0001841761FALSEDEF 14A00018417612024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| | | | | |

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

Grove Collaborative Holdings, Inc.

| | |

| (Name of Registrant as Specified In Its Charter) |

| | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

GROVE COLLABORATIVE HOLDINGS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 19, 2025

Dear Stockholder:

You are cordially invited to attend the 2025 annual meeting of stockholders (the “Annual Meeting”) of Grove Collaborative Holdings, Inc., a Delaware public benefit corporation (“Grove” or the “Company”). The Annual Meeting will be held on Thursday, June 19, 2025, at 8:00 a.m. Pacific Time, as a virtual meeting at https://www.cstproxy.com/grovecollaborative/2025, for the following purposes:

1.To elect the two nominees for Class III director named herein to hold office until the 2028 annual meeting of stockholders and until their successors are duly elected and qualified.

2.To ratify the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2025.

3.To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

The Annual Meeting will be conducted in a virtual format to provide stockholders with access to the meeting regardless of geographic location. Stockholders will not be able to attend the Annual Meeting in person; however, stockholders will be able to participate, vote electronically and submit questions during the live webcast of the Annual Meeting by visiting https://www.cstproxy.com/grovecollaborative/2025.

The Company is using the “Notice and Access” method of providing proxy materials to you via the Internet. On or about May 8, 2025, the Company will mail to its stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access proxy materials and vote via the Internet. The Notice also contains instructions on how to receive a paper copy of the proxy materials.

All stockholders are cordially invited to attend the Annual Meeting virtually and urged to submit their proxy or voting instructions as promptly as possible to ensure their representation and the presence of a quorum at the same. If you submit your proxy and then decide to attend the Annual Meeting to vote your shares through Grove’s virtual platform, you may still do so. Your proxy is revocable in accordance with the procedures set forth in this proxy statement.

By Order of the Board of Directors,

/s/ Scott Giesler

General Counsel and Secretary

San Francisco, California

April 29, 2025

| | |

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held on June 19, 2025. The Proxy Statement, Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and Notice are available at https://www.cstproxy.com/grovecollaborative/2025. |

GROVE COLLABORATIVE HOLDINGS, INC.

TABLE OF CONTENTS

GROVE COLLABORATIVE HOLDINGS, INC.

1301 Sansome Street

San Francisco, CA 94111

(800) 231-8527

PROXY STATEMENT

FOR THE 2025 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 19, 2025

GENERAL INFORMATION

The board of directors of Grove Collaborative Holdings, Inc. (“we,” “us,” “our,” the “Company” or “Grove”) is soliciting proxies to be used at our Annual Meeting of Stockholders to be held solely via webcast at https://www.cstproxy.com/grovecollaborative/2025 on June 19, 2025 at 8:00 a.m., Pacific Time, and for any postponement, adjournment or continuation thereof (the “Annual Meeting”). Grove intends to mail a Notice of Internet Availability of Proxy Materials to all stockholders entitled to vote at the Annual Meeting on or about May 8, 2025.

As background relevant to certain portions of this Proxy Statement, on June 16, 2022 (the “Closing Date”) Grove consummated previously announced transactions (the “Merger”) contemplated by the Agreement and Plan of Merger dated December 7, 2021, amended and restated on March 31, 2022 (the “Merger Agreement”), among Virgin Group Acquisition Corp. II, a blank check company incorporated as a Cayman Islands exempted company in 2020 (“VGAC II”), Treehouse Merger Sub, Inc. (“VGAC II Merger Sub I”), Treehouse Merger Sub II, LLC (“VGAC II Merger Sub II”) and Grove Collaborative, Inc. (“Legacy Grove”). In connection with the Merger, VGAC II changed its jurisdiction of incorporation from the Cayman Islands to the State of Delaware and changed its name to Grove Collaborative Holdings, Inc. (the “Domestication”), a public benefit corporation. On the Closing Date, VGAC II Merger Sub I merged with and into Legacy Grove with Legacy Grove being the surviving corporation and a wholly-owned subsidiary of the Company (the “Initial Merger”), and immediately following the Initial Merger, and as part of the same overall transaction as the Initial Merger, Legacy Grove merged with and into VGAC II Merger Sub II, the separate corporate existence of Legacy Grove ceased, and VGAC II Merger Sub II continued as the surviving company and wholly-owned subsidiary of the Company and changed its name to Grove Collaborative, Inc. (together with the Initial Merger and the Domestication, the “Business Combination”).

EXPLANATORY NOTE

We are an “emerging growth company” under applicable federal securities laws and therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this Proxy Statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, including the compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We may remain an emerging growth company until December 31, 2026, provided that, if we issue more than $1 billion in non-convertible debt before that time or if we have annual gross revenues of $1.235 billion or more in any fiscal year, we will cease to be an emerging growth company as of December 31 of that year.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

Grove has sent you these proxy materials because its board of directors (the “Board”) is soliciting your proxy to vote at the Annual Meeting on June 19, 2025, 8:00 a.m. Pacific Time, and any adjournments or postponements thereof. Grove intends to mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders entitled to vote at the Annual Meeting on or about May 8, 2025.

How do I attend the Annual Meeting?

To participate in the Annual Meeting, you must access the virtual meeting at https://www.cstproxy.com/grovecollaborative/2025 and use the control number provided with your proxy materials. Grove’s virtual meeting platform, which will be provided by Continental Stock Transfer and Trust (or subcontractor thereof), allows all participating stockholders to submit questions during the Annual Meeting. In addition, it also allows stockholders to vote on proposals online. Grove believes that the virtual platform increases stockholder participation while at the same time affording the same rights and opportunities to participate as stockholders would have at a physical annual meeting.

Grove encourages you to access the Annual Meeting before it begins. If you have difficulty accessing the Annual Meeting, please call the technical support number that will be posted at https://www.cstproxy.com/grovecollaborative/2025.

May stockholders ask questions at the Annual Meeting?

Yes. Stockholders as of the close of business on the Record Date (defined below) will have the ability to submit questions during the Annual Meeting via the virtual meeting website once the Annual Meeting has begun. In order to ask questions, stockholders will need to be logged in to the virtual meeting website as stockholders. We intend to answer questions to the extent relevant to the business of the Annual Meeting. More information regarding the question-and-answer process, including the number and types of questions permitted, and how questions will be recognized, answered, and disclosed, will be available in the meeting rules of conduct, which will be posted at https://www.cstproxy.com/grovecollaborative/2025 during the meeting.

Who is paying for this proxy solicitation?

Grove will pay for the entire cost of soliciting proxies. In addition to these proxy materials, the Company’s directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. Grove may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

Who can vote at the Annual Meeting?

Stockholders of record as of the close of business on April 23, 2025 (the “Record Date”) are entitled to receive notice of, to attend and participate, and to vote at the Annual Meeting. At the close of business on the Record Date, there were outstanding 40,254,746 shares of the Company’s Class A common stock, par value $0.0001 per share (“Class A Common Stock” or “Common Stock”). At the close of business on the Record Date, there were also 10,000 shares of Series A Convertible Preferred Stock, par value $0.0001 per share (“Series A Preferred Stock”) and 15,000 shares of Series A' Preferred Stock, par value $0.0001 per share (the “Series A' Preferred Stock” and together with the Series A Preferred Stock, the “Preferred Stock”) outstanding. Holders of Common Stock are entitled to one vote for each share held as of the above Record Date. Holders of Series A Preferred Stock are entitled to 473.9336 votes for each share held as of the Record Date. Holders of Series A' Preferred Stock are entitled to 517.3840 votes for each share of Series A' Preferred Stock. Holders of Common Stock, Series A Preferred Stock and Series A' Preferred Stock will vote together as a single class on all matters described in this Proxy Statement. There is no cumulative voting.

