Q3 2022 Earnings Presentation

2 Forward-Looking Statements / Non-GAAP Financial Measures Forward-Looking Statements This presentation contains forward-looking statements within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements other than those that are purely historical are forward-looking statements. Forward-looking statements include statements identified as such in our November 10, 2022 press release. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from those in the forward-looking statements. Additional information regarding factors that could cause results to differ can be found in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2022, as well as the Company’s subsequent filings with the Securities and Exchange Commission. These forward-looking statements are based on information as of November 10, 2022. We assume no obligation to publicly update or revise our forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. SEC Regulation G This presentation includes the non-GAAP measure Adjusted EBITDA. The description and reconciliation of this measure from GAAP is included in our November 10, 2022 earnings press release, which is available on investors.grove.co.

Q3 2022 Business Highlights 3

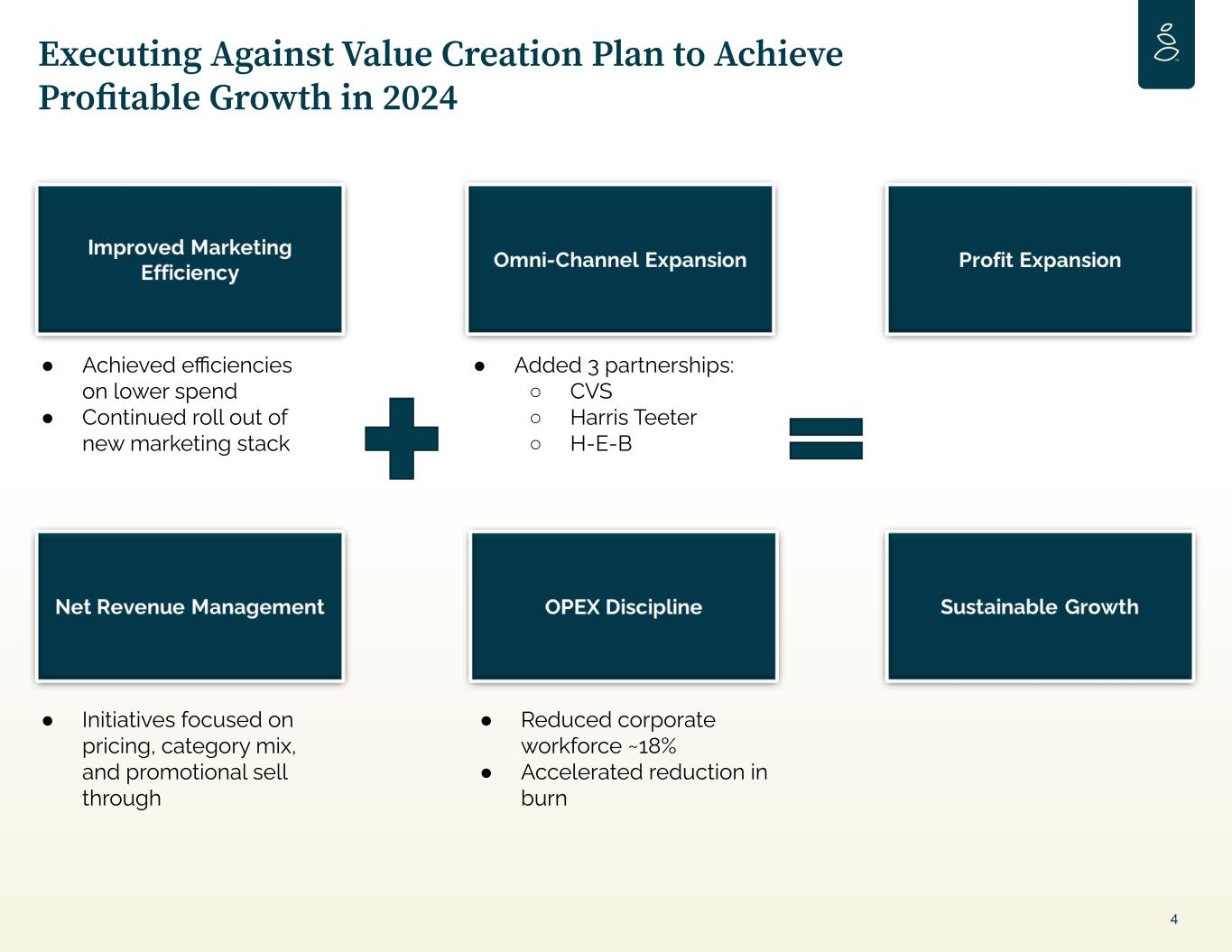

Executing Against Value Creation Plan to Achieve Profitable Growth in 2024 4 ● Achieved efficiencies on lower spend ● Continued roll out of new marketing stack ● Added 3 partnerships: ○ CVS ○ Harris Teeter ○ H-E-B ● Initiatives focused on pricing, category mix, and promotional sell through ● Reduced corporate workforce ~18% ● Accelerated reduction in burn

New Product Launches 5 Twilight Wonder Collection - Limited Edition Holiday Enchantment, Twinkling with Cheer: The Grove Co. Limited Edition Twilight Wonder Collection illuminates your home with festivity and wonder. Keep your home looking clean and smelling festive, while still delivering uncompromised performance .

