NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 1 Investor Presentation August 2023 Exhibit 99.2

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 2 Basis of Presentation This Presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential investment in Grove Collaborative Holdings, Inc. (“Grove”) (the “Potential Transaction”) and for no other purpose. By accepting, reviewing or reading this Presentation, you will be deemed to have agreed to the obligations and restrictions set out below. Without the express prior written consent of Grove, this Presentation and any information contained within it may not be used for any purpose other than your evaluation of Grove. This Presentation supersedes and replaces all previous oral or written communications between the parties hereto relating to the subject matter hereof. This Presentation and any oral statements made in connection with this Presentation do not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This Presentation does not constitute either advice or a recommendation regarding any securities. Any offer to sell securities will be made only pursuant to a definitive Subscription Agreement and will be made in reliance on an exemption from registration under the Securities Act of 1933, as amended, for offers and sales of securities that do not involve a public offering. Grove reserves the right to withdraw or amend for any reason any offering and to reject any Subscription Agreement for any reason. The communication of this Presentation is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. No representations or warranties, express or implied are given in, or in respect of, this Presentation. Industry and market data used in this Presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. Grove has not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with Grove or its respective affiliates or representatives as investment, legal or tax advice. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Grove or the Potential Transaction. Recipients of this Presentation should each make their own evaluation of Grove and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. To the fullest extent permitted by law, in no circumstances will Grove or any of its respective stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect, or consequential loss or loss of profit arising from the use of this presentation, its contents, its omissions, reliance on the information contained within it or on opinions communicated in relation thereto or otherwise arising in connection therewith. Forward-Looking Statements Certain statements included in this Presentation are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, but are not limited to, (1) statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity; (2) references with respect to the projected future financial performance of Grove and Grove’s operating companies; (3) changes in the market for Grove’s products, and expansion plans and opportunities; (4) anticipated customer retention; and (5) expectations around potential mergers and acquisitions and capital availability. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Grove’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Grove. These forward-looking statements are subject to a number of risks and uncertainties, including: changes in domestic and foreign business, market, financial, political and legal conditions; failure to realize the anticipated benefits of the Potential Transaction; risks relating to the uncertainty of the projected financial information with respect to Grove; Grove’s ability to successfully expand its business; competition; the uncertain effects of the COVID-19 pandemic; risks relating to growing inflation and rising interest rates; and those factors discussed in documents of Grove filed, or to be filed, with the U.S. Securities and Exchange Commission (the “SEC”). If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Grove does not presently know or that Grove currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Grove’s expectations, plans or forecasts of future events and views as of the date of this Presentation. Grove anticipates that subsequent events and developments will cause Grove’s assessments to change. However, while Grove may elect to update these forward-looking statements at some point in the future, Grove specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Grove’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. Use of Data The data contained herein is derived from various internal and external sources. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. Grove assumes no obligation to update the information in this Presentation. Disclaimer