How do I vote?

A stockholder’s shares can be voted at the Annual Meeting only if the stockholder attends the virtual meeting or is represented by proxy. Grove urges any stockholders not planning to attend the Annual Meeting to authorize their proxy in advance. Stockholders may complete their proxies and authorize their votes by proxy over the Internet at https://www.cstproxy.com/grovecollaborative/2025. Stockholders who complete their proxy electronically over the Internet do not need to return a proxy card. Stockholders who hold their shares beneficially in street name through a nominee should follow the instructions they receive from their nominee to vote their shares. If you decide to vote by mail, follow the instructions on the proxy card delivered to you and return the proxy using the postage paid envelope provided.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of Common Stock you own as of the Record Date, 473.9336 votes for each share of Series A Preferred Stock you own as of the Record Date and 517.3840 votes for each share of Series A' Preferred Stock you own as of the Record Date. Fractional votes shall not, however, be permitted and any fractional voting rights resulting from the Series A Preferred Stock and Series A' Preferred Stock shall be rounded down to the nearest whole number.

How are votes counted?

Stockholder votes will be tabulated by the persons appointed by the Board (or appointed by persons the Board has delegated the power to appoint) to act as inspectors of election for the Annual Meeting. Shares of Preferred Stock and Common Stock represented by a properly executed and delivered proxy will be voted at the Annual Meeting and, when the stockholder has given instructions, will be voted in accordance with those instructions.

What if I do not provide specific voting instructions?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted as follows: (1) “FOR” each of the nominees listed in Proposal No. 1, (2) “FOR” the ratification of the independent registered public accounting firm in Proposal No. 2, and (3) in accordance with the discretion of the persons appointed as proxies with respect to any other matters that properly come before the Annual Meeting.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares held in street name. These proxy materials are being forwarded to you by your bank, broker or other nominee, who is considered to be the holder of record with respect to your shares. As the beneficial owner, you have the right to direct your bank, broker or other nominee how to vote your shares by following their instructions for voting. Please refer to information from your bank, broker or other nominee on how to submit your voting instructions.

If you do not furnish voting instructions to your bank, broker or other nominee, one of two things can happen, depending upon whether a proposal is “routine.” Under the rules that govern brokers that have record ownership of shares beneficially owned by their clients, brokers have discretion to cast votes only on routine matters, such as the ratification of the appointment of independent registered public accounting firms, without voting instructions from their clients. Brokers are not permitted, however, to cast votes on “non-routine” matters without such voting instructions, such as the election of directors. Proposal No. 2 is considered a “routine” proposal. All other proposals are considered “non-routine,” and your broker will not have discretion to vote on these proposals.

What are broker non-votes?

When a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed to be “non-routine,” the broker or nominee cannot vote the shares with respect to such matters. These unvoted shares are considered “broker non-votes” with respect to such matters.

Why did I receive a Notice Regarding the Availability of Proxy Materials on the Internet?

In accordance with rules adopted by the Securities and Exchange Commission (“SEC”), the Company may provide access to its proxy materials over the Internet. Accordingly, the Company is sending a Notice to some of its stockholders of record. If you received a Notice by mail, you will not receive a printed copy of the proxy materials unless you request one. The Notice will tell you how to access and review the proxy materials over the Internet at https://www.cstproxy.com/grovecollaborative/2025. The Notice will also tell you how to access your proxy card to vote over the Internet. If you received a Notice by mail and would like to receive a printed copy of the Company’s proxy materials, please follow the instructions included in the Notice.

What should I do if I get more than one proxy or voting instruction card?

Stockholders may receive more than one set of voting materials, including multiple copies of the proxy materials and multiple Notices, proxy cards or voting instruction cards. For example, stockholders who hold shares in more than one brokerage account may receive separate sets of proxy materials or one Notice for each brokerage account in which shares are held. Stockholders of record whose shares are registered in more than one name will receive more than one set of proxy materials. You should vote in accordance with all of the proxy cards and voting instruction cards you receive relating to the Annual Meeting to ensure that all of your shares are voted and counted.

How many votes are needed to approve each proposal?

Proposal No. 1 - The election of directors shall be determined by a plurality of the votes cast by the stockholders present in person virtually or represented by proxy at the Annual Meeting and entitled to vote thereon to be approved. Holders of Common Stock and Preferred Stock are entitled to vote on Proposal No. 1. You may vote “FOR” or “WITHHOLD” with respect to this proposal. “Plurality” means that the nominees who receive the largest number of votes cast “FOR” such nominees are elected as directors. Only votes “FOR” will affect the outcome, and any shares not voted “FOR” a particular nominee (whether as a result of a stockholder “WITHHOLD” vote or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on the outcome of the election.

Proposal No. 2 - The ratification of the selection of Moss Adams LLP (“Moss Adams”) as the Company’s independent registered public accounting firm for fiscal year ending December 31, 2025, requires the affirmative vote of a majority of the votes cast by the stockholders present virtually or by proxy at the Annual Meeting and entitled to vote thereon to be approved. Holders of Common Stock and Preferred Stock are entitled to vote on Proposal No. 2. You may vote “FOR,” “AGAINST,” or “ABSTAIN” with respect to this proposal. Abstentions and broker non-votes are not considered “votes cast” and will have no effect on the outcome of this proposal.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares of Common Stock and Preferred Stock (on an as converted basis) entitled to vote are present at the Annual Meeting in person or represented by proxy. Abstentions from voting on a proposal and broker non-votes will count for purposes of determining a quorum.

On the Record Date, there were 40,254,746 shares of Common Stock, 10,000 shares of Series A Preferred Stock and 15,000 shares of Series A' Preferred Stock outstanding and entitled to vote, representing 52,754,843 votes. Thus, the holders of shares of Common Stock and Preferred Stock representing 26,377,422 votes must be present in person or represented by proxy at the Annual Meeting to have a quorum. If there is no quorum, either the chairperson of the meeting or the holders of a majority of the voting power of shares of Common Stock and Preferred Stock present at the Annual Meeting or represented by proxy may adjourn the meeting to another date.

Can I change my vote after submitting my proxy?

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is exercised by delivering a written notice of revocation or a properly executed proxy bearing a later date to the attention of Grove’s Corporate Secretary at 1301 Sansome Street, San Francisco, CA 94111.

You may also revoke your proxy by voting again on a later date on the Internet (only your latest Internet proxy submitted prior to the Annual Meeting will be counted), or by attending the virtual meeting and voting your shares while logged in and participating in the live webcast.

Beneficial owners of shares held in street name must follow their bank, broker or other nominee’s instructions to revoke their proxies or vote at the Annual Meeting and, for both stockholders of record and beneficial owners of shares held in street name, attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request or vote online at the Annual Meeting.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that Grove expects to file within four business days after the Annual Meeting. If final voting results are not available to Grove in time to file a Form 8-K within four business days after the Annual Meeting, Grove intends to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to the Company, file an additional Form 8-K to publish the final results.

What proxy materials are available on the Internet?

This Proxy Statement, Grove’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and the Notice are available, or will be made available when published, at https://www.cstproxy.com/grovecollaborative/2025.

Where can I find the stockholder list?

A complete list of registered stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder, for any purpose related to the meeting, for ten days prior to the date of the Annual Meeting during ordinary business hours at the Company’s principal offices located at 1301 Sansome Street, San Francisco, CA 94111.

Do I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Annual Meeting?

No. Delaware law does not provide stockholders any dissenters’ or appraisal rights with respect to the matters to be voted on at the Annual Meeting.

Who can I contact if I have questions concerning the Annual Meeting?

If you have any further questions about voting your shares or attending the Annual Meeting or wish to obtain directions on how to join the virtual Annual Meeting, please email Grove’s Investor Relations Department at ir@grove.co.