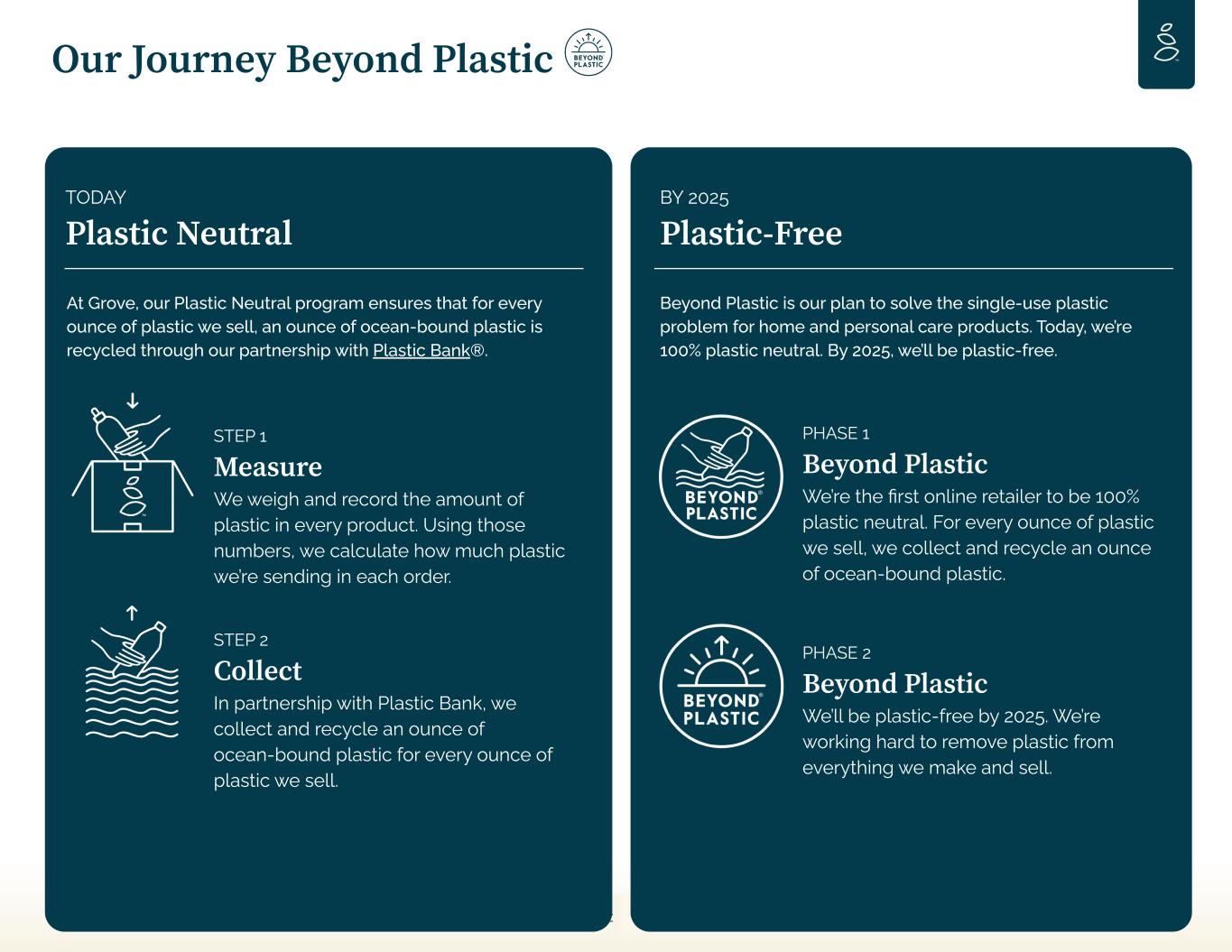

GROVE COLLABORATIVE CONFIDENTIAL Our Journey Beyond Plastic TODAY Plastic Neutral At Grove, our Plastic Neutral program ensures that for every ounce of plastic we sell, an ounce of ocean-bound plastic is recycled through our partnership with Plastic Bank®. STEP 1 Measure We weigh and record the amount of plastic in every product. Using those numbers, we calculate how much plastic we’re sending in each order. STEP 2 Collect In partnership with Plastic Bank, we collect and recycle an ounce of ocean-bound plastic for every ounce of plastic we sell. BY 2025 Plastic-Free Beyond Plastic is our plan to solve the single-use plastic problem for home and personal care products. Today, we’re 100% plastic neutral. By 2025, we’ll be plastic-free. PHASE 1 Beyond Plastic We’re the first online retailer to be 100% plastic neutral. For every ounce of plastic we sell, we collect and recycle an ounce of ocean-bound plastic. PHASE 2 Beyond Plastic We’ll be plastic-free by 2025. We’re working hard to remove plastic from everything we make and sell. 6

77 OUR TOTAL PLASTIC FOOTPRINT BEYOND PLASTIC: TRACKING OUR PROGRESS* We are the first in our industry to report on our plastic given its materiality to our business. We're using this scorecard to challenge our industry to track and publish their plastic use. 758,323 lbs TOTAL PLASTIC WEIGHT Total weight of plastic we shipped to our customers and sold through retail partners in the third quarter of 2022, including every brand and every product that we sell at Grove. *Metrics as of 9/30/2022 unless otherwise noted Beyond Plastic™ 63% of Grove Brands net revenue came from either zero-plastic, re-usable or refillable and zero plastic waste products in the third quarter of 2022, up from 46% in the third quarter of 2021 63% Grove Brands Across the Grove site and through retail partners, we shipped 1.03 lbs of plastic for every $100 in net revenue in the third quarter of 2022, an improvement from 1.33 pounds in the third quarter of 2021. This ratio enables us to decouple our plastic footprint from our revenue growth and truly pin our success to plastic reduction. 1.03 lbs / $100 in Net Revenue PLASTIC INTENSITY PLASTIC INTENSITY Across all Grove Brands, we shipped 0.85 lbs of plastic for every $100 in net revenue in the third quarter of 2022, an improvement from 1.14 pounds in the third quarter of 2021., showcasing a reduced use of plastic in our owned brands, which are designed for sustainability 0.85 lbs / $100 in Net Revenue Site-wide, 13% of our products were reusable or refillable in 2021, compared to 12% in the prior year. We seek to increase the use of reusable or refillable products and packaging while reducing single-use plastic 13% REUSABLE OR REFILLABLE PRODUCTS Reusable or Refillable Products For Grove Co., 40% of our products were reusable or refillable in 2021, as compared to 39% in 2020. We seek to increase the use of reusable or refillable products and packaging while reducing single-use plastic 40%

