0.9) ($1.2)

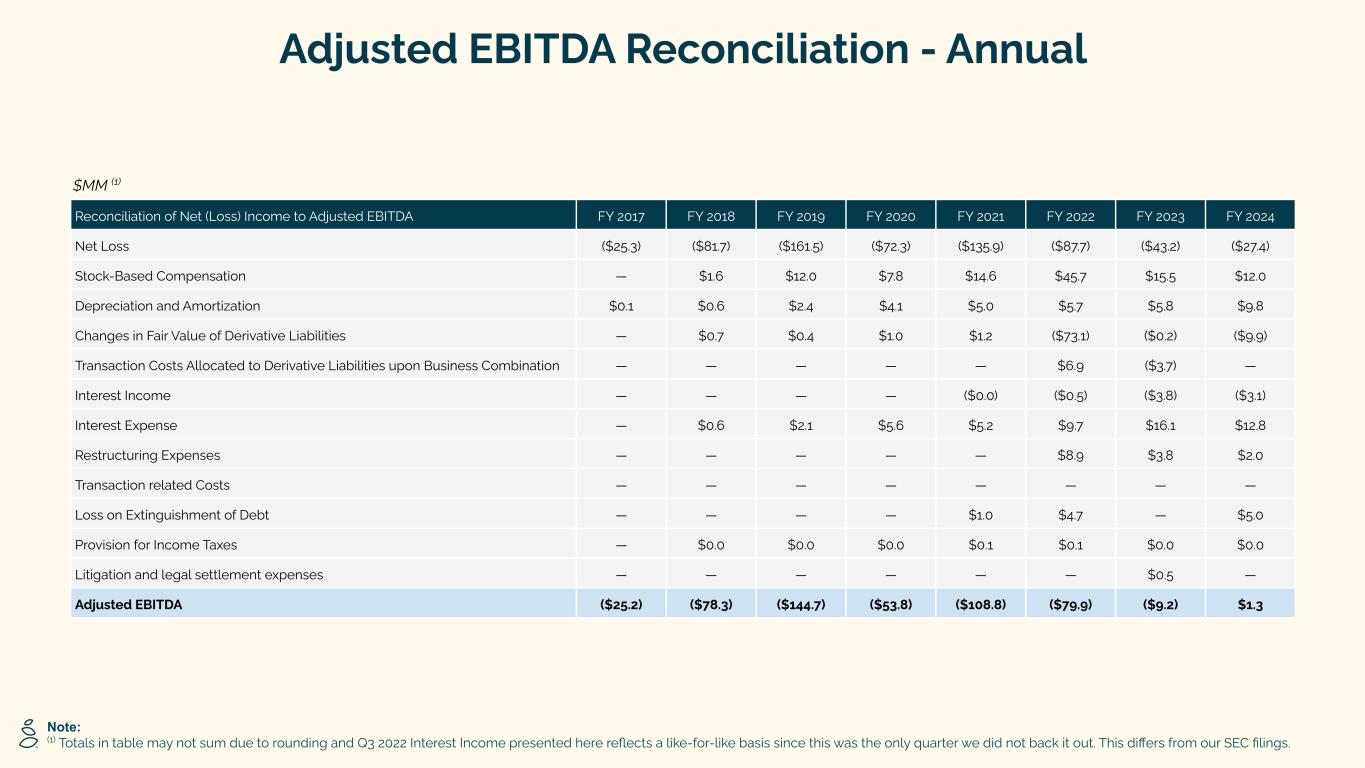

Adjusted EBITDA Reconciliation - Annual $MM (1) Reconciliation of Net (Loss) Income to Adjusted EBITDA FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 Net Loss ($25.3) ($81.7) ($161.5) ($72.3) ($135.9) ($87.7) ($43.2) ($27.4) Stock-Based Compensation — $1.6 $12.0 $7.8 $14.6 $45.7 $15.5 $12.0 Depreciation and Amortization $0.1 $0.6 $2.4 $4.1 $5.0 $5.7 $5.8 $9.8 Changes in Fair Value of Derivative Liabilities — $0.7 $0.4 $1.0 $1.2 ($73.1) ($0.2) ($9.9) Transaction Costs Allocated to Derivative Liabilities upon Business Combination — — — — — $6.9 ($3.7) — Interest Income — — — — ($0.0) ($0.5) ($3.8) ($3.1) Interest Expense — $0.6 $2.1 $5.6 $5.2 $9.7 $16.1 $12.8 Restructuring Expenses — — — — — $8.9 $3.8 $2.0 Transaction related Costs — — — — — — — — Loss on Extinguishment of Debt — — — — $1.0 $4.7 — $5.0 Provision for Income Taxes — $0.0 $0.0 $0.0 $0.1 $0.1 $0.0 $0.0 Litigation and legal settlement expenses — — — — — — $0.5 — Adjusted EBITDA ($25.2) ($78.3) ($144.7) ($53.8) ($108.8) ($79.9) ($9.2) $1.3 Note: (1) Totals in table may not sum due to rounding and Q3 2022 Interest Income presented here reflects a like-for-like basis since this was the only quarter we did not back it out. This differs from our SEC filings.

32