PROPOSAL NO. 1 − ELECTION OF DIRECTORS

Our Board is classified into three classes, with staggered three-year terms, designated as Class I, Class II and Class III. Vacancies on the Board may be filled solely by the affirmative vote of a majority of the directors then in office, even if less than a quorum, or by a sole remaining director. Any director elected to fill a vacancy or newly created directorship shall hold office until the next election of the class to which such director shall have been appointed or assigned, and until his or her successor is duly elected and qualified, subject to his or her earlier death, disqualification, resignation or removal.

The Board presently has eight members. There are three Class III directors whose term of office expires at the conclusion of the Annual Meeting. The Board has nominated two of those members for election at the Annual Meeting. Effective as of the Annual Meeting, Class III of the Board will be reduced to two members. The term of Rayhan Arif, who currently is a member of Class III of the Board, will expire at the conclusion of the Annual Meeting. The Board expresses its appreciation for Mr. Arif’s leadership, strategic insight and invaluable advice.

At the recommendation of Grove’s sustainability, nominating and governance committee (the “Sustainability, Nominating and Governance Committee”), the Board proposes that the two Class III nominees named below, each of whom is currently serving as a director in Class III, be elected as a Class III director. If elected by our stockholders, each nominee will serve for a three-year term expiring at the 2028 annual meeting of stockholders or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal. The terms of office of directors in Class I and Class II expire at Grove’s annual meeting of stockholders to be held in 2026 and 2027, respectively.

Class III Nominees for Election for a Three-year Term Expiring at the 2028 Annual Meeting

The nominees and their ages, occupations and lengths of service on the Board are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

Nominees for Class III Director (Terms Expiring on the Date of the 2028 Annual Meeting of Stockholders)

| | | | | | | | |

| David Glazer | | Director since June 2022 |

| Naytri Shroff Sramek | | Director since June 2022 |

Continuing Class I Directors (Terms Expiring on the Date of the 2026 Annual Meeting of Stockholders)

| | | | | | | | |

| Larry Cheng | | Director since August 2023 |

| Stuart Landesberg | | Director since June 2022 |

| Kristine Miller | | Director since June 2022 |

Continuing Class II Directors (Term Expiring on the Date of the 2027 Annual Meeting of Stockholders)

| | | | | | | | |

| John Replogle | | Director since June 2022 |

| Jeff Yurcisin | | Director since August 2023 |

Set forth below is each director’s and each director nominee’s name and age as of the date of this proxy statement and his or her principal occupation, business history and public company directorships held during the past five years.

Rayhan Arif. Mr. Arif, 38, is chief commercial officer of Virgin Hotels, a lifestyle hospitality brand that is part of the Virgin Group, a position he has held since 2024. From 2017 to 2024, Mr. Arif was an investment director at the Virgin Group, a global growth investor. He was responsible for investing the Virgin Group’s capital across a range of opportunities and supporting the strategic development of Virgin’s portfolio companies in the Americas. From 2013 to 2015, Mr. Arif served as an investment professional at AEA Investors, a global private equity firm focused on leveraged buyouts and growth capital investments. From 2012 to 2013, Mr. Arif worked on the strategy team of Zipcar, a leading car-sharing network. Prior thereto, Mr. Arif was a management consultant at Bain & Company. Mr. Arif received a B.A. in Economics from Harvard College and an M.B.A. from Columbia Business School. We believe that Mr. Arif’s investment and operational experience make him a valuable member of the Board.

Larry Cheng. Mr. Cheng, 49, is co-founder and managing partner at Volition Capital, a leading growth equity investment firm, a role he has held since 2010. He has more than two decades of venture capital and growth equity investing experience based on his time at Volition Capital, Fidelity Ventures, Battery Ventures and Bessemer Venture Partners. He presently leads the Internet and Consumer team at Volition Capital, focusing on companies in ecommerce, internet services, consumer brands and digital media and gaming. Mr. Cheng is currently a member of the board of directors of GameStop (NYSE: GME) and several private companies. Mr. Cheng received his B.A. in Psychology from Harvard College. Mr. Cheng brings to the Board significant experience in capital allocation, finance, ecommerce, internet services and consumer brands.

David Glazer. Since 2013, Mr. Glazer, 41, has served in various positions at Palantir Technologies Inc. (NYSE: PLTR), a leading builder of operating systems for the modern enterprise, most recently as chief financial officer and treasurer. Prior to that, Mr. Glazer was a corporate securities attorney at Wilson Sonsini Goodrich & Rosati. Mr. Glazer received a J.D. degree from Emory University School of Law and a B.A from Santa Clara University. We believe Mr. Glazer is qualified to serve on the Board because of his legal, public company financial and technology experience.

Stuart Landesberg. Mr. Landesberg, 39, is currently chief executive officer at Amor Fati Industries Inc., a provider of advanced technology for wildland fire agencies and high-risk properties, a position he has held since November 2024. Mr. Landesberg co-founded Grove in 2012 and served as its executive chairman from August 2023 to February 2025 and president and chief executive officer from its inception to August 2023. Prior to co-founding Grove, he worked for TPG Capital, where he was involved in consumer and internet investments. He was also a founding team member for Toro Investment Partners, a consumer and technology focused long/short hedge fund. Mr. Landesberg started his career in the investment banking division of Lehman Brothers. Mr. Landesberg earned a B.A. in Economics and Spanish from Amherst College where he graduated magna cum laude with distinction. We believe Mr. Landesberg’s extensive direct-to-consumer and consumer packaged goods industry experience, capital markets expertise, as well as his institutional knowledge as the co-founder of Grove qualify him to serve on the Board.

Kristine Miller. Ms. Miller, 61, most recently served as the chief strategy officer for global e-commerce marketplace eBay Inc., from 2014 to 2020. In this role, Ms. Miller set the vision for the future of commerce and led numerous digital transformation initiatives to improve buyer and seller experiences. She is a retail thought leader, frequently speaking on topics such as technology’s impact on consumer shopping behavior. Prior to joining eBay Inc., Ms. Miller was a partner and director at Bain & Company where she served as head of the North American retail practice and chairperson of Bain’s Worldwide Compensation & Promotion Committee. Ms. Miller began her career with The Procter & Gamble Company’s Beauty Care Division supporting new product development. Ms. Miller served on the board of directors of Cable One (NYSE: CABO) from 2019 to 2023 and serves on the board of directors of Neiman Marcus Group (private, post-emergence) and Chairish (private), a home furnishings marketplace. Ms. Miller received her M.B.A. from the Stanford Graduate School of Business, where she was an

Arjay Miller Scholar, and a B.S. in Chemical Engineering with honors from Carnegie-Mellon University. We believe Ms. Miller is qualified to serve on the Board because of her significant operating and leadership experience as well as her direct-to-consumer experience.

John Replogle. Mr. Replogle, 59, has served as a founding partner of One Better Ventures, LLC, a venture capital firm focused on consumer brands that have a positive impact, since October 2017. Mr. Replogle previously served as the chief executive officer and president of Seventh Generation, Inc. and Burt’s Bees, Inc. Mr. Replogle also previously served as the general manager of Unilever’s Skin Care division. He started his career with the Boston Consulting Group. Mr. Replogle is currently a member of the board of directors of Crocs, Inc. (NYSE: CROX) and previously served as a member of the board of directors of Wolfspeed, Inc. (NYSE: WOLF) from 2014 until 2024. Mr. Replogle received his M.B.A. from Harvard Business School and a B.A. from Dartmouth College. We believe Mr. Replogle is qualified to serve on the Board because of his significant senior executive leadership experience, including eleven years of experience as chief executive officer at two companies, as well as deep experience in marketing, branding and distribution of consumer goods.