Q3 2022 Financial Update 8

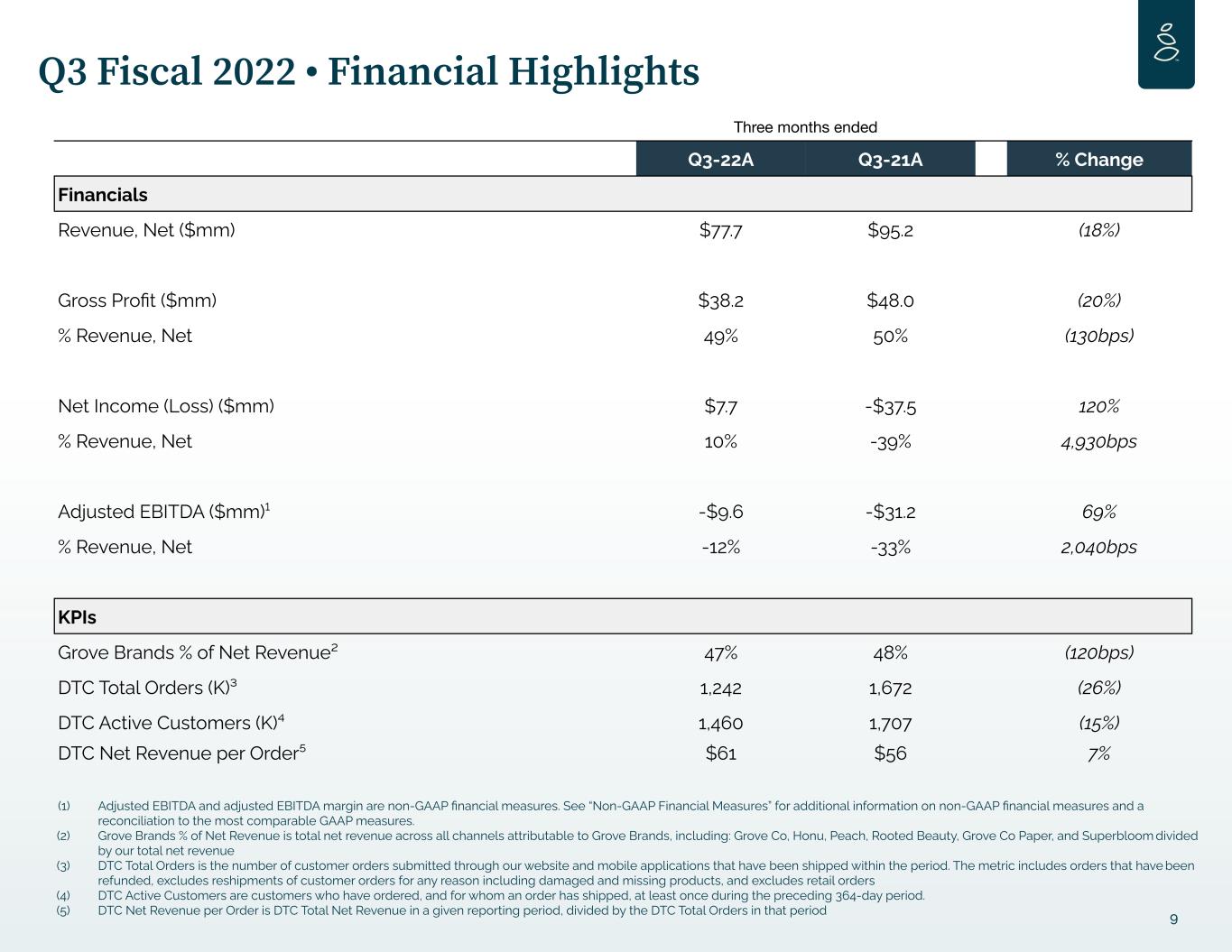

9 Q3 Fiscal 2022 • Financial Highlights (1) Adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures. See “Non-GAAP Financial Measures” for additional information on non-GAAP financial measures and a reconciliation to the most comparable GAAP measures. (2) Grove Brands % of Net Revenue is total net revenue across all channels attributable to Grove Brands, including: Grove Co, Honu, Peach, Rooted Beauty, Grove Co Paper, and Superbloom divided by our total net revenue (3) DTC Total Orders is the number of customer orders submitted through our website and mobile applications that have been shipped within the period. The metric includes orders that have been refunded, excludes reshipments of customer orders for any reason including damaged and missing products, and excludes retail orders (4) DTC Active Customers are customers who have ordered, and for whom an order has shipped, at least once during the preceding 364-day period. (5) DTC Net Revenue per Order is DTC Total Net Revenue in a given reporting period, divided by the DTC Total Orders in that period Three months ended Q3-22A Q3-21A % Change Financials Revenue, Net ($mm) $77.7 $95.2 (18%) Gross Profit ($mm) $38.2 $48.0 (20%) % Revenue, Net 49% 50% (130bps) Net Income (Loss) ($mm) $7.7 -$37.5 120% % Revenue, Net 10% -39% 4,930bps Adjusted EBITDA ($mm)¹ -$9.6 -$31.2 69% % Revenue, Net -12% -33% 2,040bps KPIs Grove Brands % of Net Revenue² 47% 48% (120bps) DTC Total Orders (K)³ 1,242 1,672 (26%) DTC Active Customers (K)⁴ 1,460 1,707 (15%) DTC Net Revenue per Order⁵ $61 $56 7%

10 Q3 Fiscal 2022 • Financial Highlights Net revenue was $78 million, a year-over-year decrease of 18 percent. The decrease was primarily driven by fewer new and existing customer orders as a result of fewer active customers and the reduction in advertising spend with Grove’s prioritization of increasing profitability. The decrease in orders was partly offset by an increase in AOVs and an increase in retail revenue. Gross margin was down 130 bps year-over-year to 49.1% due to an increase in product costs, including inbound freight costs, an increase in sales from retail sales, which produce lower margins than our DTC channel sales, and an increase to inventory reserves, partially offset by the impacts of net revenue management initiatives including the introduction of strategic price increases on Grove Brands and third party products. GROSS MARGIN NET REVENUE ($MM)