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 3 Trademarks Grove owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its business. This Presentation may also contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with Grove, or an endorsement or sponsorship by or of Grove. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Presentation may appear without the TM, SM, ® or © symbols, but such references are not intended to indicate, in any way, that Grove will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights. Use of Projections This Presentation contains projected financial information with respect to Grove, namely revenue and gross margin, Grove brands revenue share, net revenue share by brand, gross profit, adjusted EBITDA, adjusted EBITDA margin, fulfillment cost, operating expenses, advertising spend. Such projected financial information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The projections, estimates and targets in this Presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Grove’s control. See “Forward-Looking Statements” above. While all projections, estimates and targets are necessarily speculative, Grove believes that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic, regulatory, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in such projections, estimates and targets. The inclusion of projections, estimates and targets in this Presentation should not be regarded as an indication that Grove, or its representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events. The independent registered public accounting firm of Grove has not audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. Financial Information; Non-GAAP Financial Measures The Grove financial information and data for the fiscal years ended December 31, 2019, 2020, 2021 and 2022 included herein are audited in accordance with Public Company Accounting Oversight Board (PCAOB) audit standards. Grove financial information for 2023 reflects unaudited financial information or management estimates. Some of the financial information and data contained in this Presentation, such as adjusted gross margin, adjusted selling, general, and administrative and product development expenses, and adjusted EBITDA, have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). These non-GAAP measures, and other measures that are calculated using such non-GAAP measures, are an addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to revenue, operating income, profit before tax, net income or any other performance measures derived in accordance with GAAP. A reconciliation of adjusted EBITDA to Net Income is provided at the end of this presentation. A reconciliation of the projected non-GAAP financial measures has not been provided and is unable to be provided without unreasonable effort because certain items excluded from these non-GAAP financial measures such as charges related to stock-based compensation expenses and related tax effects, including non-recurring income tax adjustments, cannot be reasonably calculated or predicted at this time. Grove believes these non-GAAP measures of financial results, including on a forward-looking basis, provide useful information to management and investors regarding certain financial and business trends relating to Grove’s financial condition and results of operations. Grove’s management uses these non-GAAP measures for trend analyses and for budgeting and planning purposes. Grove believes that the use of these non-GAAP financial measures provide an additional tool for investors to use in evaluating projected operating results and trends in and in comparing Grove’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. However, there are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents. For example, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore Grove’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. See the footnotes on the slides where these measures are discussed and the Appendix for definitions of these non-GAAP financial measures and reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures. Important Information for Investors and Stockholders This Presentation is not a substitute for a registration statement or for any other document that Grove may file with the SEC in connection with any Potential Transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of other documents filed with the SEC by Grove through the website maintained by the SEC at http://www.sec.gov. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. Disclaimer (continued)