Naytri Shroff Sramek. Since 2024, Ms. Sramek, 35, has served as head of operations for California Forever, a real estate development corporation. Prior to that time, she served in various positions at GitHub, Inc., a subsidiary of Microsoft Corporation (NASDAQ: MSFT), most recently as chief of staff to the chief executive officer from 2018 to 2021. From 2017 to 2018, Ms. Sramek was the head of enterprise at Crew, a workplace management software company acquired by Block, Inc. in 2021. Prior thereto, Ms. Sramek served in various positions at Palantir Technologies Inc. (NYSE: PLTR). Ms. Sramek received a B.A. in Business Economics from the University of California Los Angeles. We believe Ms. Sramek is qualified to serve on the Board because of her financial expertise and leadership experience.

Jeff Yurcisin. Mr. Yurcisin, 50, has been chief executive officer of Grove since August 2023. From November 2022 to July 2023, Mr. Yurcisin served as executive in residence at Madrona Venture Group, a venture capital firm. Prior to that time, he was the president and chief executive officer of Zulily, an ecommerce company, from August 2018 to March 2022. Prior to that, he was vice president, private brands at Amazon, a multinational technology company, from 2015 to 2018 and vice president, Amazon clothing and chief executive officer of Shopbop, a subsidiary of Amazon, from 2013 to 2015. He became chief executive officer of Shopbop in 2008 after it was acquired by Amazon. Prior to that, Mr. Yurcisin held various managerial roles at Amazon and held positions at Boston Consulting Group, Westlaw.com, Broadband Office and Oliver Wyman. Mr. Yurcisin holds a Bachelor’s degree in Economics from Princeton University and an M.B.A. from Harvard Business School. We believe Mr. Yurcisin is qualified to serve on the Board in light of his in-depth knowledge of our business as chief executive officer as well as his significant senior executive leadership experience and deep direct-to-consumer, marketing, branding and ecommerce experience.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE CLASS III DIRECTOR NOMINEES

PROPOSAL NO. 2 − RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board (the “Audit Committee”) has selected Moss Adams as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025, and has further directed that management submit the selection of its independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Moss Adams has been engaged by Grove since October 2024. Representatives of Moss Adams are expected to be present during the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

The Company was notified in April 2025 that Moss Adams entered into an Equity Purchase Agreement under which Moss Adams and its subsidiaries will undergo a restructuring to effectuate a merger with Baker Tilly US, LLP, Baker Tilly Advisory Group, LP, and their respective subsidiaries and affiliates (the “BT Transaction”). It is anticipated that the BT Transaction will close in early June 2025. Following the closing, the combined audit practices will operate under Baker Tilly US, LLP. The Audit Committee has been notified of the BT Transaction and believes it will approve the continuation of the engagement if the BT Transaction closes.

If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain Moss Adams. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

Change in Independent Registered Accounting Firm

On October 9, 2024, the Company, with the approval of the Audit Committee, notified Ernst & Young LLP (“EY”) that EY was being dismissed as the Company’s independent registered public accounting firm, effective October 9, 2024 (the “Effective Date”), and as of the Effective Date, the Audit Committee of the Company’s Board of Directors approved the appointment of Moss Adams as the Company’s new independent registered public accounting firm commencing for the Company’s quarter ending September 30, 2024 and its year ending December 31, 2024.

The audit reports of EY on the Company’s consolidated financial statements for the years ended December 31, 2022 and 2023 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principle.

During the year ended December 31, 2023 and through the date of EY’s dismissal there were no (i) disagreements with EY on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to EY’s satisfaction, would have caused EY to make reference to the subject matter thereof in connection with its reports for such periods; or (ii) reportable events as described under Item 304(a)(1)(v) of Regulation S-K.

During the Company’s fiscal year ended December 31, 2023 and through October 9, 2024, neither the Company nor anyone acting on its behalf consulted Moss Adams on any matter relating to either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report nor oral advice was provided to the Company that Moss Adams concluded was an important factor considered by the Company in reaching a decision as to an accounting, auditing or financial reporting issue; or (ii) any matter that was the subject of a “disagreement” (as defined in Regulation S-K Item 304(a)(1)(iv)) or a “reportable event” (as defined in Regulation S-K Item 304(a)(1)(v)).

The Company previously provided EY with a copy of the disclosures regarding the dismissal reproduced in this Proxy Statement prior to its filing with the SEC and requested that EY provide the Company with a letter addressed to the SEC stating whether EY agrees with the statements made by the Company in accordance with Item 304(a) of Regulation S-K. Such letter, dated October 10, 2024 and furnished by EY in response to that request, was filed as Exhibit 16.1 to Grove’s Current Report on Form 8-K filed with the SEC on October 10, 2024.

Principal Accountant Fees and Services

The following table represents aggregate fees billed to the Company for the fiscal years ended December 31, 2024 and 2023, by Moss Adams and EY.

EY

| | | | | | | | | | | |

| Year Ended December 31, |

| 2024 | | 2023 |

Audit Fees(1) | $ | 256,000 | | | $ | 1,011,050 | |

Tax Fees(2) | $ | — | | | $ | — | |

| All Other Fees | $ | — | | | $ | — | |

| Total Fees | $ | 256,000 | | | $ | 1,011,050 | |

Moss Adams

| | | | | | | | | | | |

| Year Ended December 31, |

| 2024 | | 2023 |

Audit Fees(1) | $ | 620,000 | | | $ | — | |

| Audit-Related Fees | $ | — | | | $ | — | |

Tax Fees(2) | $ | — | | | $ | — | |

| All Other Fees | $ | — | | | $ | — | |

| Total Fees | $ | 620,000 | | | $ | — | |

| | | | | |

| (1) | “Audit Fees” consist of audit services related to the audit of the Company’s annual consolidated financial statements and the review of the Company’s quarterly condensed consolidated financial statements. The Audit Fees incurred also include fees related to services performed in connection with Grove’s securities offerings, in each case including consents and review of documents filed with the SEC and other offering documents. |

| (2) | “Tax Fees” consist of professional services for tax compliance and tax advice. |

Pre-Approval Policies and Procedures

Pursuant to its charter, the Audit Committee may pre-approve audit and permissible non-audit and tax services provided to the Company by the independent auditors. The Audit Committee may delegate to one or more designated members of the Audit Committee the authority to pre-approve audit and permissible non-audit services, provided such pre-approval decision is presented to the full Audit Committee at its scheduled meetings.

All of the services listed in the table above provided by Moss Adams and EY were pre-approved by the Audit Committee.

THE BOARD AND THE AUDIT COMMITTEE RECOMMEND A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF MOSS ADAMS AS GROVE’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

BOARD OF DIRECTORS AND COMMITTEES; CORPORATE GOVERNANCE

Overview

Grove is committed to maintaining high standards of business conduct and corporate governance, which we believe are important to the overall success of our business and serve Grove’s stakeholders well. The Board’s Corporate Governance Guidelines and Grove’s Code of Ethics and Business Conduct, together with Grove’s certificate of incorporation, bylaws, and the charters of the committees of the Board form the basis for the Company’s corporate governance framework. The Corporate Governance Guidelines are posted on our website at https://investors.grove.co under the Governance section.

Director Independence

Our Board has undertaken a review of the independence of each director and considered whether each director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. The Board has determined that Rayhan Arif, Larry Cheng, David Glazer, Kristine Miller, Naytri Shroff Sramek and John Replogle qualify as independent directors, as defined under the applicable rules and regulations of the SEC and the New York Stock Exchange (“NYSE”) listing rules. Jeff Yurcisin was determined not to be independent under such rules and regulations, because he was, and is, an employee of the Company. In addition, Mr. Landesberg was determined not to be independent due to his previous employment by the Company. Chris Clark, who served on the Board during 2024 but is not a current member of the Board, also was determined not to be independent due to his employment by the Company. Kevin Cleary, who served on the Board during 2024 but is not a current member of the Board, was determined to be an independent director.

