UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| | | | | |

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

Grove Collaborative Holdings, Inc.

| | |

| (Name of Registrant as Specified In Its Charter) |

| | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

GROVE COLLABORATIVE HOLDINGS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 23, 2024

Dear Stockholder:

You are cordially invited to attend the 2024 annual meeting of stockholders (the “Annual Meeting”) of Grove Collaborative Holdings, Inc., a Delaware public benefit corporation (“Grove” or the “Company”). The Annual Meeting will be held on Thursday, May 23, 2024, at 8:00 a.m. Pacific Time, as a virtual meeting at https://www.cstproxy.com/grovecollaborative/2024, for the following purposes:

1.To elect the two nominees for Class II director named herein to hold office until the 2027 annual meeting of stockholders and until their successors are duly elected and qualified.

2.To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ended December 31, 2024.

3.To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

The Annual Meeting will be conducted in a virtual format to provide stockholders with access to the meeting regardless of geographic location. Stockholders will not be able to attend the Annual Meeting in person; however, stockholders will be able to participate, vote electronically and submit questions during the live webcast of the Annual Meeting by visiting https://www.cstproxy.com/grovecollaborative/2024.

The Company is using the “Notice and Access” method of providing proxy materials to you via the Internet. On or about April 12, 2024, the Company will mail to its stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access proxy materials and vote via the Internet. The Notice also contains instructions on how to receive a paper copy of the proxy materials.

All stockholders are cordially invited to attend the Annual Meeting virtually and urged to submit their proxy or voting instructions as promptly as possible to ensure their representation and the presence of a quorum at the same. If you submit your proxy and then decide to attend the Annual Meeting to vote your shares through Grove’s virtual platform, you may still do so. Your proxy is revocable in accordance with the procedures set forth in this proxy statement.

By Order of the Board of Directors,

/s/ Scott Giesler

General Counsel and Secretary

San Francisco, California

April 5, 2024

| | |

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held on May 23, 2024. The Proxy Statement, Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and Notice are available at https://www.cstproxy.com/grovecollaborative/2024. |

GROVE COLLABORATIVE HOLDINGS, INC.

TABLE OF CONTENTS

GROVE COLLABORATIVE HOLDINGS, INC.

1301 Sansome Street

San Francisco, CA 94111

(800) 231-8527

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 23, 2024

GENERAL INFORMATION

The board of directors of Grove Collaborative Holdings, Inc. (“we,” “us,” “our,” the “Company” or “Grove”) is soliciting proxies to be used at our Annual Meeting of Stockholders to be held solely via webcast at https://www.cstproxy.com/grovecollaborative/2024 on May 23, 2024 at 8:00 a.m., Pacific Time, and for any postponement, adjournment or continuation thereof (the “Annual Meeting”). Grove intends to mail a Notice of Internet Availability of Proxy Materials to all stockholders entitled to vote at the Annual Meeting on or about April 12, 2024.

As background relevant to certain portions of this Proxy Statement, on June 16, 2022 (the “Closing Date”) Grove consummated previously announced transactions (the “Merger”) contemplated by the Agreement and Plan of Merger dated December 7, 2021, amended and restated on March 31, 2022 (the “Merger Agreement”), among Virgin Group Acquisition Corp. II, a blank check company incorporated as a Cayman Islands exempted company in 2020 (“VGAC II”), Treehouse Merger Sub, Inc. (“VGAC II Merger Sub I”), Treehouse Merger Sub II, LLC (“VGAC II Merger Sub II”) and Grove Collaborative, Inc. (“Legacy Grove”). In connection with the Merger, VGAC II changed its jurisdiction of incorporation from the Cayman Islands to the State of Delaware and changed its name to Grove Collaborative Holdings, Inc. (the “Domestication”), a public benefit corporation. On the Closing Date, VGAC II Merger Sub I merged with and into Legacy Grove with Legacy Grove being the surviving corporation and a wholly-owned subsidiary of the Company (the “Initial Merger”), and immediately following the Initial Merger, and as part of the same overall transaction as the Initial Merger, Legacy Grove merged with and into VGAC II Merger Sub II, the separate corporate existence of Legacy Grove ceased, and VGAC II Merger Sub II continued as the surviving company and wholly-owned subsidiary of the Company and changed its name to Grove Collaborative, Inc. (together with the Initial Merger and the Domestication, the “Business Combination”).

EXPLANATORY NOTE

We are an “emerging growth company” under applicable federal securities laws and therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this Proxy Statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, including the compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We may remain an emerging growth company until December 31, 2026, provided that, if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any June 30 before that time or if we have annual gross revenues of $1.235 billion or more in any fiscal year, we would cease to be an emerging growth company as of December 31 of that year.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

Grove has sent you these proxy materials because its board of directors (the “Board”) is soliciting your proxy to vote at the Annual Meeting on May 23, 2024, 8:00 a.m. Pacific Time, and any adjournments or postponements thereof. Grove intends to mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders entitled to vote at the Annual Meeting on or about April 12, 2024.

How do I attend the Annual Meeting?

To participate in the Annual Meeting, you must access the virtual meeting at https://www.cstproxy.com/grovecollaborative/2024 and use the control number provided with your proxy materials. Grove’s virtual meeting platform, which will be provided by Continental Stock Transfer and Trust, allows all participating stockholders to submit questions during the Annual Meeting. In addition, it also allows stockholders to vote on proposals online. Grove believes that the virtual platform increases stockholder participation while at the same time affording the same rights and opportunities to participate as stockholders would have at a physical annual meeting.

More information regarding the question-and-answer process, including the number and types of questions permitted, the time allotted for questions, and how questions will be recognized, answered, and disclosed, will be available in the meeting rules of conduct, which will be posted at https://www.cstproxy.com/grovecollaborative/2024 during the meeting.

Grove encourages you to access the Annual Meeting before it begins. If you have difficulty accessing the Annual Meeting, please call the technical support number that will be posted at https://www.cstproxy.com/grovecollaborative/2024.

Who is paying for this proxy solicitation?

Grove will pay for the entire cost of soliciting proxies. In addition to these proxy materials, the Company’s directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. Grove may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

Who can vote at the Annual Meeting?

Stockholders of record as of the close of business on April 3, 2024 (the “Record Date”) are entitled to receive notice of, to attend and participate, and to vote at the Annual Meeting. At the close of business on the Record Date, there were 32,477,667 shares of the Company’s Class A common stock, par value $0.0001 per share (“Class A Common Stock”) and 5,704,431 shares of Class B common stock, par value $0.0001 per share (“Class B Common Stock” and, together with Class A Common Stock, “Common Stock”) outstanding. At the close of business on the Record Date, there were also 10,000 shares of Series A Convertible Preferred Stock, par value $0.0001 per share (“Series A Preferred Stock”) outstanding. Holders of Grove’s Class A Common Stock are entitled to one vote for each share held as of the above Record Date. Holders of Grove’s Class B Common Stock are entitled to ten votes for each share held as of the above Record Date. Holders of Groves Series A Preferred Stock are entitled to 473.9336 votes for each share held as of the Record Date. Holders of Grove’s Class A Common Stock, Class B Common Stock and Series A Preferred Stock will vote together as a single class on all matters described in this Proxy Statement. There is no cumulative voting.

How do I vote?

A stockholder’s shares can be voted at the Annual Meeting only if the stockholder attends the virtual meeting or is represented by proxy. Grove urges any stockholders not planning to attend the Annual Meeting to authorize their proxy in advance. Stockholders may complete their proxies and authorize their votes by proxy over the Internet at https://www.cstproxy.com/grovecollaborative/2024. Stockholders who complete their proxy electronically over the

Internet do not need to return a proxy card. Stockholders who hold their shares beneficially in street name through a nominee should follow the instructions they receive from their nominee to vote their shares. If you decide to vote by mail, follow the instructions on the proxy card delivered to you and return the proxy using the postage paid envelope provided.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of Class A Common Stock you own as of the Record Date, ten votes for each share of Class B Common Stock you own as of the Record Date and 473.9336 votes for each share of Series A Preferred Stock you own as of the Record Date.