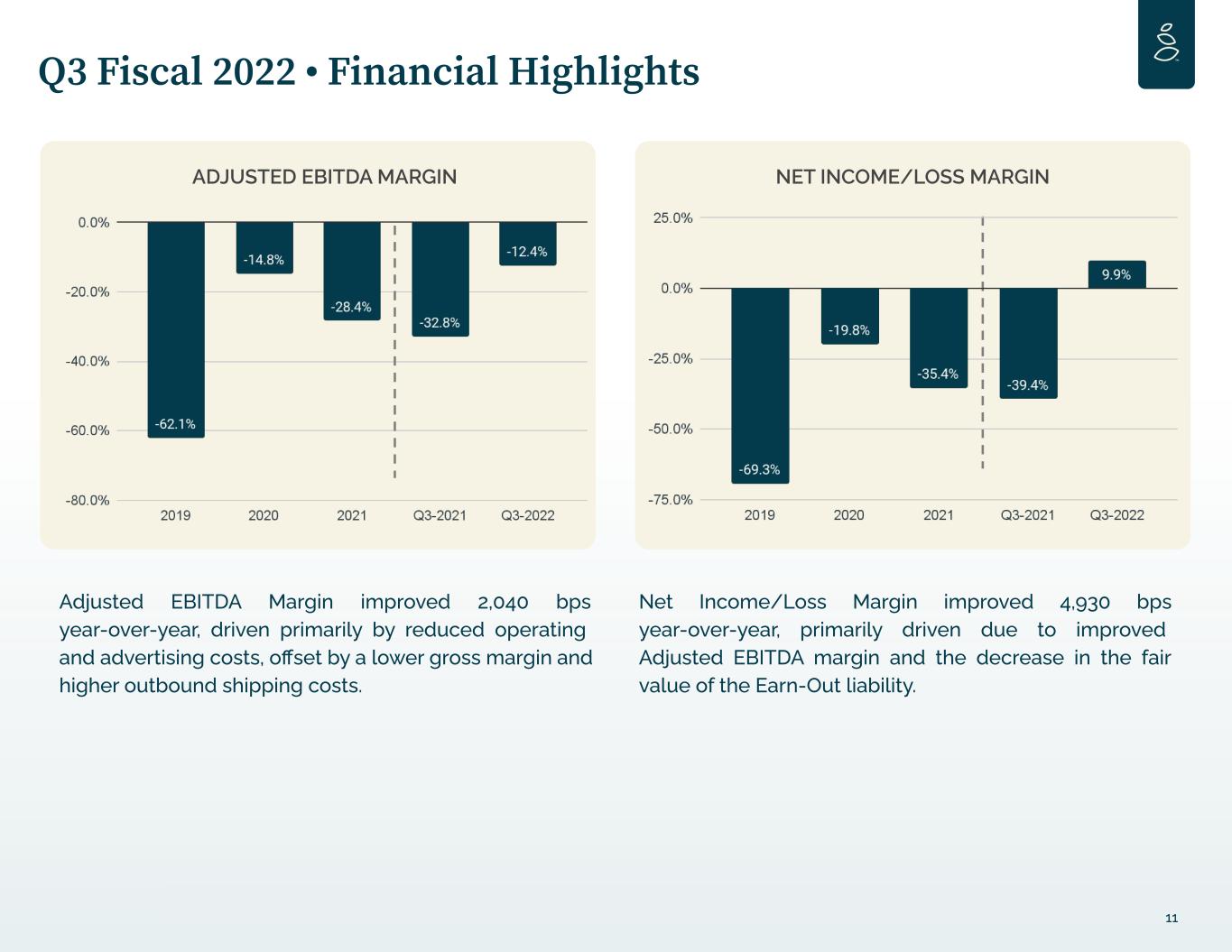

Adjusted EBITDA Margin improved 2,040 bps year-over-year, driven primarily by reduced operating and advertising costs, offset by a lower gross margin and higher outbound shipping costs. 11 Q3 Fiscal 2022 • Financial Highlights ADJUSTED EBITDA MARGIN Net Income/Loss Margin improved 4,930 bps year-over-year, primarily driven due to improved Adjusted EBITDA margin and the decrease in the fair value of the Earn-Out liability. NET INCOME/LOSS MARGIN

12 Q3 Fiscal 2022 • Financial Highlights DTC Total orders were down 26% year-over-year due to a decrease in active customers, along with the decrease in direct advertising spend in early 2022 as the company focuses on profitability, resulting in fewer new and existing customer orders. DTC Active customers were down 15% year-over-year following COVID-related tailwinds in 2021. Similar to orders, the reduction of customer acquisition spend also contributed to this decline as the company shifts its focus to profitability. DTC ACTIVE CUSTOMERS (M)DTC TOTAL ORDERS (K)

Grove Brands as a percent of net revenue declined year-over-year to 47% driven by strong 3rd party Fall seasonal performance, YoY decrease in new customer orders which tend to include more Grove brand products as well as a mix shift of advertising spend into channels with less Grove Brands promotion. DTC net revenue per order continued its long-term upward trend, increasing 7% year-over-year to $61. The improvement in revenue per order was driven primarily by improved existing customer Average Order Value and the impacts of net revenue management initiatives including the introduction of strategic price increases on Grove Brands and third party products. 13 Q3 Fiscal 2022 • Financial Highlights DTC NET REVENUE PER ORDER GROVE BRANDS % NET REVENUE