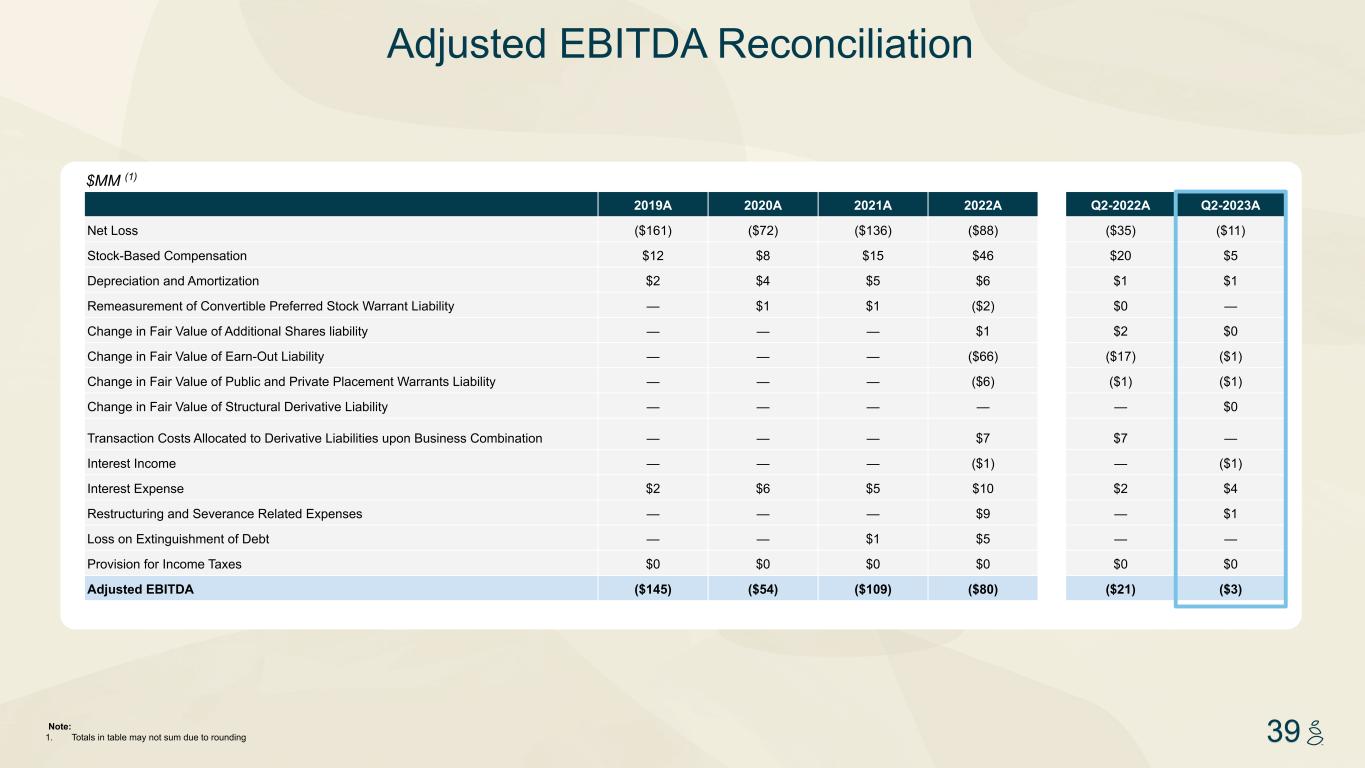

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 4 Non-GAAP Financial Measures Some of the financial information and data contained in this presentation, such as adjusted EBITDA and adjusted EBITDA margin, have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). These non-GAAP measures, and other measures that are calculated using such non-GAAP measures, are an addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to revenue, operating income, profit before tax, net income or any other performance measures derived in accordance with GAAP. A reconciliation of historical adjusted EBITDA to Net Income is provided in the appendix. The reconciliation of projected adjusted EBITDA and adjusted EBITDA Margin to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward-looking basis due to the high variability, complexity, and low visibility with respect to the charges excluded from these non-GAAP measures, such as the impact of depreciation and amortization of fixed assets, amortization of internal use software, the effects of net interest expense (income), other expense (income), and non-cash stock based compensation expense. Grove believes these non-GAAP measures of financial results, including on a forward-looking basis, provide useful information to management and investors regarding certain financial and business trends relating to Grove’s financial condition and results of operations. Grove’s management uses these non-GAAP measures for trend analyses and for budgeting and planning purposes. Grove believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing Grove’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management of Grove does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. However, there are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents. For example, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore Grove’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. We calculate Adjusted EBITDA as net loss, adjusted to exclude: (1) stock-based compensation expense; (2) depreciation and amortization; (3) remeasurement of convertible preferred stock warrant liability; (4) changes in fair values of Additional Shares, Earn-out Shares, Public Private Placement Warrant, Structural Derivative liabilities; (5) transaction costs allocated to derivative liabilities upon Business Combination; (6) interest income; (7) interest expense; (8) restructuring and severance related costs and (9) provision for income taxes. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by revenue.

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 5 Executive Summary: Leading brand, unique entry point