How are votes counted?

Stockholder votes will be tabulated by the persons appointed by the Board (or appointed by persons the Board has delegated the power to appoint) to act as inspectors of election for the Annual Meeting. Shares of Series A Preferred Stock and Common Stock represented by a properly executed and delivered proxy will be voted at the Annual Meeting and, when the stockholder has given instructions, will be voted in accordance with those instructions.

What if I do not provide specific voting instructions?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted as follows: (1) “FOR” each of the nominees listed in Proposal No. 1, (2) “FOR” the ratification of the independent registered public accounting firm in Proposal No. 2, and (3) in accordance with the discretion of the persons appointed as proxies with respect to any other matters that properly come before the Annual Meeting.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares held in street name. These proxy materials are being forwarded to you by your bank, broker or other nominee, who is considered to be the holder of record with respect to your shares. As the beneficial owner, you have the right to direct your bank, broker or other nominee how to vote your shares by following their instructions for voting. Please refer to information from your bank, broker or other nominee on how to submit your voting instructions.

If you do not furnish voting instructions to your bank, broker or other nominee, one of two things can happen, depending upon whether a proposal is “routine.” Under the rules that govern brokers that have record ownership of shares beneficially owned by their clients, brokers have discretion to cast votes only on routine matters, such as the ratification of the appointment of independent registered public accounting firms, without voting instructions from their clients. Brokers are not permitted, however, to cast votes on “non-routine” matters without such voting instructions, such as the election of directors. Proposal No. 2 is considered a “routine” proposal. All other proposals are considered “non-routine,” and your broker will not have discretion to vote on these proposals.

What are broker non-votes?

When a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed to be “non-routine,” the broker or nominee cannot vote the shares with respect to such matters. These unvoted shares are considered “broker non-votes” with respect to such matters.

Why did I receive a Notice Regarding the Availability of Proxy Materials on the Internet?

In accordance with rules adopted by the Securities and Exchange Commission (“SEC”), the Company may provide access to its proxy materials over the Internet. Accordingly, the Company is sending a Notice to some of its stockholders of record. If you received a Notice by mail, you will not receive a printed copy of the proxy materials

unless you request one. The Notice will tell you how to access and review the proxy materials over the Internet at https://www.cstproxy.com/grovecollaborative/2024. The Notice will also tell you how to access your proxy card to vote over the Internet. If you received a Notice by mail and would like to receive a printed copy of the Company’s proxy materials, please follow the instructions included in the Notice.

What should I do if I get more than one proxy or voting instruction card?

Stockholders may receive more than one set of voting materials, including multiple copies of the proxy materials and multiple Notices, proxy cards or voting instruction cards. For example, stockholders who hold shares in more than one brokerage account may receive separate sets of proxy materials or one Notice for each brokerage account in which shares are held. Stockholders of record whose shares are registered in more than one name will receive more than one set of proxy materials. You should vote in accordance with all of the proxy cards and voting instruction cards you receive relating to the Annual Meeting to ensure that all of your shares are voted and counted.

How many votes are needed to approve each proposal?

Proposal No. 1 - The election of directors requires a plurality vote of the shares of Common Stock and Series A Preferred Stock present virtually or by proxy at the Annual Meeting and entitled to vote thereon to be approved. You may vote “FOR” or “WITHHOLD” with respect to this proposal. “Plurality” means that the nominees who receive the largest number of votes cast “FOR” such nominees are elected as directors. Only votes “FOR” will affect the outcome, and any shares not voted “FOR” a particular nominee (whether as a result of a stockholder “WITHHOLD” vote or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on the outcome of the election.

Proposal No. 2 - The ratification of the selection of Ernst & Young LLP (“EY”) as the Company’s independent registered public accounting firm for fiscal year ending December 31, 2024, requires the affirmative vote of a majority of the votes cast by the holders of shares of Common Stock and Series A Preferred Stock present virtually or by proxy at the Annual Meeting and entitled to vote thereon to be approved. You may vote “FOR,” “AGAINST,” or “ABSTAIN” with respect to this proposal. Abstentions and broker non-votes are not considered “votes cast” and will have no effect on the outcome of this proposal.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares of Common Stock and Series A Preferred Stock entitled to vote are present at the Annual Meeting in person or represented by proxy. Abstentions from voting on a proposal and broker non-votes will count for purposes of determining a quorum.

On the Record Date, there were 32,477,667 shares of Class A Common Stock, 5,704,431 shares of Class B Common Stock and 10,000 shares of Series A Preferred Stock outstanding and entitled to vote, representing 94,261,313 votes. Thus, the holders of shares of Common Stock and Series A Preferred Stock representing 47,130,657 votes must be present in person or represented by proxy at the Annual Meeting to have a quorum. If there is no quorum, either the chairperson of the meeting or the holders of a majority of the voting power of shares of Common Stock and Series A Preferred Stock present at the Annual Meeting or represented by proxy may adjourn the meeting to another date.

Can I change my vote after submitting my proxy?

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is exercised by delivering a written notice of revocation or a properly executed proxy bearing a later date to the attention of Grove’s Corporate Secretary at 1301 Sansome Street, San Francisco, CA 94111.

You may also revoke your proxy by voting again on a later date on the Internet (only your latest Internet proxy submitted prior to the Annual Meeting will be counted), or by attending the virtual meeting and voting your shares while logged in and participating in the live webcast.

Beneficial owners of shares held in street name must follow their bank, broker or other nominee’s instructions to revoke their proxies or vote at the Annual Meeting and, for both stockholders of record and beneficial owners of shares held in street name, attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request or vote online at the Annual Meeting.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that Grove expects to file within four business days after the Annual Meeting. If final voting results are not available to Grove in time to file a Form 8-K within four business days after the Annual Meeting, Grove intends to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to the Company, file an additional Form 8-K to publish the final results.

What proxy materials are available on the Internet?

This Proxy Statement, Grove’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and the Notice are available, or will be made available when published, at https://www.cstproxy.com/grovecollaborative/2024.

Where can I find the stockholder list?

A complete list of registered stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder, for any purpose related to the meeting, for ten days prior to the date of the Annual Meeting during ordinary business hours at the Company’s principal offices located at 1301 Sansome Street, San Francisco, CA 94111. The list will also be available electronically at https://www.cstproxy.com/grovecollaborative/2024 during the Annual Meeting.

Do I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Annual Meeting?

No. Delaware law does not provide stockholders any dissenters’ or appraisal rights with respect to the matters to be voted on at the Annual Meeting.

Who can I contact if I have questions concerning the Annual Meeting?

If you have any further questions about voting your shares or attending the Annual Meeting or wish to obtain directions on how to join the virtual Annual Meeting, please email Grove’s Investor Relations Department at ir@grove.co.

PROPOSAL NO. 1 − ELECTION OF DIRECTORS

Our Board is classified into three classes, with staggered three-year terms, designated as Class I, Class II and Class III. Vacancies on the Board may be filled solely by the affirmative vote of a majority of the directors then in office, even if less than a quorum, or by a sole remaining director. Any director elected to fill a vacancy or newly created directorship shall hold office until the next election of the class to which such director shall have been appointed or assigned, and until his or her successor is duly elected and qualified, subject to his or her earlier death, disqualification, resignation or removal.