Meeting Attendance and Executive Sessions

The Board held seven meetings during 2024. During 2024, each of our current directors attended at least 75% of the aggregate number of meetings of our Board and committees thereof, if any, on which such director served during the period for which he or she was a director or committee member. The independent members of our Board met regularly in executive session in Board and committee meetings. For additional information about the number of meetings held by each Board committee during the year ended December 31, 2024, see “Board Committees” below. We encourage, but do not require, members of our Board to attend our annual meeting of stockholders. Six members of our Board attended the annual meeting of our stockholders held in 2024.

Board Oversight of Risk

One of the key functions of the Board is informed oversight of the Company’s risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various standing committees of the Board that address risks inherent in their respective areas of oversight. For example, the Audit Committee of the Board is responsible for overseeing the management of risks associated with the Company’s financial reporting, accounting, and auditing matters and the compensation committee of the Board (the “Compensation Committee”) oversees the management of risks associated with compensation policies and programs.

Board Committees and Leadership Structure

The Board has established the Audit Committee, the Compensation Committee, and the Sustainability, Nominating and Governance Committee. The Board may establish other committees to facilitate the management of the Company’s business. The Board and its committees will set schedules for meetings throughout the year and can also hold special meetings and act by written consent from time to time, as appropriate. The Board delegates various responsibilities and authority to its committees as generally described below. The committees regularly report on their activities and actions to the full Board. Copies of each committee charter are posted on our investor website at https://investors.grove.co under the Governance section. The information found on or that can be accessed from or that is hyperlinked to our website is not part of this Proxy Statement. Members serve on these committees until their resignation or until otherwise determined by the Board.

The Board periodically reviews its leadership structure. In 2024, Mr. Landesberg served as executive chair of the Board and Mr. Replogle as lead independent director. In February 2025, Mr. Landesberg transitioned to the role of non-executive chairperson of the Board, and Mr. Replogle has remained lead independent director. The Board has adopted that leadership structure as it believes it to be appropriate in light Mr. Landesberg’s familiarity with the operations of the Board and detailed knowledge regarding the Company’s operations. As lead independent director, Mr. Replogle has responsibility for helping to develop agendas for the meetings of the Board with the chairperson of the Board and chief executive officer. Mr. Replogle also is responsible for calling meetings or executive sessions of the independent directors, developing agendas for those meetings and chairing them.

Audit Committee

The current members of the Audit Committee are David Glazer, Kristine Miller and Naytri Shroff Sramek. In 2024 (and in early 2025 in the case of Messrs. Arif and Cheng), Messrs. Arif, Cheng and Replogle also served on the Audit Committee. Mr. Glazer is the chair of the Audit Committee. Each Mses. Miller and Sramek and Messrs. Arif, Glazer, Replogle and Cheng can read and understand fundamental financial statements, and the Board determined that each is independent under the rules and regulations of the SEC and NYSE listing standards applicable to audit committee members and is “financially literate” under NYSE rules. The Board has also determined that Mr. Glazer and Ms. Sramek qualify and each of Messrs. Arif, Cheng and Replogle, when they were members of the Audit Committee, qualified as audit committee financial experts within the meaning of SEC regulations.

The Audit Committee assists the Board with its oversight of the following: the integrity of the Company’s financial statements; the Company’s compliance with legal and regulatory requirements; the qualifications, independence, and performance of the independent registered public accounting firm; and the design and implementation of our internal audit function and risk assessment and risk management. Among other things, the Audit Committee is responsible for reviewing and discussing with Company management the adequacy and effectiveness of the Company’s disclosure controls and procedures. The Audit Committee also discusses with Company management and the Company’s independent registered public accounting firm the annual audit plan and scope of audit activities, scope and timing of the annual audit of the Company’s financial statements, and the results of the audit and quarterly reviews of the Company’s financial statements, and, as appropriate, will initiate inquiries into certain aspects of the Company’s financial affairs. The Audit Committee is responsible for establishing and overseeing procedures for the receipt, retention, and treatment of any complaints regarding accounting, internal accounting controls, or auditing matters, as well as for the confidential and anonymous submissions by the Company’s employees of concerns regarding questionable accounting or auditing matters. In addition, the Audit Committee has direct responsibility for the appointment, compensation, retention, and oversight of the work of the Company’s independent registered public accounting firm. The Audit Committee also has sole authority to approve the hiring and discharging of the Company’s independent registered public accounting firm, all audit engagement terms and fees, and all permissible non-audit engagements with the independent auditor. The Audit Committee reviews and oversees all related person transactions in accordance with the Company’s Related Person Transaction Policy.

The Audit Committee met five times during the year ended December 31, 2024.

Compensation Committee

Larry Cheng, Kristine Miller and John Replogle serve on the Compensation Committee. In 2024 and early 2025, Naytri Shroff Sramek also served on the Compensation Committee. Kristine Miller is the chair of the Compensation Committee. Each member of the Compensation Committee (and Ms. Sramek when she was on the Compensation Committee) is independent under the rules and regulations of the SEC and NYSE listing standards applicable to compensation committee members. The Compensation Committee assists the Board in discharging certain of the Company’s responsibilities with respect to compensating the Company’s executive officers, and the administration and review of the Company’s incentive plans for employees and other service providers, including the Company’s equity incentive plan(s), and certain other matters related to the Company’s compensation programs.

The Compensation Committee met six times during the year ended December 31, 2024.

Sustainability, Nominating and Governance Committee

Larry Cheng, Naytri Shroff Sramek and John Replogle currently serve on the Sustainability, Nominating and Governance Committee. In 2024 and early 2025, Rayhan Arif also served on the Sustainability, Nominating and Governance Committee. Ms. Sramek is the chair of the Sustainability, Nominating and Governance Committee. Each member of the Sustainability, Nominating and Governance Committee (and Mr. Arif when he was a member of the Sustainability, Nominating and Governance Committee) is independent under the rules and regulations of the SEC and NYSE listing standards applicable to nominating and governance committee members. The Sustainability, Nominating and Governance Committee assists the Board in identifying, screening, and reviewing individuals qualified to serve as directors consistent with criteria approved by the Board, recommending to the Board candidates for nomination for appointment at the annual general meeting or to fill vacancies on the Board, developing and recommending to the Board and overseeing implementation of the Company’s corporate governance guidelines, coordinating and overseeing the annual self-evaluation of the Board, its committees, individual directors, and management in the governance of the Company, and reviewing on a regular basis the Company’s overall corporate governance and recommending improvements as and when necessary. The Sustainability, Nominating and Governance Committee is also responsible for oversight of the Company’s ongoing commitment to environmental stewardship, corporate social responsibility and sustainability.

Pursuant to the Company’s Corporate Governance Guidelines, the Sustainability, Nominating and Governance Committee takes into account many factors when evaluating the suitability of director candidates and when considering whether to nominate a director for re-election. Such factors many include general understanding of various business disciplines (e.g., marketing, finance, etc.), the Company’s business environment, educational and professional background, analytical ability, independence, diversity of experience, viewpoints and backgrounds, willingness to devote adequate time to Board duties and ability to act in and represent the balanced best interests of the Company, and the long-term interests of the stockholders, the Company’s other stakeholders, and the public benefit, rather than special constituencies. The Sustainability, Nominating and Governance Committee will consider director candidates properly recommended by the Company’s stockholders in the same manner by which it evaluates other director candidates.

The Sustainability, Nominating and Governance Committee met three times during the year ended December 31, 2024.