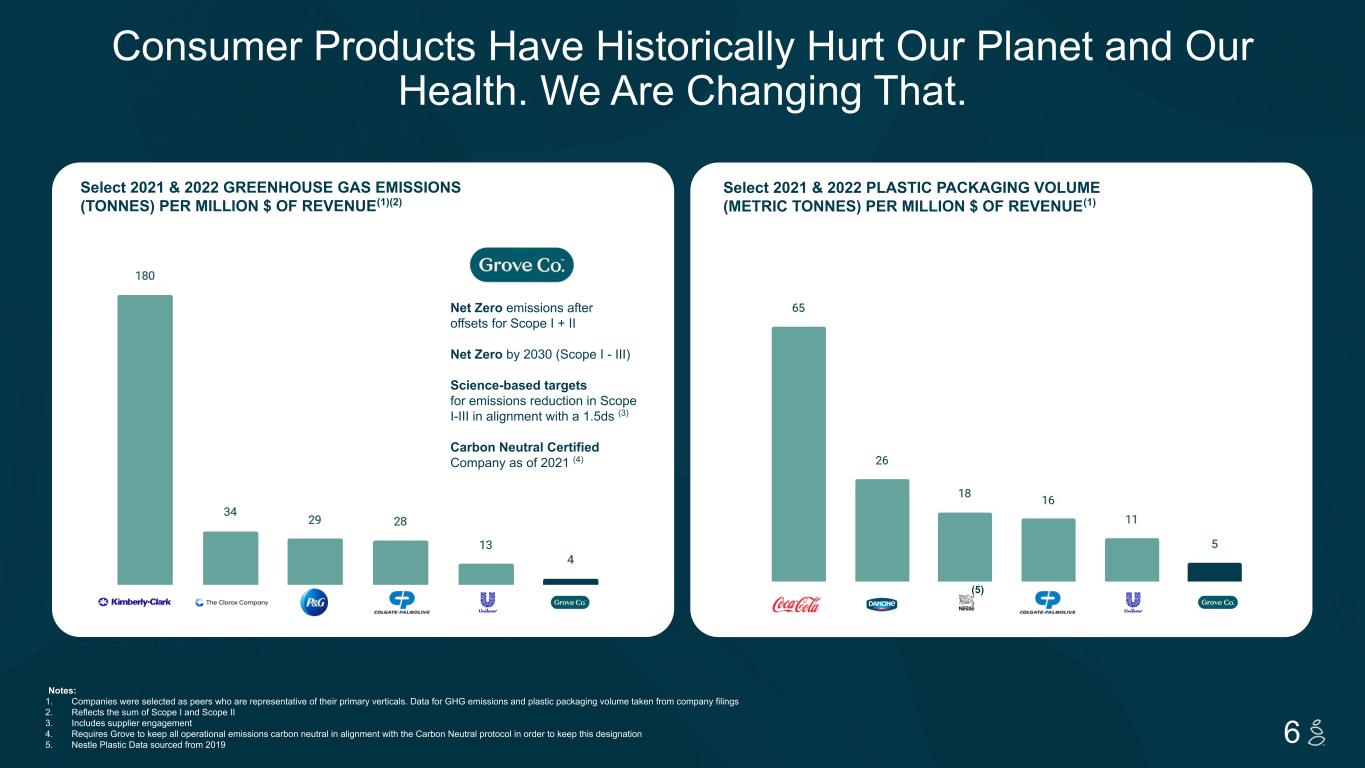

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 6 Consumer Products Have Historically Hurt Our Planet and Our Health. We Are Changing That. Source: Company filings Net Zero emissions after offsets for Scope I + II Net Zero by 2030 (Scope I - III) Science-based targets for emissions reduction in Scope I-III in alignment with a 1.5ds (3) Carbon Neutral Certified Company as of 2021 (4) Select 2021 & 2022 GREENHOUSE GAS EMISSIONS (TONNES) PER MILLION $ OF REVENUE(1)(2) Notes: 1. Companies were selected as peers who are representative of their primary verticals. Data for GHG emissions and plastic packaging volume taken from company filings 2. Reflects the sum of Scope I and Scope II 3. Includes supplier engagement 4. Requires Grove to keep all operational emissions carbon neutral in alignment with the Carbon Neutral protocol in order to keep this designation 5. Nestle Plastic Data sourced from 2019 Select 2021 & 2022 PLASTIC PACKAGING VOLUME (METRIC TONNES) PER MILLION $ OF REVENUE(1) (5)

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 7 We create and curate high performance, planet-first products to make that possible. Grove’s vision is that consumer products will be a positive force for human and environmental health.

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 8 of plastic-free purchasers started purchasing in the last 2 years (5) of American shoppers are concerned about plastics and packaging waste (4) of natural home shoppers are willing to pay a premium to purchase plastic-free products (5) of natural home shoppers are likely to purchase plastic-free products in the future (5) Plastic Waste Is the #1 Issue for Our Industry (1) Sources: 1. Kara Lavender Law, Natalie Starr et al., The United States’ Contribution of Plastic Waste to Land and Ocean. October, 2020; PEW Charitable Trust and SYSTEMIQ, Breaking the Plastic Wave: A Comprehensive Assessment of Pathways Towards Stopping Ocean Plastic Pollution. July, 2020 2. Shelton Grp, Waking the Sleeping Giant: What Middle America knows about plastic waste and how they’re taking action. June, 2019 3. Supply Chain Dive, Packaging Makes Up Nearly Half Of Plastic Waste. March, 2019 4. Consumer Brands/Ipsos poll based on a sample of 1,530 people in July’21 5. Natural home care market survey commissioned by Grove (August 2021) More U.S. consumers care about plastic waste than about climate change. (2) Plastic packaging represents nearly half of all plastic waste. (3) 84% 81% 95% 83%