The Board presently has ten members. The Board has reduced the authorized number of directors to eight members immediately following the Annual Meeting. There are four Class II directors whose term of office expires at the conclusion of the Annual Meeting. The Board has nominated two of those members for election at the Annual Meeting. The terms of office of directors in Class III and Class I expire at Grove’s annual meeting of stockholders to be held in 2025 and 2026, respectively. At the recommendation of Grove’s sustainability, nominating and governance committee (the “Sustainability, Nominating and Governance Committee”), the Board proposes that the two Class II nominees named below, each of whom is currently serving as a director in Class II, be elected as a Class II director. If elected by our stockholders, each nominee will serve for a three-year term expiring at the 2027 annual meeting of stockholders or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal.

Class II Nominees for Election for a Three-year Term Expiring at the 2027 Annual Meeting

The nominees and their ages, occupations and lengths of service on the Board are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

Vote Required for Approval

Directors are elected by a plurality of the voting power of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. Proxies cannot be voted for more than one person for each of the two Class II Board seats to be elected. Each nominee nominated by the Board to serve as Class II director must receive the most “FOR” votes (among votes properly cast online during the meeting or by proxy) of nominees for the vacancies in such director class in order to be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, “FOR” the election of the nominees named below. Only votes “FOR” will affect the outcome.

Nominees for Class II Directors (Term Expiring on the Date of the 2027 Annual Meeting of Stockholders)

| | | | | | | | |

| John Replogle | | Director since June 2022 |

| Jeff Yurcisin | | Director since August 2023 |

Continuing Class III Directors (Terms Expiring on the Date of the 2025 Annual Meeting of Stockholders)

| | | | | | | | |

| Rayhan Arif | | Director since June 2022 |

| David Glazer | | Director since June 2022 |

| Naytri Shroff Sramek | | Director since June 2022 |

Continuing Class I Directors (Term Expiring on the Date of the 2026 Annual Meeting of Stockholders)

| | | | | | | | |

| Larry Cheng | | Director since August 2023 |

| Stuart Landesberg | | Director since June 2022 |

| Kristine Miller | | Director since June 2022 |

Set forth below is each director’s and each director nominee’s name and age as of the date of this proxy statement and his or her principal occupation, business history and public company directorships held during the past five years.

Rayhan Arif. Mr. Arif, 37, is an investment director at the Virgin Group, a global growth investor, where he has worked since 2017. He is responsible for investing the Virgin Group’s capital across a range of opportunities and supporting the strategic development of Virgin’s portfolio companies in the Americas. Mr. Arif currently serves on the boards of Virgin Mobile Latin America and BMR Energy. From 2013 to 2015, Mr. Arif served as an investment professional at AEA Investors, a global private equity firm focused on leveraged buyouts and growth capital investments. From 2012 to 2013, Mr. Arif worked on the strategy team of Zipcar, a leading car-sharing network. Prior thereto, Mr. Arif was a management consultant at Bain & Company. Mr. Arif received a B.A. in Economics from Harvard College and an M.B.A. from Columbia Business School. We believe that Mr. Arif’s investment and operational experience make him a valuable member of the Board.

Larry Cheng. Mr. Cheng, 48, is co-founder and managing partner at Volition Capital, a leading growth equity investment firm, a role he has held since 2010. He has more than two decades of venture capital and growth equity investing experience based on his time at Volition Capital, Fidelity Ventures, Battery Ventures and Bessemer Venture Partners. He presently leads the Internet and Consumer team at Volition Capital, focusing on companies in ecommerce, internet services, consumer brands and digital media and gaming. Mr. Cheng is currently a member of the board of directors of GameStop (NYSE: GME) and several private companies. Mr. Cheng received his B.A. in Psychology from Harvard College. Mr. Cheng brings to the Board significant experience in capital allocation, finance, ecommerce, internet services and consumer brands.

David Glazer. Since 2013, Mr. Glazer, 40, has served in various positions at Palantir Technologies Inc. (NYSE: PLTR), a leading builder of operating systems for the modern enterprise, most recently as chief financial officer and treasurer. Prior to that, Mr. Glazer was a corporate securities attorney at Wilson Sonsini Goodrich & Rosati. Mr. Glazer received a J.D. degree from Emory University School of Law and a B.A from Santa Clara University. We believe Mr. Glazer is qualified to serve on the Board because of his legal, public company financial and technology experience.

Stuart Landesberg. Mr. Landesberg, 38, is the executive chairman at Grove, a position he has held since August 2023. Mr. Landesberg co-founded Grove in 2012 and served as its president and chief executive officer from its inception to August 2023. Prior to co-founding Grove, he worked for TPG Capital, where he was involved in consumer and internet investments. He was also a founding team member for Toro Investment Partners, a consumer and technology focused long/short hedge fund. Mr. Landesberg started his career in the investment banking division of Lehman Brothers. Mr. Landesberg earned a B.A. in Economics and Spanish from Amherst College where he graduated magna cum laude with distinction. We believe Mr. Landesberg’s extensive direct-to-consumer and consumer packaged goods industry experience, capital markets expertise, as well as his institutional knowledge as the co-founder of Grove qualify him to serve on the Board.

Kristine Miller. Ms. Miller, 60, most recently served as the chief strategy officer for global e-commerce marketplace eBay Inc., from 2014 to 2020. In this role, Ms. Miller set the vision for the future of commerce and led numerous digital transformation initiatives to improve buyer and seller experiences. She is a retail thought leader, frequently speaking on topics such as technology’s impact on consumer shopping behavior. Prior to joining eBay Inc., Ms. Miller was a partner and director at Bain & Company where she served as head of the North American retail practice and chairperson of Bain’s Worldwide Compensation & Promotion Committee. Ms. Miller began her career with The Procter & Gamble Company’s Beauty Care Division supporting new product development. Ms. Miller served on the board of directors of Cable One (NYSE: CABO) from 2019 to 2023 and serves on the board of directors of Neiman Marcus Group (private, post-emergence) and Chairish (private), a home furnishings marketplace. Ms. Miller received her M.B.A. from the Stanford Graduate School of Business, where she was an Arjay Miller Scholar, and a B.S. in Chemical Engineering with honors from Carnegie-Mellon University. We believe Ms. Miller is qualified to serve on the Board because of her significant operating and leadership experience as well as her direct to consumer experience.

John Replogle. Mr. Replogle, 58, has served as a founding partner of One Better Ventures, LLC, a venture capital firm focused on consumer brands that have a positive impact, since October 2017. Mr. Replogle previously served as the chief executive officer and president of Seventh Generation, Inc. and Burt’s Bees, Inc. Mr. Replogle also previously served as the general manager of Unilever’s Skin Care division. He started his career with the Boston Consulting Group. Mr. Replogle is currently a member of the board of directors of Wolfspeed, Inc. (NYSE: WOLF), and also served as a director of Sealy Corporation, a publicly traded mattress manufacturer, from 2010 to 2013, until its sale to Tempur-Pedic International Inc. Mr. Replogle received his M.B.A. from Harvard Business School and a B.A from Dartmouth College. We believe Mr. Replogle is qualified to serve on the Board because of his significant senior executive leadership experience, including eleven years of experience as chief executive officer at two companies, as well as deep experience in marketing, branding and distribution of consumer goods.

Naytri Shroff Sramek. Since 2018, Ms. Sramek, 34, has served in various positions at GitHub, Inc., a subsidiary of Microsoft Corporation (NASDAQ: MSFT), most recently as chief of staff to the chief executive officer. From 2017 to 2018, Ms. Sramek was the head of enterprise at Crew, a workplace management software company acquired by Block, Inc. in 2021. Prior thereto, Ms. Sramek served in various positions at Palantir Technologies Inc. (NYSE: PLTR). Ms. Sramek received a B.A. in Business Economics from the University of California Los Angeles. We believe Ms. Sramek is qualified to serve on the Board because of her financial expertise and leadership experience.