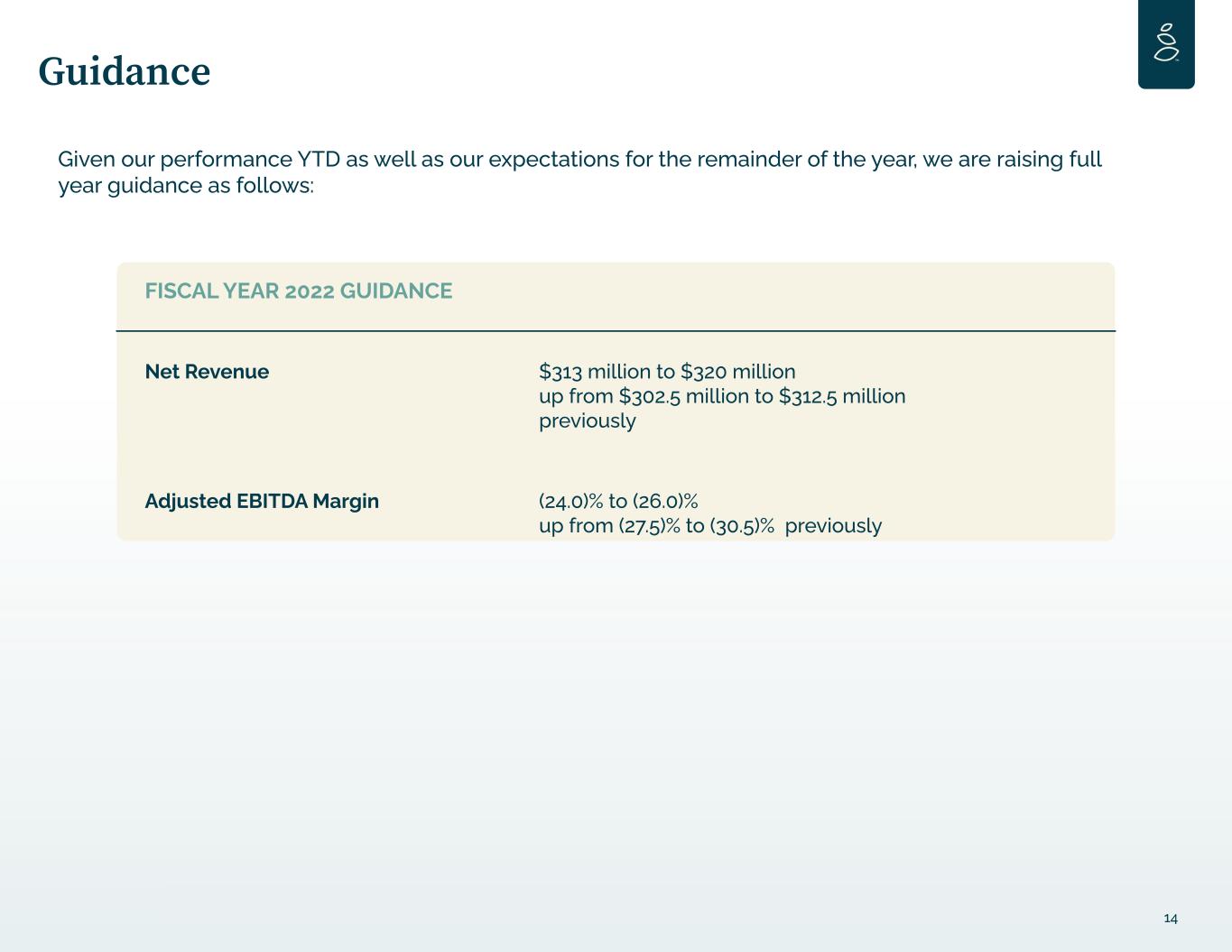

FISCAL YEAR 2022 GUIDANCE Net Revenue $313 million to $320 million up from $302.5 million to $312.5 million previously Adjusted EBITDA Margin (24.0)% to (26.0)% up from (27.5)% to (30.5)% previously 14 Guidance Given our performance YTD as well as our expectations for the remainder of the year, we are raising full year guidance as follows:

Financial Statements 15

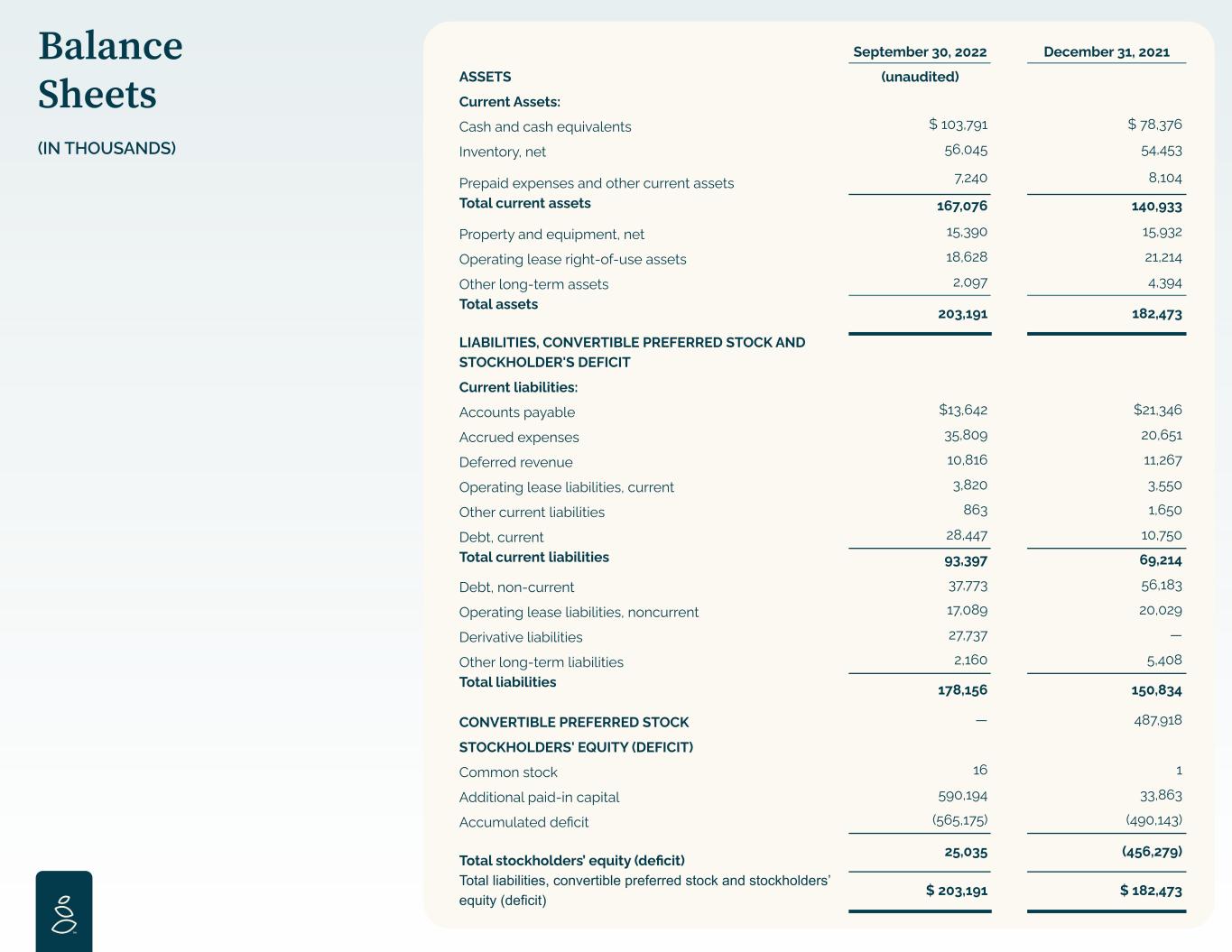

Balance Sheets (IN THOUSANDS) September 30, 2022 December 31, 2021 ASSETS (unaudited) Current Assets: Cash and cash equivalents $ 103,791 $ 78,376 Inventory, net 56,045 54,453 Prepaid expenses and other current assets 7,240 8,104 Total current assets 167,076 140,933 Property and equipment, net 15,390 15,932 Operating lease right-of-use assets 18,628 21,214 Other long-term assets 2,097 4,394 Total assets 203,191 182,473 LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDER'S DEFICIT Current liabilities: Accounts payable $13,642 $21,346 Accrued expenses 35,809 20,651 Deferred revenue 10,816 11,267 Operating lease liabilities, current 3,820 3,550 Other current liabilities 863 1,650 Debt, current 28,447 10,750 Total current liabilities 93,397 69,214 Debt, non-current 37,773 56,183 Operating lease liabilities, noncurrent 17,089 20,029 Derivative liabilities 27,737 — Other long-term liabilities 2,160 5,408 Total liabilities 178,156 150,834 CONVERTIBLE PREFERRED STOCK — 487,918 STOCKHOLDERS' EQUITY (DEFICIT) Common stock 16 1 Additional paid-in capital 590,194 33,863 Accumulated deficit (565,175) (490,143) Total stockholders’ equity (deficit) 25,035 (456,279) Total liabilities, convertible preferred stock and stockholders’ equity (deficit) $ 203,191 $ 182,473

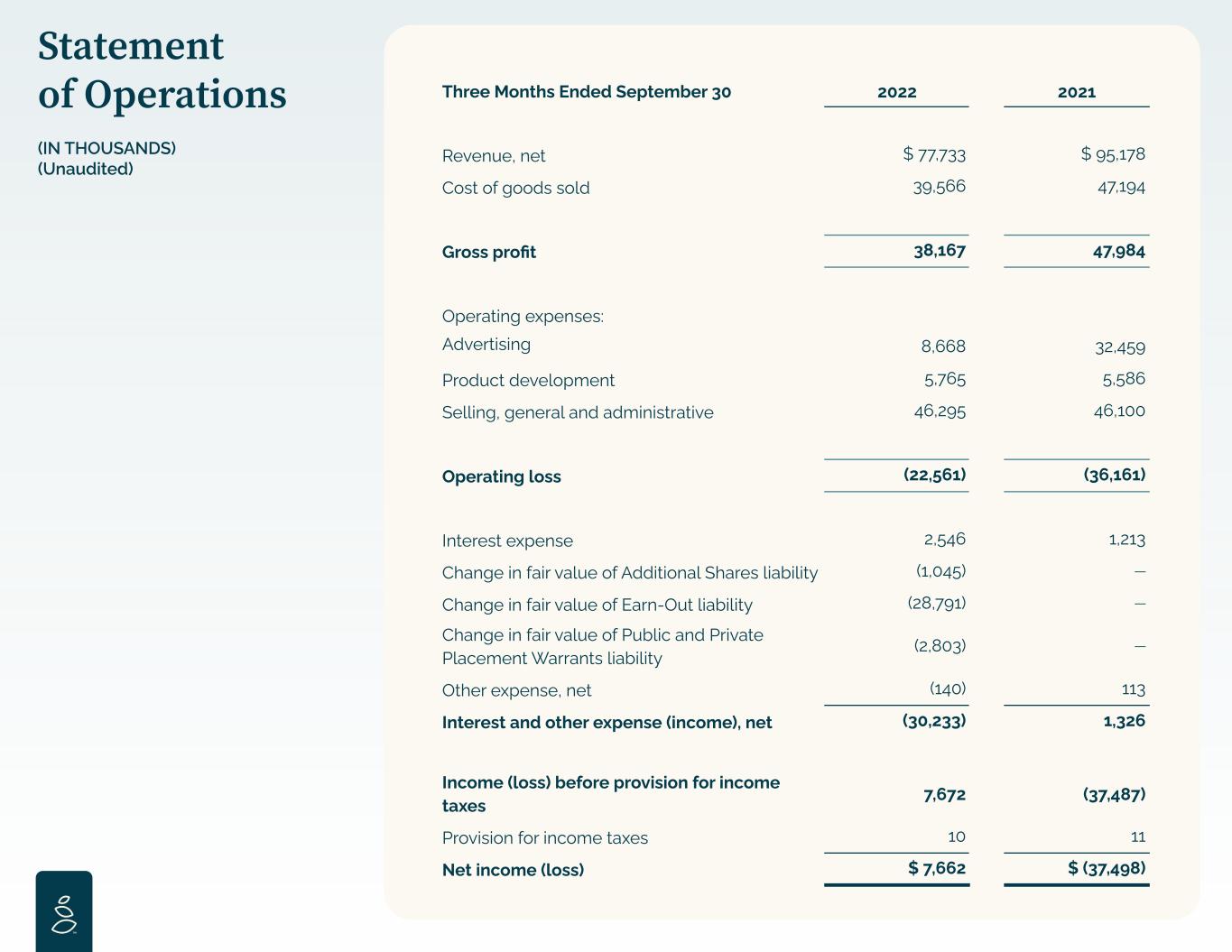

Statement of Operations (IN THOUSANDS) (Unaudited) Three Months Ended September 30 2022 2021 Revenue, net $ 77,733 $ 95,178 Cost of goods sold 39,566 47,194 Gross profit 38,167 47,984 Operating expenses: Advertising 8,668 32,459 Product development 5,765 5,586 Selling, general and administrative 46,295 46,100 Operating loss (22,561) (36,161) Interest expense 2,546 1,213 Change in fair value of Additional Shares liability (1,045) — Change in fair value of Earn-Out liability (28,791) — Change in fair value of Public and Private Placement Warrants liability (2,803) — Other expense, net (140) 113 Interest and other expense (income), net (30,233) 1,326 Income (loss) before provision for income taxes 7,672 (37,487) Provision for income taxes 10 11 Net income (loss) $ 7,662 $ (37,498)