Board and Committee Evaluations

The Sustainability, Nominating and Governance Committee assists the Board in coordinating and overseeing the annual self-evaluation of the Board and its committees. The self-evaluation process is conducted by a third party and involves written questionnaires that are completed by each director as well as one-on-one interviews of each director. The information collected through the written questionnaires and interviews is summarized and reported to the full Board, which engages in discussion of Board effectiveness in governance and support of corporate strategies, areas for change or improvement in Board practice and specific actions to be taken.

Code of Ethics and Business Conduct

The Company has adopted a Code of Ethics and Business Conduct (the “Code”) that applies to all of the Company’s employees, officers, and directors, including the principal executive officer, principal financial officer and principal accounting officer or controller (or persons performing similar functions to the aforementioned officers). The full text of the Code is posted on our website at https://investors.grove.co under the Governance section. The Company intends to disclose future amendments to, or waivers of, the Code, as and to the extent required by SEC regulations, at the same location on our website identified above or in public filings. The

information found on, or that can be accessed from or that is hyperlinked to, our website is not part of this proxy statement.

Insider Trading Policy

The Company has an Insider Trading Policy governing the purchase, sale, and/or other dispositions of our securities by directors, officers, employees, agents and consultants that is designed to promote compliance with insider trading laws, rules and regulations, and applicable listing standards. It is also our policy that the Company will not trade in company securities in violation of applicable securities laws or stock exchange listing standards. A copy of the Insider Trading Policy is included as an exhibit to the Company’s Form 10-K for the year-ended December 31, 2024.

Anti-Hedging and Anti-Pledging Policy

Our insider trading policy prohibits our directors, executive officers and other employees from engaging in hedging transactions with respect to Company securities, such as transactions in put or call options. Our directors, executive officers and other employees are also prohibited from holding Company securities in a margin account or pledging Company securities as collateral for a loan.

Family Relationships

There are no family relationships between any of the individuals who serve as our directors or executive officers.

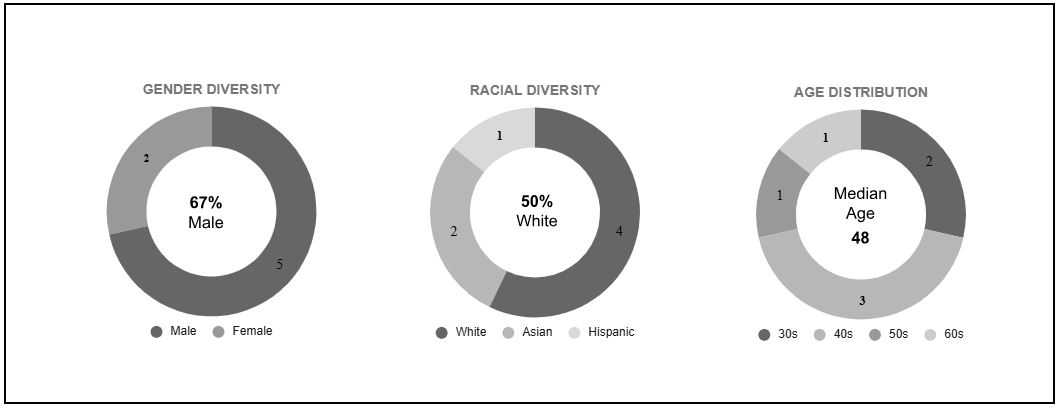

Board Demographics

The Board believes that varying tenures, diverse backgrounds and perspectives create a balance between directors with a deeper knowledge of the Company’s business, operations and history, and directors who bring new and fresh perspectives, which is important to the effectiveness of the Board’s oversight of the Company. The following provides certain demographic information about the members of our Board following the Annual Meeting, assuming that the Board’s nominees are elected at the Annual Meeting:

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee (including any member of the Compensation Committee during 2024) has ever been a member of the board of directors or compensation committee of any other entity that has or has had one or more executive officers serving as a member of our Board or Compensation Committee. Certain members of the Compensation Committee may be deemed to have an interest in certain transactions

DELINQUENT SECTION 16(a) REPORTS

Under U.S. securities laws, directors, executive officers and persons holding more than 10% of Common Stock must report their initial ownership of Common Stock and any changes in that ownership to the SEC. The SEC has designated specific due dates for such reports, and Grove must identify in this Proxy Statement those persons who did not file such reports when due.

Based solely upon a review of Forms 3 and 4 and any amendments furnished to Grove during its fiscal year ended December 31, 2024, and Forms 5 and any amendments furnished to Grove with respect to the same year, Grove believes that Grove’s directors, officers, and greater than 10% beneficial owners complied with all applicable Section 16 filing requirements.

EXECUTIVE OFFICERS

Grove’s executive officers are appointed by the Board and serve at its discretion. Set forth below is information regarding the Company’s current executive officers as of April 1, 2025:

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

Jeff Yurcisin | | 50 | | Chief Executive Officer, President and Director |

| Tom Siragusa | | 34 | | Interim Chief Financial Officer |

Additional information about each of Grove’s current executive officers is as follows:

Tom Siragusa. Mr. Siragusa, age 34, has served in various leadership roles in Grove’s finance department, most recently as Vice President, Finance, a position he has held since October 2024. Prior to that time, Mr. Siragusa acted as Grove’s director and senior director of finance from September 2022 to October 2024 and as Grove’s manager and senior manager of finance from April 2019 to September 2022. Prior to joining the Company, Mr. Siragusa held various management positions in Ernst & Young LLP’s strategy and transactions and assurance services groups. Mr. Siragusa is a certified public accountant (inactive) and holds a B.S. in Managerial Economics and a Master’s Degree in Accounting from the University of California, Davis.

EXECUTIVE COMPENSATION

Grove is considered a smaller reporting company and an emerging growth company for purposes of the SEC’s executive compensation disclosure rules. For the fiscal year ended December 31, 2024, Grove’s named executive officers were:

•Jeff Yurcisin, chief executive officer and director

•Stuart Landesberg, former executive chairperson and current chairperson of the Board; and

•Sergio Cervantes, former chief financial officer.

See “Executive Transitions” below for a description of the transitions of Messrs. Landesberg, Cervantes and Clark.

Grove’s compensation policies and philosophies are designed to align compensation with business objectives, while also enabling it to attract, motivate and retain individuals who contribute to its long-term success. The Compensation Committee approved and recommended the compensation to be paid to Grove’s named executive officers. The Compensation Committee engaged an independent compensation consultant to provide advice with respect to such determinations. For 2024, the principal elements of Grove’s executive compensation program consisted of base salary, eligibility for a performance-based bonus and equity-based incentive awards.

2024 Compensation of Named Executive Officers

Cash Compensation

Base salaries are intended to provide a level of compensation sufficient to attract and retain an effective management team, when considered in combination with the other components of the executive compensation program. In general, the Company provides a base salary level designed to reflect each named executive officer’s scope of responsibility and accountability. None of the named executive officers received base salary increases in 2024. At Mr. Landesberg’s request, Mr. Landesberg received a reduction in his 2024 base salary from $500,000 to $375,000 in March 2024. Mr. Yurcisin’s base salary in 2024 was $500,000. However, in 2024, Mr. Yurcisin’s 2025 base salary was reduced from $500,000 to $450,000 in light of Mr. Yurcisin’s willingness to receive an equity award in November 2024 in lieu of a portion of his base salary. Neither Mr. Cervantes nor Mr. Clark’s base salary changed in 2024.

In 2024 the Compensation Committee approved, and our named executive officers other than Mr. Landesberg participated in, an annual incentive plan. At his request, Mr. Landesberg did not participate in the Company’s 2024 annual incentive plan, and he also requested that the $500,000 transition bonus that Mr. Landesberg was eligible to receive as a part of his transition from chief executive officer to executive chairman be eliminated.