Jeff Yurcisin. Mr. Yurcisin, 49, has been chief executive officer of Grove since August 2023. He was the president and chief executive officer of Zulily, an ecommerce company, from August 2018 to March 2022. Prior to that, he was vice president, private brands at Amazon, a multinational technology company, from 2015 to 2018 and vice president, Amazon clothing and chief executive officer of Shopbop, a subsidiary of Amazon, from 2013 to 2015. He became chief executive officer of Shopbop in 2008 after it was acquired by Amazon. Prior to that, Mr. Yurcisin held various managerial roles at Amazon and held positions at Boston Consulting Group, Westlaw.com, Broadband Office and Oliver Wyman. Mr. Yurcisin holds a Bachelor’s degree in Economics from Princeton University and an M.B.A. from Harvard Business School. We believe Mr. Yurcisin is qualified to serve on the Board in light of his in-depth knowledge of our business as chief executive officer as well as his significant senior executive leadership experience and deep direct-to-consumer, marketing, branding and ecommerce experience.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE CLASS II DIRECTOR NOMINEES

PROPOSAL NO. 2 − RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board (the “Audit Committee”) has selected Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024, and has further directed that management submit the selection of its independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. EY has been engaged by Grove since June 16, 2022, and was engaged by Legacy Grove from 2018 until the completion of the Business Combination. Representatives of EY are expected to be present during the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain EY. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

Change in Independent Registered Accounting Firm

As previously disclosed, on June 16, 2022, after the recommendation of the Audit Committee, the Board approved the engagement of EY as the Company’s independent registered public accounting firm to audit the Company’s financial statements for the fiscal year ending December 31, 2022. EY served as the independent registered public accounting firm of Grove prior to the Business Combination. Accordingly, WithumSmith+Brown, PC (“Withum”), VGAC II’s independent registered public accounting firm prior to the Business Combination, was informed that it would be replaced by EY as the Company’s independent registered public accounting firm.

Withum’s report of independent registered public accounting firm, dated February 24, 2022, on VGAC II’s balance sheet as of December 31, 2021 and the related statements of operations, changes in shareholders’ deficit and cash flows for the period from January 13, 2021 (inception) through December 31, 2021, did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During the period from January 13, 2021 (inception) through December 31, 2021 and the subsequent interim period through June 16, 2022, there were no: (i) disagreements between VGAC II and Withum on any matter of accounting principles or practices, financial statement disclosures or auditing scope or procedures, which disagreements if not resolved to Withum’s satisfaction would have caused Withum to make reference to the subject matter of the disagreement in connection with its report or (ii) reportable events as defined in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

During the period from January 13, 2021 (inception) to December 31, 2021 and the subsequent interim period through June 16, 2022, VGAC II did not consult EY with respect to either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on VGAC II’s financial statements, and no written report or oral advice was provided to VGAC II by EY that EY concluded was an important factor considered by VGAC II in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement, as that term is defined in Item 304(a)(1)(iv) of Regulation S-K under the Exchange Act and the related instructions to Item 304 of Regulation S-K under the Exchange Act, or a reportable event, as that term is defined in Item 304(a)(1)(v) of Regulation S-K under the Exchange Act.

The Company previously provided Withum with a copy of the disclosures regarding the dismissal reproduced in this Proxy Statement and received a letter from Withum addressed to the SEC stating that they agree with the above statements. This letter was filed as Exhibit 16.1 to Grove’s Current Report on Form 8-K filed with the SEC on June 23, 2022.

Principal Accountant Fees and Services

The following table represents aggregate fees billed to the Company for the fiscal years ended December 31, 2023 and 2022, by Withum and EY.

Withum

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

Audit Fees(1) | $ | — | | | $ | 132,895 | |

Tax Fees(2) | $ | — | | | $ | 3,750 | |

| All Other Fees | $ | — | | | $ | — | |

| Total Fees | $ | — | | | $ | 136,645 | |

EY

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

Audit Fees(1) | $ | 1,011,050 | | | $ | 2,014,667 | |

| Audit-Related Fees | $ | — | | | $ | — | |

Tax Fees(2) | $ | — | | | $ | — | |

All Other Fees(3) | $ | — | | | 1,225 | |

| Total Fees | $ | 1,011,050 | | | $ | 2,015,892 | |

| | | | | |

| (1) | “Audit Fees” consist of audit services related to the audit of the Company’s annual consolidated financial statements and the review of the Company’s quarterly condensed consolidated financial statements. The Audit Fees incurred also include fees related to services performed in connection with Grove’s Business Combination and securities offerings, in each case including consents and review of documents filed with the SEC and other offering documents. |

| (2) | “Tax Fees” consist of professional services for tax compliance and tax advice. |

| (3) | “All Other Fees” include consulting services associated with Grove’s readiness to become a public company and fees for accessing EY’s online research database. |

Pre-Approval Policies and Procedures

Pursuant to its charter, the Audit Committee may pre-approve audit and permissible non-audit and tax services provided to the Company by the independent auditors. The Audit Committee may delegate to one or more designated members of the Audit Committee the authority to pre-approve audit and permissible non-audit services, provided such pre-approval decision is presented to the full Audit Committee at its scheduled meetings.

Prior to the Business Combination, all of the services listed in the table above provided by Withum were pre-approved by VGAC II in accordance with its policies then in effect. Following the Business Combination, all of the services listed in the table above provided by EY were pre-approved by the Audit Committee.

Vote Required for Approval

The affirmative vote of the holders of a majority of the shares present virtually or by proxy and entitled to vote on the proposal at the Annual Meeting is required to ratify the appointment of the independent registered public accounting firm. Holders of proxies solicited by this Proxy Statement will vote the proxies received by them as directed on the proxy card or, if no direction is made, then “FOR” approval of this proposal. Abstentions will have the same effect as voting against the proposal. Proposal No. 2 is considered “routine,” therefore, Grove does not expect any broker non-votes for this proposal. If Grove’s stockholders do not ratify the selection of EY, the Board will consider other independent auditors.

THE BOARD AND THE AUDIT COMMITTEE RECOMMEND A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF EY AS GROVE’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

BOARD OF DIRECTORS AND COMMITTEES; CORPORATE GOVERNANCE

Overview

Grove is committed to maintaining high standards of business conduct and corporate governance, which we believe are important to the overall success of our business and serve Grove’s stakeholders well. The Board’s Corporate Governance Guidelines and Grove’s Code of Ethics and Business Conduct, together with Grove’s certificate of incorporation, bylaws, and the charters of the committees of the Board form the basis for the Company’s corporate governance framework. The Corporate Governance Guidelines are posted on our website at https://investors.grove.co under the Governance section.

Director Independence

Our Board has undertaken a review of the independence of each director and considered whether each director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. The Board has determined that Rayhan Arif, Larry Cheng, Kevin Cleary, David Glazer, Kristine Miller, Naytri Shroff Sramek and John Replogle qualify as independent directors, as defined under the applicable rules and regulations of the SEC and the NYSE listing rules. Jeff Yurcisin, Stuart Landesberg and Chris Clark were determined not to be independent under such rules and regulations because they are employees of the Company.

Meeting Attendance and Executive Sessions

The Board held eight meetings during 2023. During 2023, each of our current directors attended at least 75% of the aggregate number of meetings of our Board and committees thereof, if any, on which such director served during the period for which he or she was a director or committee member. The independent members of our Board met regularly in executive session in Board and committee meetings. For additional information about the number of meetings held by each Board committee during the year ended December 31, 2023, see “Board Committees” below. We encourage, but do not require, members of our Board to attend our annual meeting of stockholders. Five members of our Board attended the annual meeting of our stockholders held in 2023.