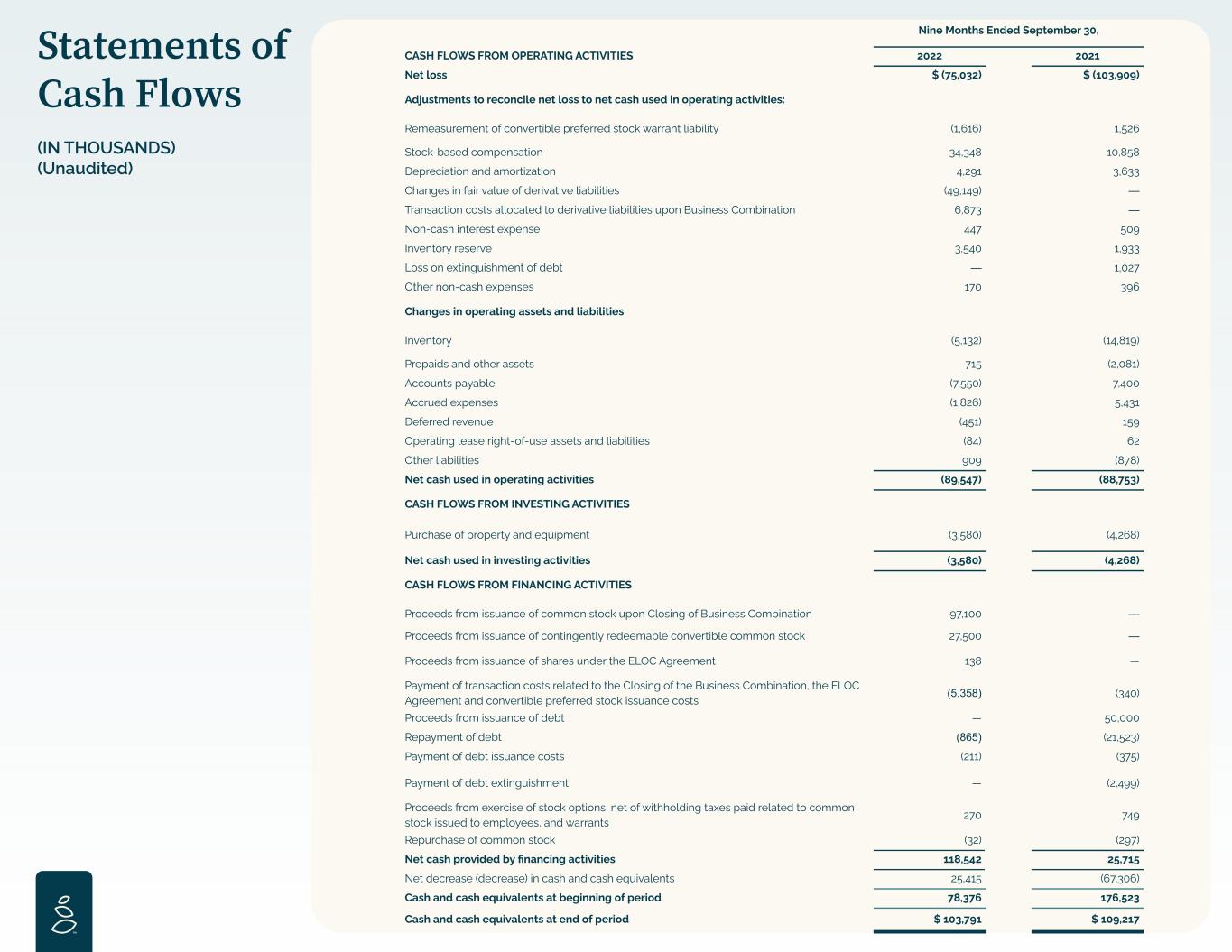

Statements of Cash Flows (IN THOUSANDS) (Unaudited) Nine Months Ended September 30, CASH FLOWS FROM OPERATING ACTIVITIES 2022 2021 Net loss $ (75,032) $ (103,909) Adjustments to reconcile net loss to net cash used in operating activities: Remeasurement of convertible preferred stock warrant liability (1,616) 1,526 Stock-based compensation 34,348 10,858 Depreciation and amortization 4,291 3,633 Changes in fair value of derivative liabilities (49,149) — Transaction costs allocated to derivative liabilities upon Business Combination 6,873 — Non-cash interest expense 447 509 Inventory reserve 3,540 1,933 Loss on extinguishment of debt — 1,027 Other non-cash expenses 170 396 Changes in operating assets and liabilities Inventory (5,132) (14,819) Prepaids and other assets 715 (2,081) Accounts payable (7,550) 7,400 Accrued expenses (1,826) 5,431 Deferred revenue (451) 159 Operating lease right-of-use assets and liabilities (84) 62 Other liabilities 909 (878) Net cash used in operating activities (89,547) (88,753) CASH FLOWS FROM INVESTING ACTIVITIES Purchase of property and equipment (3,580) (4,268) Net cash used in investing activities (3,580) (4,268) CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from issuance of common stock upon Closing of Business Combination 97,100 — Proceeds from issuance of contingently redeemable convertible common stock 27,500 — Proceeds from issuance of shares under the ELOC Agreement 138 — Payment of transaction costs related to the Closing of the Business Combination, the ELOC Agreement and convertible preferred stock issuance costs (5,358) (340) Proceeds from issuance of debt — 50,000 Repayment of debt (865) (21,523) Payment of debt issuance costs (211) (375) Payment of debt extinguishment — (2,499) Proceeds from exercise of stock options, net of withholding taxes paid related to common stock issued to employees, and warrants 270 749 Repurchase of common stock (32) (297) Net cash provided by financing activities 118,542 25,715 Net decrease (decrease) in cash and cash equivalents 25,415 (67,306) Cash and cash equivalents at beginning of period 78,376 176,523 Cash and cash equivalents at end of period $ 103,791 $ 109,217