The annual incentive plan was adopted to attract and retain employees with a high caliber of talent and experience for our key positions and to link payments to the achievement of annual financial and/or operational objectives. Under the annual incentive plan, the named executive officers were eligible to receive a percentage of their annual base salary as a target cash payout contingent on Grove’s performance and the named executive officer’s individual performance.

For 2024, the Company’s performance was measured using net revenue and adjusted EBITDA goals, each weighted 50%. Under the terms of the 2024 annual incentive plan, net revenue was defined as GAAP net revenue. Adjusted EBITDA was defined as GAAP net loss, adjusted to exclude: stock-based compensation expense; depreciation and amortization; changes in fair values of derivative liabilities; transaction costs allocated to derivative liabilities upon closing of the Business Combination; interest income; interest expense; restructuring costs; loss on extinguishment of debt; provision for income taxes and certain litigation and legal settlement expenses that the Company does not consider representative of underlying operations.

The target net revenue at which the named executive officers would earn 100% of their target payout attributed to the net revenue goal, subject to individual performance, was net revenue of $231.4 million, with no payout for net revenue performance below $222.1 million. The target adjusted EBITDA at which the named executive officers would earn 100% of their target payout attributed to the adjusted EBITDA goal, subject to individual performance, was adjusted EBITDA of $200,000, with no payout if adjusted EBITDA was lower than -$2.5 million. The named executive officers could earn up to 200% of their target payout for over-achievement against the net revenue and adjusted EBITDA goals. The amount of the payout for over-achievement and under-achievement was to be determined by straight line interpolation.

Our actual performance in 2024 was net revenue of $203.4 million and adjusted EBITDA of $1.3 million. As a result, the named executive officers participating in the annual incentive plan were entitled to no payout for achievement against the net revenue goal and were entitled to a payout of 122.3% of the amount of their incentive tied to the adjusted EBITDA goal due to the Company’s over-achievement against the adjusted EBITDA goal. Based on the weighting of the performance goals, the participating named executive officers were entitled to and received a payout of 61% of their target bonus in light of the Company’s performance against both the net revenue and adjusted EBITDA goals.

Equity Awards

To focus the Company’s executive officers on the Company’s long-term performance, we have granted equity compensation in the form of time-based restricted stock units (“RSUs”) and performance-based restricted stock units (“PSUs”). In February 2024, the Compensation Committee granted RSUs to Messrs. Cervantes and Clark and PSUs to Mr. Landesberg. See “Outstanding Equity Awards at 2024 Fiscal Year-End” below for a description of the 2024 equity awards to our named executive officers. The Compensation Committee did not grant an equity award to Mr. Yurcisin in February 2024 given that Mr. Yurcisin received equity awards in connection with the commencement of his employment with the Company in August 2023. However, as noted above, Mr. Yurcisin received an RSU grant in November 2024 in lieu of a portion of his 2025 base salary.

In determining the number of shares subject to RSUs to grant to Messrs. Cervantes in February 2024, the Compensation Committee reviewed, as one factor, the value of equity awards at the 50th percentile of a group of peer companies it had approved with the advice of the Compensation Committee’s compensation consultant. In light of the Company’s stock price at the time and the dilution to existing stockholders that would result by granting the number of shares subject to RSUs with a targeted value at the 50th percentile, the Compensation Committee reduced the number of shares that would provide that value by 70% for Mr. Cervantes.

The Compensation Committee granted a PSU award to Mr. Landesberg in February 2024. The PSU award granted to Mr. Landesberg in February 2024 was with respect to 286,000 shares of Common Stock. The PSU award was structured with both performance-based and time-based vesting conditions. Under the performance-based vesting component, the PSUs were eligible to vest in 25% installments based on the Company achieving a 90-day volume weighted average price of our Common Stock of $3.50, $5.00, $7.00, and $10.00 during the January 1, 2024 through December 31, 2027 performance period. The closing price of the Common Stock on the New York Stock Exchange was $1.84 on the date the award to Mr. Landesberg was approved by the Compensation Committee. In addition to the performance-based component, the Mr. Landesberg’s PSU award is subject to time-based vesting over three years (1/3 vesting on January 1, 2025 and the remainder vesting in eight quarterly installments thereafter).

In connection with the Company’s hiring of Mr. Yurcisin, Mr. Yurcisin was awarded a PSU award covering 510,000 shares of Common Stock in August 2023. The award was structured similarly to the award granted to Mr. Landesberg in February 2024, but the time-based aspect of Mr. Yurcisin’s award was four years, the stock-price thresholds for vesting were $5.00, $8.00. $12.50 and $21.00 and the performance period applicable to Mr. Yurcisin’s award was five years. In connection with the approval of Mr. Landesberg’s award in February 2024, and in order to increase the retention value of Mr. Yurcisin’s award in light of the market value of our Common Stock, the Compensation Committee changed Mr. Yurcisin’s stock-price vesting thresholds to equal those in the award it approved for Mr. Landesberg. It also changed the performance period for the highest stock price threshold to be five years.

In December 2024, the Compensation Committee granted Mr. Yurcisin RSU awards covering 70,000 shares of Class A Common Stock, consisting of an RSU award covering 30,000 shares of Class A Common Stock that vests quarterly for three years and an RSU covering 40,000 shares of Class A Common Stock that vests approximately one year from the date of grant. These awards were granted to Mr. Yurcisin in connection with the reduction in Mr. Yurcisin’s 2025 base salary from $500,000 to $450,000, which also had the effect of reducing Mr. Yurcisin’s target bonus opportunity for 2025 by an additional $50,000.

Please see the “Outstanding Equity Awards at 2024 Fiscal Year-End” table below for a summary of the equity awards held by the named executive officers as of December 31, 2024.

Equity Grant Procedures

The Company does not grant equity awards in anticipation of the release of material, non-public information. Similarly, the Company does not time the release of material, non-public information based on equity grant dates for the purpose of affecting the value of any award granted to a named executive officer. The Company also does not take material, non-public information into account when determining the timing and terms of the equity grants. During 2024, none of the named executive officers were granted stock options.

Executive Transitions

In December 2024, the Company and Mr. Landesberg agreed that Mr. Landesberg would step down as executive chairperson, effective February 17, 2025 and transition to the role of non-employee member of the Board, initially as chairperson of the Board. In connection with the transition, the Company and Mr. Landesberg entered into a letter agreement in December 2024, which provides that, after Mr. Landesberg’s transition to non-employee member of the Board, Mr. Landesberg will no longer be entitled to receive the compensation set forth in Mr. Landesberg’s executive chairperson letter agreement. Instead, based on his service as a non-employee member of the Board, Mr. Landesberg would be eligible to receive annual cash and equity compensation consistent with the compensation paid to other non-employee members of the Board. While serving as a non-employee member of the Board, Mr. Landesberg’s outstanding equity awards will continue to vest in accordance with their original vesting schedules, with any performance-based awards subject to the achievement of the underlying performance conditions and, in the event that he is terminated by the Company other than for cause, his outstanding time-based equity awards will fully vest. The Company also agreed, subject to Mr. Landesberg’s timely enrollment for continued health and dental benefits under the Consolidated Omnibus Budget Reconciliation Act, as amended (“COBRA”), to pay to Mr. Landesberg up to three months of the employer cost of such continued coverage for him and his dependents.

In January 2025, the Company and Mr. Cervantes agreed that Mr. Cervantes’ would depart the Company, effective February 16, 2025 (the “Separation Date”). In connection with Mr. Cervantes’ separation, the Company and Mr. Cervantes entered into a separation and general release agreement on February 14, 2025 (the “Separation Agreement”), which provides that, subject to Mr. Cervantes remaining employed through the Separation Date and his execution of a release of claims in favor of the Company, Mr. Cervantes will receive: (i) a lump sum cash payment equal to 25 weeks of Mr. Cervantes’ base salary; (ii) a cash bonus under the Company’s 2024 Annual Incentive Plan, based on actual performance of the Company; (iii) continued COBRA coverage for up to three months; and (iv) accelerated vesting of the portion of Mr. Cervantes’ outstanding RSU awards that would have vested on or before May 15, 2025 if Mr. Cervantes had remained employed with the Company through such date.