Board Oversight of Risk

One of the key functions of the Board is informed oversight of the Company’s risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various standing committees of the Board that address risks inherent in their respective areas of oversight. For example, the Audit Committee of the Board is responsible for overseeing the management of risks associated with the Company’s financial reporting, accounting, and auditing matters and the compensation committee of the Board (the “Compensation Committee”) oversees the management of risks associated with compensation policies and programs.

Board Committees and Leadership Structure

The Board has established the Audit Committee, the Compensation Committee, and Sustainability, Nominating and Governance Committee. The Board may establish other committees to facilitate the management of the Company’s business. The Board and its committees will set schedules for meetings throughout the year and can also hold special meetings and act by written consent from time to time, as appropriate. The Board also delegates various responsibilities and authority to its committees as generally described below. The committees regularly report on their activities and actions to the full Board. Copies of each committee charter are posted on our investor website at https://investors.grove.co under the Governance section. The information found on or that can be accessed from or that is hyperlinked to our website is not part of this Proxy Statement. Members serve on these committees until their resignation or until otherwise determined by the Board.

The Board periodically reviews its leadership structure. Prior to our hiring Mr. Yurcisin as our chief executive officer in August 2023, Mr. Replogle, an independent director, served as the chairperson of the Board. In connection with our hiring Mr. Yurcisin, the Board approved Mr. Landesberg as executive chair of the Board and Mr. Replogle as lead independent director. The Board adopted that leadership structure as it believed it to be appropriate in light of Mr. Landesberg’s role in transitioning Mr. Yurcisin into the chief executive officer role and Mr. Landesberg’s familiarity with the operations of the Board and the role of chief executive officer at the company. As lead independent director, Mr. Replogle has responsibility for helping to develop agendas for the meetings of the Board with the executive chair and chief executive officer. Mr. Replogle also is responsible for calling meetings of the independent directors if necessary, developing agendas for those meetings and chairing them.

Audit Committee

The members of the Audit Committee are Rayhan Arif, David Glazer and Larry Cheng. Mr. Replogle served on the audit committee during 2023. Mr. Glazer is the chair of the Audit Committee. Each of Messrs. Arif, Glazer, Cheng and Replogle can read and understand fundamental financial statements, and the Board determined that each is independent under the rules and regulations of the SEC and NYSE listing standards applicable to audit committee members. The Board has determined that each of Rayhan Arif, Larry Cheng and David Glazer and Mr. Replogle when he was a member of the Audit Committee qualify as an audit committee financial expert within the meaning of SEC regulations and meet the financial sophistication requirements of the NYSE. The Audit Committee assists the Board with its oversight of the following: the integrity of the Company’s financial statements; the Company’s compliance with legal and regulatory requirements; the qualifications, independence, and performance of the independent registered public accounting firm; and the design and implementation of our internal audit function and risk assessment and risk management. Among other things, the Audit Committee is responsible for reviewing and discussing with Company management the adequacy and effectiveness of the Company’s disclosure controls and procedures. The Audit Committee also discusses with Company management and the Company’s independent registered public accounting firm the annual audit plan and scope of audit activities, scope and timing of the annual audit of the Company’s financial statements, and the results of the audit and quarterly reviews of the Company’s financial statements, and, as appropriate, will initiate inquiries into certain aspects of the Company’s financial affairs. The Audit Committee is responsible for establishing and overseeing procedures for the receipt, retention, and treatment of any complaints regarding accounting, internal accounting controls, or auditing matters, as well as for the confidential and anonymous submissions by the Company’s employees of concerns regarding questionable accounting or auditing matters. In addition, the Audit Committee has direct responsibility for the appointment, compensation, retention, and oversight of the work of the Company’s independent registered public accounting firm. The Audit Committee also has sole authority to approve the hiring and discharging of the Company’s independent registered public accounting firm, all audit engagement terms and fees, and all permissible non-audit engagements with the independent auditor. The Audit Committee reviews and oversees all related person transactions in accordance with the Company’s Related Person Transaction Policy.

The Audit Committee met four times during the year ended December 31, 2023.

Compensation Committee

Kevin Cleary, Naytri Shroff Sramek, Kristine Miller and John Replogle serve on the Compensation Committee. Mr. Glazer also served on the Compensation Committee during 2023. Kristine Miller is the chair of the Compensation Committee. Each member of the Compensation Committee is independent under the rules and regulations of the SEC and NYSE listing standards applicable to compensation committee members. The Compensation Committee assists the Board in discharging certain of the Company’s responsibilities with respect to compensating the Company’s executive officers, and the administration and review of the Company’s incentive plans for employees and other service providers, including the Company’s equity incentive plan(s), and certain other matters related to the Company’s compensation programs.

The Compensation Committee met five times during the year ended December 31, 2023.

Sustainability, Nominating and Governance Committee

Rayhan Arif, Kevin Cleary, Naytri Sramek and John Replogle currently serve on the Sustainability, Nominating and Governance Committee. Mr. Glazer and Ms. Miller no longer serve on the committee, but were members of the committee during all or a portion of 2023. Ms. Sramek is the chair of the Sustainability, Nominating and Governance Committee. Each member of the Sustainability, Nominating and Governance Committee is independent under the rules and regulations of the SEC and NYSE listing standards applicable to nominating and governance committee members. The Sustainability, Nominating and Governance Committee assists the Board in identifying, screening, and reviewing individuals qualified to serve as directors consistent with criteria approved by the Board, recommending to the Board candidates for nomination for appointment at the annual general meeting or to fill vacancies on the Board, developing and recommending to the Board and overseeing implementation of the Company’s corporate governance guidelines, coordinating and overseeing the annual self-evaluation of the Board, its committees, individual directors, and management in the governance of the Company, and reviewing on a regular basis the Company’s overall corporate governance and recommending improvements as and when necessary. The Sustainability, Nominating and Governance Committee is also responsible for oversight of the Company’s ongoing commitment to environmental stewardship, corporate social responsibility and sustainability.

The Sustainability, Nominating and Governance Committee met three times during the year ended December 31, 2023.

Board and Committee Evaluations

The Sustainability, Nominating and Governance Committee assists the Board in coordinating and overseeing the annual self-evaluation of the Board and its committees. The self-evaluation process is conducted by a third party and involves written questionnaires that are completed by each director as well as one-on-one interviews of each director. The information collected through the written questionnaires and interviews is summarized and reported to the full Board, which engages in discussion of Board effectiveness in governance and support of corporate strategies, areas for change or improvement in Board practice and specific actions to be taken.

Code of Ethics and Business Conduct

The Company has adopted a Code of Ethics and Business Conduct (the “Code”) that applies to all of the Company’s employees, officers, and directors, including the principal executive officer, principal financial officer and principal accounting officer or controller (or persons performing similar functions to the aforementioned officers). The full text of the Code is posted on our website at https://investors.grove.co under the Governance section. The Company intends to disclose future amendments to, or waivers of, the Code, as and to the extent required by SEC regulations, at the same location on our website identified above or in public filings. The information found on, or that can be accessed from or that is hyperlinked to, our website is not part of this proxy statement.

Anti-Hedging and Anti-Pledging Policy

Our insider trading policy prohibits our directors, executive officers and other employees from engaging in hedging transactions with respect to Company securities, such as transactions in put or call options. Our directors, executive officers and other employees are also prohibited from holding Company securities in a margin account or pledging Company securities as collateral for a loan.

Family Relationships

There are no family relationships between any of the individuals who serve as our directors or executive officers.