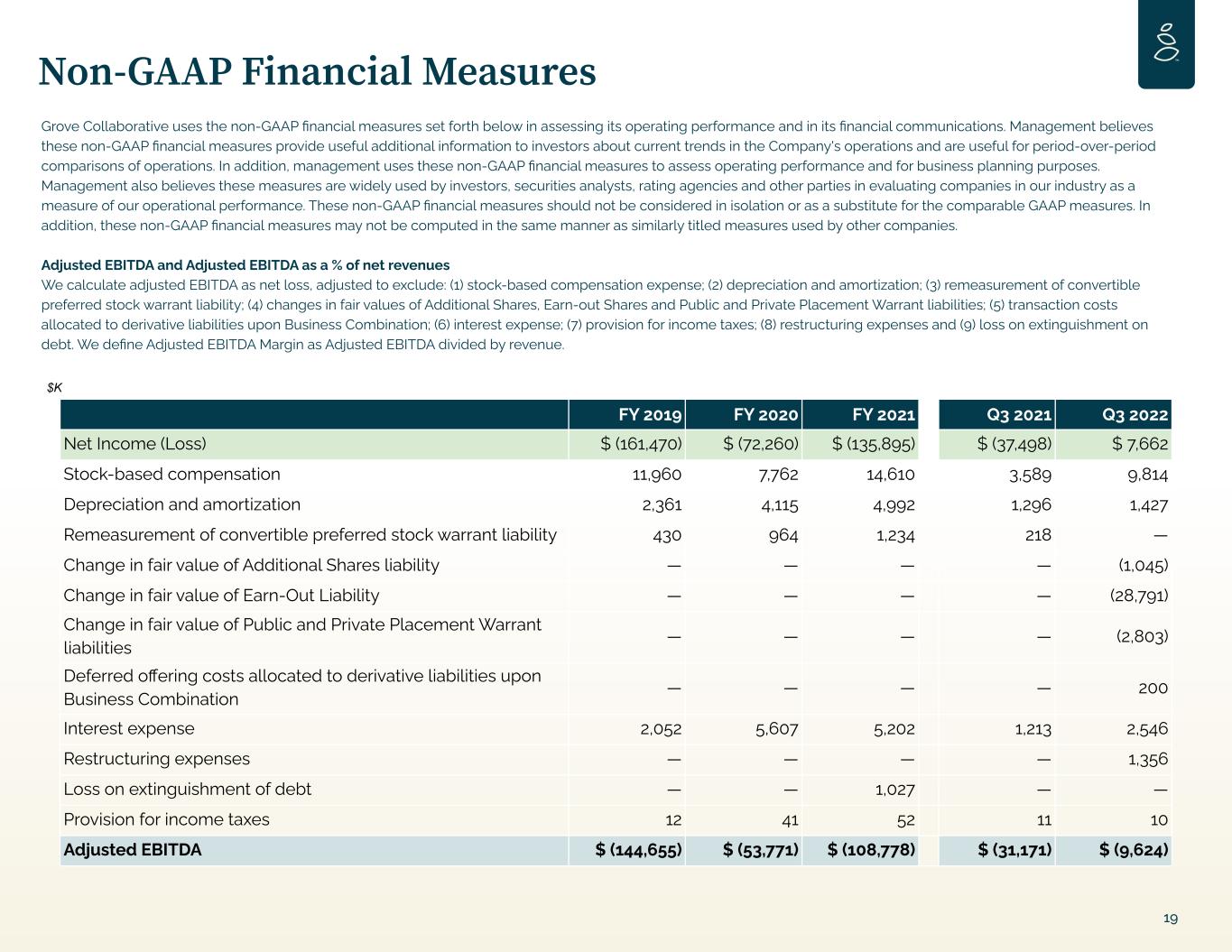

Non-GAAP Financial Measures 19 Grove Collaborative uses the non-GAAP financial measures set forth below in assessing its operating performance and in its financial communications. Management believes these non-GAAP financial measures provide useful additional information to investors about current trends in the Company's operations and are useful for period-over-period comparisons of operations. In addition, management uses these non-GAAP financial measures to assess operating performance and for business planning purposes. Management also believes these measures are widely used by investors, securities analysts, rating agencies and other parties in evaluating companies in our industry as a measure of our operational performance. These non-GAAP financial measures should not be considered in isolation or as a substitute for the comparable GAAP measures. In addition, these non-GAAP financial measures may not be computed in the same manner as similarly titled measures used by other companies. Adjusted EBITDA and Adjusted EBITDA as a % of net revenues We calculate adjusted EBITDA as net loss, adjusted to exclude: (1) stock-based compensation expense; (2) depreciation and amortization; (3) remeasurement of convertible preferred stock warrant liability; (4) changes in fair values of Additional Shares, Earn-out Shares and Public and Private Placement Warrant liabilities; (5) transaction costs allocated to derivative liabilities upon Business Combination; (6) interest expense; (7) provision for income taxes; (8) restructuring expenses and (9) loss on extinguishment on debt. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by revenue. $K FY 2019 FY 2020 FY 2021 Q3 2021 Q3 2022 Net Income (Loss) $ (161,470) $ (72,260) $ (135,895) $ (37,498) $ 7,662 Stock-based compensation 11,960 7,762 14,610 3,589 9,814 Depreciation and amortization 2,361 4,115 4,992 1,296 1,427 Remeasurement of convertible preferred stock warrant liability 430 964 1,234 218 — Change in fair value of Additional Shares liability — — — — (1,045) Change in fair value of Earn-Out Liability — — — — (28,791) Change in fair value of Public and Private Placement Warrant liabilities — — — — (2,803) Deferred offering costs allocated to derivative liabilities upon Business Combination — — — — 200 Interest expense 2,052 5,607 5,202 1,213 2,546 Restructuring expenses — — — — 1,356 Loss on extinguishment of debt — — 1,027 — — Provision for income taxes 12 41 52 11 10 Adjusted EBITDA $ (144,655) $ (53,771) $ (108,778) $ (31,171) $ (9,624)

Thank you