2024 Summary Compensation Table

The following table summarizes the compensation awarded to, earned by or paid to the named executive officers for the fiscal years ended December 31, 2024 and December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary ($)(1) | | Bonus ($) | | Stock Awards ($)(2) | | Option Awards ($) | | Non-Equity Incentive Plan Compensation ($) | | All Other Compensation ($)(3) | | Total ($) |

Jeff Yurcisin | | 2024 | | 500,000 | | | — | | | 95,200 | | | — | | | 305,000 | | | — | | | 900,200 | |

Chief Executive Officer and Director | | 2023 | | 188,462 | | | 189,041 | | | 2,026,145 | | | — | | | — | | | — | | | 2,403,648 | |

| Stuart Landesberg | | 2024 | | 409,135 | | | — | | | 350,865 | | | — | | | — | | | — | | | 760,000 | |

Former Chief Executive Officer and President and current Executive Chair and Director | | 2023 | | 484,526 | | | — | | | 1,629,514 | | | — | | | 900,000 | | | 23,100 | | | 3,037,140 | |

| Sergio Cervantes | | 2024 | | 500,000 | | | — | | | 559,645 | | | — | | | 122,000 | | | — | | | 1,181,645 | |

| Chief Financial Officer | | 2023 | | 500,000 | | | — | | | 762,569 | | | — | | | 200,000 | | | — | | | 1,462,569 | |

| | | | | |

(1) | Mr. Yurcisin joined Grove in August 2023. His 2023 base salary amount reflects a pro-rated amount of his annual base salary of $500,000. |

| (2) | Represents the aggregate grant date fair value of awards of RSUs and/or PSUs computed in accordance with FASB Accounting Standards Codification (“ASC”) Topic 718. Such aggregate grant date fair values do not take into account any estimated forfeitures related to service-based vesting conditions. The amounts included in the Stock Awards column for Mr. Yurcisin’s 2023 PSU and Mr. Landesberg’s 2024 PSU are calculated based on the probable satisfaction of the performance conditions for such awards as of the date of grant. Under ASC Topic 718, the vesting condition related to Mr. Yurcisin’s and Mr. Landesberg’s PSUs are considered a market condition and not a performance condition. Accordingly, there is no grant date fair value below or in excess of the amount reflected in the table above for Mr. Yurcisin’s 2023 PSU and Mr. Landesberg’s 2024 PSU that could be calculated and disclosed based on achievement of the underlying market condition. The assumptions used in calculating the grant date fair value of such RSUs and PSUs granted in 2024 and 2023 are set forth in Note 11 to Grove’s audited consolidated financial statements included in Grove’s Annual Report on Form 10-K for the year ended December 31, 2024. In addition, in accordance with FASB Topic 718, Grove did not recognize any incremental fair value in connection with the modification in 2024 of the performance-based RSU awards granted to Mr. Yurcisin in August 2023. |

| (3) | The amounts in the All Other Compensation column for Mr. Landesberg consist of reimbursement for consulting services received by Mr. Landesberg related to our business. |

Outstanding Equity Awards at 2024 Fiscal Year-End

The following table presents information regarding the outstanding stock options, RSUs and PSUs held by each of the named executive officers as of December 31, 2024. The following table does not include earn-out shares that Messrs. Landesberg and Cervantes received pursuant to the terms of the Merger Agreement in connection with the Business Combination and which were issued to Messrs. Landesberg and Cervantes on the same terms as other holders of Legacy Grove preferred stock, common stock, options, RSUs and warrants. Earn-out shares beneficially owned by Messrs. Landesberg and Cervantes are reflected in the section entitled “Security Ownership of Certain Beneficial Owners and Management” in this proxy statement below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Option Awards | | Stock Awards | | Equity Incentive Plan Awards |

Name | | Grant Date | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable | | Equity

Incentive

Plan Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#) | | Option

Exercise

Price

($) | | Option

Expiration

Date | | Number of

Unearned

Shares, Units

or Other

Rights

That Have

Not Vested

(#) | | Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) (1) | | Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) (1) |

Jeff Yurcisin | | 8/16/2023 | (2) | — | | | — | | | — | | | — | | | — | | | 233,750 | | | $ | 324,913 | | | — | | | — | |

| | 8/16/2023 | (3) | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 510,000 | | | $ | 708,900 | |

| | 11/18/2024 | (4) | — | | | — | | | — | | | — | | | — | | | 40,000 | | | $ | 55,600 | | | — | | | — | |

| | 11/18/2024 | (5) | — | | | — | | | — | | | — | | | — | | | 30,000 | | | $ | 41,700 | | | — | | | — | |

Stuart Landesberg | | 3/30/2018 | | 530,706 | | | — | | | — | | | $ | 3.20 | | | 3/29/2028 | | — | | | $ | — | | | — | | | — | |

| | 2/15/2021 | (6) | — | | | — | | | 203,433 | | | $ | 18.85 | | | 2/14/2031 | | — | | | $ | — | | | — | | | — | |

| | 10/27/2022 | (7) (8) | — | | | — | | | — | | | — | | | — | | | 31,704 | | | $ | 44,069 | | | — | | | — | |

| | 12/8/2022 | (8) (9) | — | | | — | | | — | | | — | | | — | | | 225,287 | | | $ | 313,149 | | | — | | | — | |

| | 3/1/2023 | (8) (10) | — | | | — | | | — | | | — | | | — | | | 226,850 | | | $ | 315,322 | | | — | | | — | |

| | 2/26/2024 | (11) | — | | | — | | | — | | | — | | | — | | | — | | | $ | — | | | 286,000 | | | $ | 397,540 | |

Sergio Cervantes | | 5/2/2022 | (8) (12) | — | | | — | | | — | | | — | | | — | | | 52,923 | | | $ | 73,563 | | | — | | | — | |

| | 3/1/2023 | (8) (13) | — | | | — | | | — | | | — | | | — | | | 93,634 | | | $ | 130,151 | | | — | | | — | |

| | 4/12/2023 | (8) (13) | — | | | — | | | — | | | — | | | — | | | 12,000 | | | $ | 16,680 | | | — | | | — | |

| | 2/26/2024 | (14) | — | | | — | | | — | | | — | | | — | | | 228,117 | | | $ | 317,083 | | | — | | | — | |

| | | | | |

| (1) | | The market value of shares or units of stock that have not vested reflects the closing stock price of $1.39 per share on December 31, 2024. |

| (2) | | These RSUs vest 25% on August 15, 2024, and then in twelve equal quarterly installments thereafter, subject to Mr. Yurcisin’s continued service, with acceleration of vesting provisions the same as set forth in the Additional Narrative Disclosure below. |

| (3) | | These PSUs vest 25% on August 15, 2024, and then in twelve equal quarterly installments thereafter, subject to Mr. Yurcisin’s continued service and subject to the achievement of specified stock price metrics, vesting in 25% installments when the 90-day volume-weighted average price of the Common Stock equals $3.50, $5.00, $7.00 (each on or before the four-year anniversary of August 16, 2023) and $10.00 (on or before the five year anniversary of August 16, 2023).

|

| (4) | | This award vests 100% on November 18, 2025. |

| (5) | | These RSUs will vest in equal quarterly installments each February 15, May 15, August 15 and November 15 commencing on February 15, 2025, subject to the award recipient’s continued service with the Company through each applicable vesting date. |