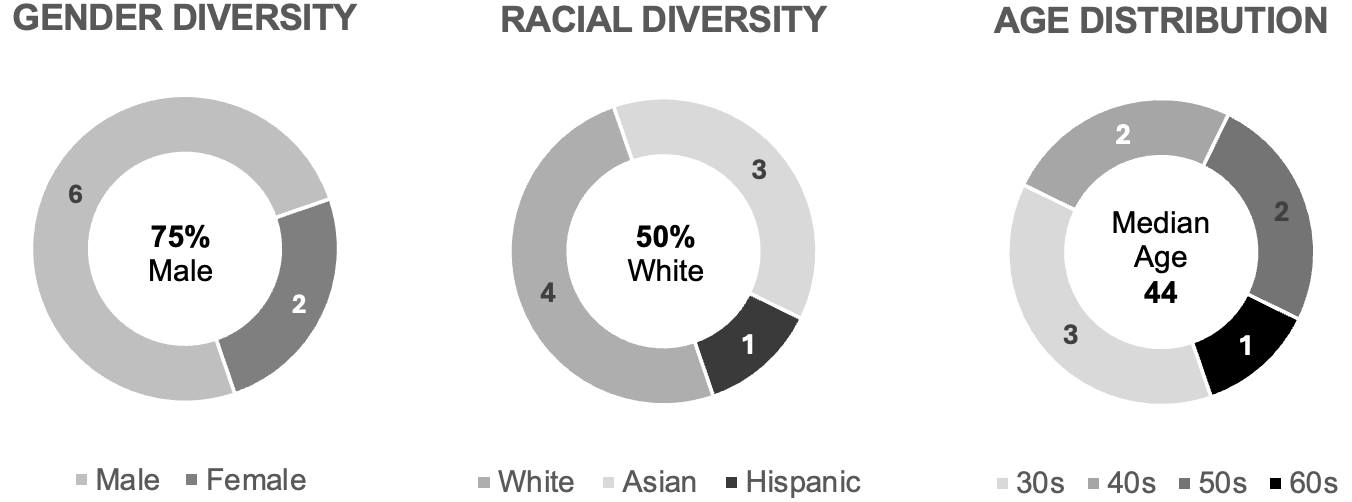

Board Diversity

The Board believes that varying tenures, diverse backgrounds and perspectives create a balance between directors with a deeper knowledge of the Company’ business, operations and history, and directors who bring new and fresh perspectives, which is important to the effectiveness of the Board’s oversight of the Company. Two women are currently members of the Board and four members of the Board are Asian or Hispanic. The following provides certain demographic information about the members of our Board following the Annual Meeting, assuming that the Board’s nominees are elected at the Annual Meeting:

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee has ever been a member of the board of directors or compensation committee of any other entity that has or has had one or more executive officers serving as a member of our Board or Compensation Committee. Certain members of the Compensation Committee may be deemed to have an interest in certain transactions requiring disclosure under Item 404 of Regulation S-K under the Securities Act that are disclosed in “Certain Relationships and Related Person Transactions” which disclosure is hereby incorporated by reference in this section.

DELINQUENT SECTION 16(a) REPORTS

Under U.S. securities laws, directors, executive officers and persons holding more than 10% of Common Stock must report their initial ownership of Common Stock and any changes in that ownership to the SEC. The SEC has designated specific due dates for such reports, and Grove must identify in this Proxy Statement those persons who did not file such reports when due.

Based solely upon a review of Forms 3 and 4 and any amendments furnished to Grove during its fiscal year ended December 31, 2023, and Forms 5 and any amendments furnished to Grove with respect to the same year, Grove believes that Grove’s directors, officers, and greater than 10% beneficial owners complied with all applicable Section 16 filing requirements.

EXECUTIVE OFFICERS

Grove’s executive officers are appointed by the Board and serve at its discretion. Set forth below is information regarding the Company’s current executive officers as of April 1, 2024:

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

Jeff Yurcisin | | 49 | | Chief Executive Officer, President and Director |

| Sergio Cervantes | | 53 | | Chief Financial Officer |

| Christopher Clark | | 39 | | Chief Technology Officer and Director |

| Jennie Perry | | 57 | | Chief Marketing Officer |

Additional information about each of Grove’s current executive officers is as follows:

Sergio Cervantes. Mr. Cervantes, 53, joined Grove in 2022 as its chief financial officer. Prior to joining Grove, Mr. Cervantes served as the chief financial officer of Murad, a skincare business within the Unilever Prestige division, from 2016 to 2022. From 2013 to 2016, Mr. Cervantes, served as the treasurer and corporate finance lead at Unilever for the Americas region, based out of Switzerland. From 2003 to 2013, Mr. Cervantes held various roles with Unilever where he partnered with major commercial areas across regions, based out of Mexico and the U.K. Mr. Cervantes holds a Masters in Finance, a degree in Business Administration and an Executive Diploma, all from the Instituto Tecnológico y de Estudios Superiores de Monterrey.

Christopher Clark. Mr. Clark, 38, co-founded Grove in 2012 and has served as its Chief Technology Officer or Chief Digital Officer since 2013. Prior to joining Grove, Mr. Clark led project management and engineering in 2012 at Kaggle, Inc. and was a product manager and engineer at Blackbaud from 2007 to 2012. Mr. Clark earned a B.S. in Computer Science from Vanderbilt University. Mr. Clark has served as a member of the Board since June 2022, but is not standing for re-election at the Annual Meeting and will not be a member of the Board following the Annual Meeting. The Company thanks Mr. Clark for the valuable contributions he made while a member of the Board.

Jennie Perry. Ms. Perry, 57, has served as Grove’s chief marketing officer since 2021. Prior to joining Grove, Ms. Perry worked for Amazon, Inc., an ecommerce company, from 2011 to 2019, most recently as the chief marketing officer of Prime and Amazon North America. Prior thereto, Ms. Perry held various leadership roles including vice president of Old Navy and brand manager for Kraft Foods. Ms. Perry received a M.B.A. from the University of Pennsylvania, Wharton School of Business and a B.A. degree in Economics from the University of California, Davis.

EXECUTIVE COMPENSATION

Grove is considered a smaller reporting company and an emerging growth company for purposes of the SEC’s executive compensation disclosure rules. For the fiscal year ended December 31, 2023, Grove’s named executive officers were:

•Jeff Yurcisin, chief executive officer and director

•Stuart Landesberg, former chief executive officer and president and current executive chair and director;

•Sergio Cervantes, chief financial officer; and

•Chris Clark, chief technology officer and director.

See “2023 Compensation of Named Executive Officers, Management Transition” below for a description of the transition to Mr. Yurcisin as our chief executive officer.

Grove’s compensation policies and philosophies are designed to align compensation with business objectives, while also enabling it to attract, motivate and retain individuals who contribute to its long-term success. The compensation committee approved and recommended the compensation to be paid to Grove’s named executive officers. The compensation committee engaged an independent compensation consultant to provide advice with respect to such determinations. For 2023, the principal elements of Grove’s executive compensation program consisted of base salary, eligibility for a performance-based bonus and equity-based incentive awards.

2023 Compensation of Named Executive Officers

Cash Compensation

Base salaries are intended to provide a level of compensation sufficient to attract and retain an effective management team, when considered in combination with the other components of the executive compensation program. In general, the Company provides a base salary level designed to reflect each executive officer’s scope of responsibility and accountability. Messrs. Landesberg and Clark received adjustments to their 2023 base salaries to further align their compensation with competitive market data. Mr. Landesberg’s adjustment as chief executive officer of the company prior to his transition to the executive chair role was from $255,000 in 2022 to $500,000 in 2023. Mr. Landesberg’s base salary continued at the same amount after his transition from chief executive officer to executive chair until March 2024 when it was reduced to $375,000. Mr. Clark’s adjustment was from $400,000 in 2022 to $425,000 in 2023. Mr.Cervantes did not receive an increase to his base salary in 2023. See “Management Transition” below for a discussion of Mr. Yurcisin’s base salary.

In 2023 the Compensation Committee approved, and our named executive officers participated in, an annual incentive plan. The annual incentive plan was adopted to attract and retain employees with a high caliber of talent and experience for our key positions and to link payments to the achievement of annual financial and/or operational objectives. Under the annual incentive plan, the named executive officers were eligible to receive a percentage of their annual base salary as a target cash payout contingent on Grove's performance and the named executive officer’s individual performance. The Company’s performance was measured using adjusted EBITDA. The target adjusted EBITDA at which the named executive officers would earn 100% of their target payout, subject to individual performance, was an adjusted EBITDA loss of $27 million. If adjusted EBITDA loss was $32 million or more, the named executive officers would receive no payout. The named executive officers could earn up to 200% of their target payout for over-achievement against the adjusted EBITDA goal. Adjusted EBITDA loss results of $24 million resulted in a 125% of target payout. Adjusted EBITDA loss results of $21.5 million resulted in a 150% of target payout, and adjusted EBITDA loss results of $20 million resulted in 175% of target payout. The amount of the payout between each of those levels was to be determined by straight line interpolation. Our actual performance in 2023 was an adjusted EBITDA loss of $9.2 million, entitling the named executive officers 200% of their target payout, before any adjustment downward for individual performance.

Equity Awards

To focus the Company’s executive officers on the Company’s long-term performance, we have granted equity compensation in the form of stock options and restricted stock units (“RSUs”). In March 2023, the Compensation Committee granted RSUs to the named executive officers. See “Outstanding Equity Awards at 2023 Fiscal Year-End” below for a description of those RSU awards.

In addition to the awards granted in March 2023, Mr. Cervantes was granted an RSU award covering 40,000 shares of Class A Common Stock in April 2023, which was granted pursuant to his offer letter to compensate Mr. Cervantes for compensation that he forfeited upon leaving his prior employer.

Management Transition

In August 2023, the Company hired Jeff Yurcisin as the company’s chief executive officer, and Mr. Landesberg transitioned to the position of executive chairman. Pursuant to Mr. Yurcisin’s offer of employment, he received a base salary at an annual rate of $500,000 and was eligible in 2023 for a cash incentive at a target amount of 100% of his base salary, prorated based on the number of days he was employed in 2023. Mr. Yurcisin participated in the same annual incentive plan as the other named executive officers described above. In connection with Mr. Yurcisin being appointed chief executive officer, he was granted a service-based RSU with respect to 340,000 shares of the Company’s Class A Common Stock and a performance-based RSU (“PSU”) with respect to 510,000 shares of Class A Common Stock. The PSU has a time-based vesting component and a stock price performance component. The RSU and PSU vest on 25% on August 15, 2024 and in twelve equal quarterly installments thereafter, subject to Mr. Yurcisin’s continued service with the Company and, in the case of the PSU, subject to the achievement of specified stock price metrics within four or five years (depending upon the particular metric) after the grant date. After considering in 2024 the company’s stock price as well as the retentive and incentive design of Mr. Yurcisin’s PSU award, the compensation committee reduced the PSU’s stock price hurdles.

In connection with his transition to executive chairman, the company and Mr. Landesberg entered into a letter agreement in August 2023. Pursuant to it, Mr. Landesberg’s base salary continued in an amount of $500,000. Mr. Landesberg was eligible to receive a target cash incentive opportunity of 100% of his base salary as chief executive officer and, pursuant to the letter agreement, 50% of his base salary as executive chairman. The letter agreement also provided for a one-time $500,000 performance bonus for 2024 (the “2024 Performance Bonus”) subject to Mr. Landesberg’s assistance in the transition of his duties to Mr. Yurcisin, continued employment through 2024 and the achievement of an adjusted EBITDA performance goal. Mr. Landesberg and the company agreed in March 2024 that the bonus payout for his 2023 cash incentive opportunity would be $900,000 in light of the company’s over-achievement of its adjusted EBITDA goal under the annual incentive plan. Also in the beginning of 2024, Mr. Landesberg agreed that his base salary would be reduced to $375,000 and agreed to forgo the 2024 Performance Bonus as well as his annual target cash incentive opportunity for 2024.

Please see the “Outstanding Equity Awards at 2023 Fiscal Year-End” table below for a summary of the equity awards held by the named executive officers as of December 31, 2023.

2023 Summary Compensation Table

The following table summarizes the compensation awarded to, earned by or paid to the named executive officers for the fiscal years ended December 31, 2023 and, to the extent required by SEC disclosure rules, December 31, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary ($)(1) | | Bonus ($)(2) | | Stock Awards ($)(3) | | Option Awards ($) | | Non-Equity Incentive Plan Compensation ($) | | All Other Compensation ($)(4) | | Total ($) |

Jeff Yurcisin | | 2023 | | 188,462 | | | 189,041 | | | 2,026,145 | | | — | | | — | | | — | | | 2,403,648 | |

Chief Executive Officer and Director | | 2022 | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Stuart Landesberg | | 2023 | | 484,526 | | | — | | | 1,629,514 | | | — | | | 900,000 | | | 23,100 | | | 3,037,140 | |

Former Chief Executive Officer and President and current Executive Chair and Director | | 2022 | | 255,000 | | | — | | | 4,414,755 | | | — | | | — | | | 6,300 | | | 4,676,055 | |

| Sergio Cervantes | | 2023 | | 500,000 | | | — | | | 762,569 | | | — | | | 200,000 | | | — | | | 1,462,569 | |

| Chief Financial Officer | | 2022 | | 363,637 | | | 150,000 | | | 4,215,184 | | | — | | | — | | | — | | | 4,728,821 | |

Chris Clark | | 2023 | | 408,173 | | | — | | | 464,234 | | | — | | | 106,119 | | | | | 978,526 | |

Chief Technology Officer | | 2022 | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | |

(1) | Mr. Yurcisin joined Grove in August 2023. His 2023 base salary amount reflects a pro-rated amount of his annual base salary of $500,000. Mr. Cervantes joined Grove in April 2022. His 2022 base salary amount reflects a base salary of $500,000 pro-rated to his start date. |

| (2) | Mr. Yurcisin’s 2023 bonus amount is pro-rated based on his start date in 2023. In the case of Mr. Cervantes, his 2022 bonus amount includes a $150,000 signing bonus, which was paid in 2022 pursuant to the terms of his offer letter. |

| (3) | Represents the aggregate grant date fair value of awards of RSUs and/or PSUs computed in accordance with FASB Accounting Standards Codification (“ASC”) Topic 718. Such aggregate grant date fair values do not take into account any estimated forfeitures related to service-vesting conditions. The amounts included in the Stock Awards column for Mr. Yurcisin’s 2023 PSUs are calculated based on the probable satisfaction of the performance conditions for such awards as of the date of grant. Under ASC Topic 718, the vesting condition related to Mr. Yurcisin’s PSU is considered a market condition and not a performance condition. Accordingly, there is no grant date fair value below or in excess of the amount reflected in the table above for Mr. Yurcisin’s 2023 PSU that could be calculated and disclosed based on achievement of the underlying market condition. The assumptions used in calculating the grant date fair value of such RSUs and PSUs granted in 2023 and 2022 are set forth in Note 11 to Grove’s audited consolidated financial statements included in Grove’s Annual Report on Form 10-K for the year ended December 31, 2023. In the case of Mr. Landesberg, the 2022 amounts also include $3,117,108 representing the incremental grant date fair value of the RSU awards received in exchange for options surrendered in connection with the option exchange the company conducted in 2022. |

(4) | The amounts in the All Other Compensation column for Mr. Landesberg consist of reimbursement for consulting services received by Mr. Landesberg related to our business. |

Outstanding Equity Awards at 2023 Fiscal Year-End

The following table presents information regarding the outstanding stock options, RSUs and PSUs held by each of the named executive officers as of December 31, 2023. The share numbers in the table reflect a 1:5 reverse stock split effected June 6, 2023.

The following table does not include Grove Earnout Shares that Messrs. Landesberg, Cervantes and Clark received pursuant to the terms of the Merger Agreement in connection with the Business Combination and which were issued to Messrs. Landesberg, Cervantes and Clark on the same terms as other holders of Legacy Grove preferred stock, common stock, options, RSUs and warrants. Grove Earnout Shares beneficially owned by Messrs. Landesberg, Cervantes and Clark are reflected in the section entitled “Security Ownership of Certain Beneficial Owners and Management” in this proxy statement below. Unless otherwise noted in the footnotes to the following table, the number of shares represented in the table are shares of the Company’s Class A Common Stock.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Option Awards | | Stock Awards | | Equity Incentive Plan Awards |

Name | | Grant Date | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable | | Equity

Incentive

Plan Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#) | | Option

Exercise

Price

($) | | Option

Expiration

Date | | Number of

Unearned

Shares, Units

or Other

Rights

That Have

Not Vested

(#) | | Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) (1) | | Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) (1) |

Jeff Yurcisin | | 8/16/2023 | (2) | — | | | — | | | — | | | — | | | — | | | 340,000 | | | $ | 601,800 | | | | | |

| | 8/16/2023 | (3) | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 510,000 | | | $ | 902,700 | |

Stuart Landesberg | | 3/30/2018 | (4) | 530,706 | | | — | | | — | | | $ | 3.20 | | | 3/29/2028 | | — | | | $ | — | | | — | | | — | |

| | 2/15/2021 | (5) | — | | | — | | | 203,433 | | | $ | 18.85 | | | 2/14/2031 | | — | | | $ | — | | | — | | | — | |

| | 10/27/2022 | (6) (7) | — | | | — | | | — | | | — | | | — | | | 158,511 | | | $ | 280,564 | | | — | | | — | |

| | 12/8/2022 | (8) (7) | — | | | — | | | — | | | — | | | — | | | 405,515 | | | $ | 717,762 | | | — | | | — | |

| | 3/1/2023 | (9) (7) | — | | | — | | | — | | | — | | | — | | | 529,310 | | | $ | 936,879 | | | — | | | — | |

Sergio Cervantes | | 5/2/2022 | (10) (7) | — | | | — | | | — | | | — | | | — | | | 88,203 | | | $ | 156,119 | | | — | | | — | |

| | 3/1/2023 | (11) (7) | — | | | — | | | — | | | — | | | — | | | 246,470 | | | $ | 436,252 | | | — | | | — | |

Chris Clark | | 7/18/2016 | | 25,662 | | | — | | | — | | | $ | 1.10 | | | 7/17/2026 | | — | | | $ | — | | | — | | | — | |

| | 10/4/2017 | | 47,707 | | | — | | | — | | | $ | 1.90 | | | 10/3/2027 | | — | | | $ | — | | | — | | | — | |

| | 11/9/2018 | | 79,970 | | | — | | | — | | | $ | 3.80 | | | 11/8/2028 | | — | | | $ | — | | | — | | | — | |

| | 10/27/2022 | (6) (7) | — | | | — | | | — | | | — | | | — | | | 11,406 | | | $ | 20,189 | | | — | | | — | |

| | 10/27/2022 | (12) (7) | — | | | — | | | — | | | — | | | — | | | 6,125 | | | $ | 10,841 | | | — | | | — | |

| | 12/8/2022 | (13) (7) | — | | | — | | | — | | | — | | | — | | | 109,633 | | | $ | 194,050 | | | — | | | — | |

| | 3/1/2023 | (11) (7) | — | | | — | | | — | | | — | | | — | | | 150,796 | | | $ | 266,909 | | | — | | | — | |

| | | | | |

| (1) | | The market value of shares or units of stock that have not vested reflects the closing stock price of $1.77 per share on December 29, 2023. |

| (2) | | These RSUs vest 25% on August 15, 2024, and then in twelve equal quarterly installments thereafter, subject to Mr. Yurcisin’s continued service, with acceleration of vesting provisions the same as set forth in the Additional Narrative Disclosure below. |

| (3) | | These RSUs vest 25% on August 15, 2024, and then in twelve equal quarterly installments thereafter, subject to Mr. Yurcisin’s continued service and subject to the achievement of specified stock price metrics, with acceleration of vesting provisions the same as set forth in the Additional Narrative Disclosure below.

|

| (4) | | This option is exercisable for Class B Common Stock. |

| (5) | | This option is exercisable for Class B Common Stock and vests on the earlier of (i) such time as the 20-day trading day volume-weighted average price of our Class A Common Stock is at least $63.90 per share, or (ii) immediately prior to the consummation of certain corporate transactions in which the holders of shares of Grove common stock will receive, in exchange for such shares, cash or other consideration the aggregate amount of $63.90 per share, subject to Mr. Landesberg’s continuous employment on the date of such milestone. |

| (6) | | These RSUs vest in equal installments on each February 15, May 15, August 15 and November 15 until becoming fully vested on February 15, 2025, subject to the award recipient’s continued service with the Company through each applicable vesting date. |

| (7) | | 100% of the award accelerates in connection with a termination of employment due to death or disability. In the context of a change in control, if the award is not effectively assumed or continued, it will vest in its entirety. In the change in control context, if the award is effectively assumed or continued and the award recipient's employment is terminated without cause or the award recipient resigns for good reason within 24 months following the change in control, the award will become fully vested. |

| | | | | |

| (8) | | These RSUs will vest in twelve equal installments on each February 15th, May 15th, August 15th and November 15th of each year beginning on May 15, 2023, subject to Mr. Landesberg’s continued service with the Company through each applicable vesting date and with accelerated vesting if Mr. Landesberg’s employment is terminated by the Company without cause or by Mr. Landesberg for good reason. |

| (9) | | These RSUs will vest in ten equal installments on each February 15th, May 15th, August 15th and November 15th of each year beginning on May 15, 2023 subject to Mr. Landesberg’s continued service with the Company through each applicable vesting date and with accelerated vesting if Mr. Landesberg’s employment is terminated by the Company without cause or by Mr. Landesberg due to good reason. |

| (10) | | These RSUs vest 25% on May 15, 2023, and then in quarterly installments for the next 36 months. |

| (11) | | These RSUs will vest in ten equal installments on each February 15th, May 15th, August 15th and November 15th of each year beginning on May 15, 2023, subject to continued service with the Company through each applicable vesting date. |

| (12) | | These RSUs vest in equal installments on each February 15, May 15, August 15 and November 15 until becoming fully vested on February 15, 2024, subject to Mr. Clark’s continued service with the Company through each applicable vesting date. |

| (13) | | These RSUs will vest in twelve equal installments on each February 15th, May 15th, August 15th and November 15th of each year beginning on May 15, 2023, subject to Mr. Clark’s continued service with the Company through each applicable vesting date. |

Additional Narrative Disclosure

Severance Arrangements

The Company generally executes an offer of employment before an executive joins the Company. This offer describes the basic terms of the executive’s employment, including his or her start date, starting salary, annual incentive target and equity awards.

The terms of the executive’s employment are based thereafter on sustained good performance rather than contractual terms, and the Company’s policies will apply as warranted. The Company does not generally provide contractual severance rights to its employees, except that the vesting of certain equity awards held by our named executive officers will accelerate if their services are terminated by the Company without cause or they resign for good reason following a change in control, as described above.