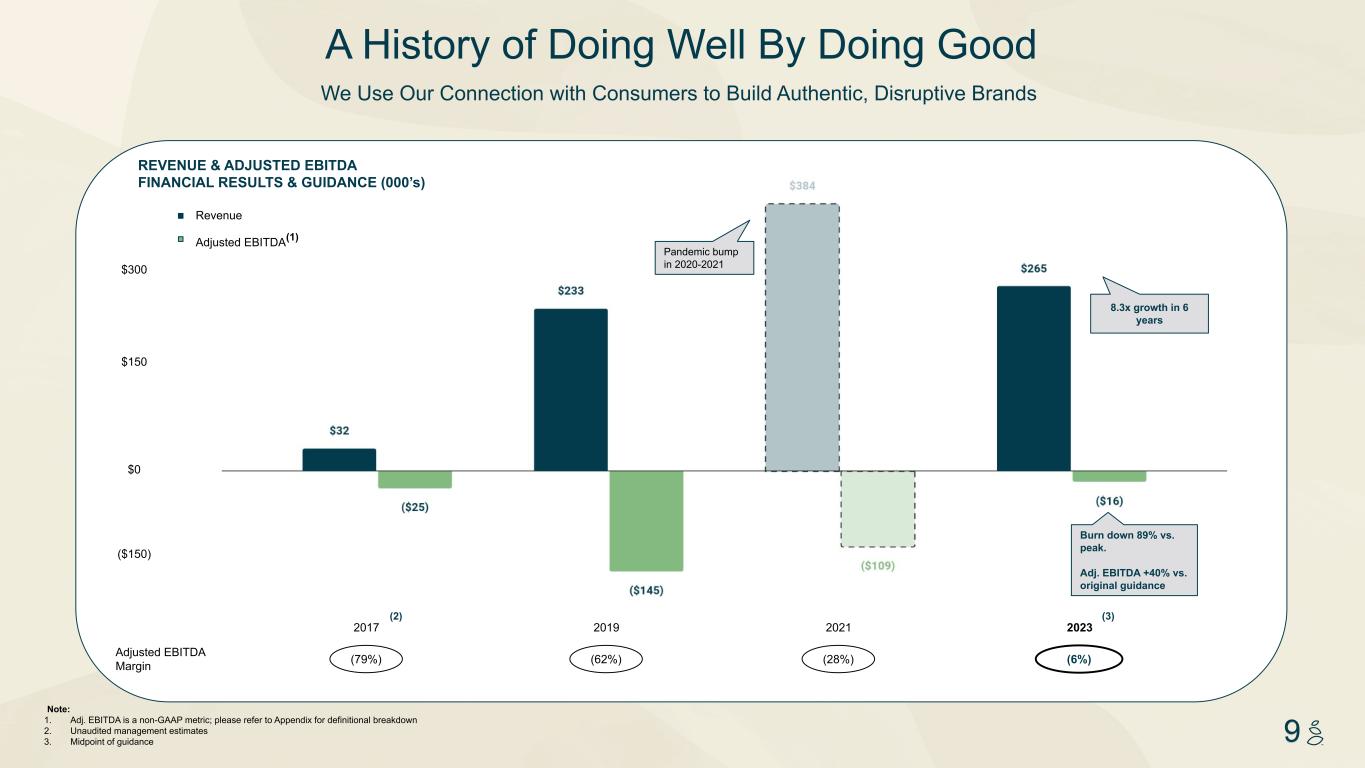

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 9 A History of Doing Well By Doing Good We Use Our Connection with Consumers to Build Authentic, Disruptive Brands Note: 1. Adj. EBITDA is a non-GAAP metric; please refer to Appendix for definitional breakdown 2. Unaudited management estimates 3. Midpoint of guidance Revenue Adjusted EBITDA(1) 8.3x growth in 6 years REVENUE & ADJUSTED EBITDA FINANCIAL RESULTS & GUIDANCE (000’s) Pandemic bump in 2020-2021 (2) $300 $150 $0 ($150) Burn down 89% vs. peak. Adj. EBITDA +40% vs. original guidance 2017 2019 2021 (79%)Adjusted EBITDA Margin (62%) (28%) 2023 (6%) (3)

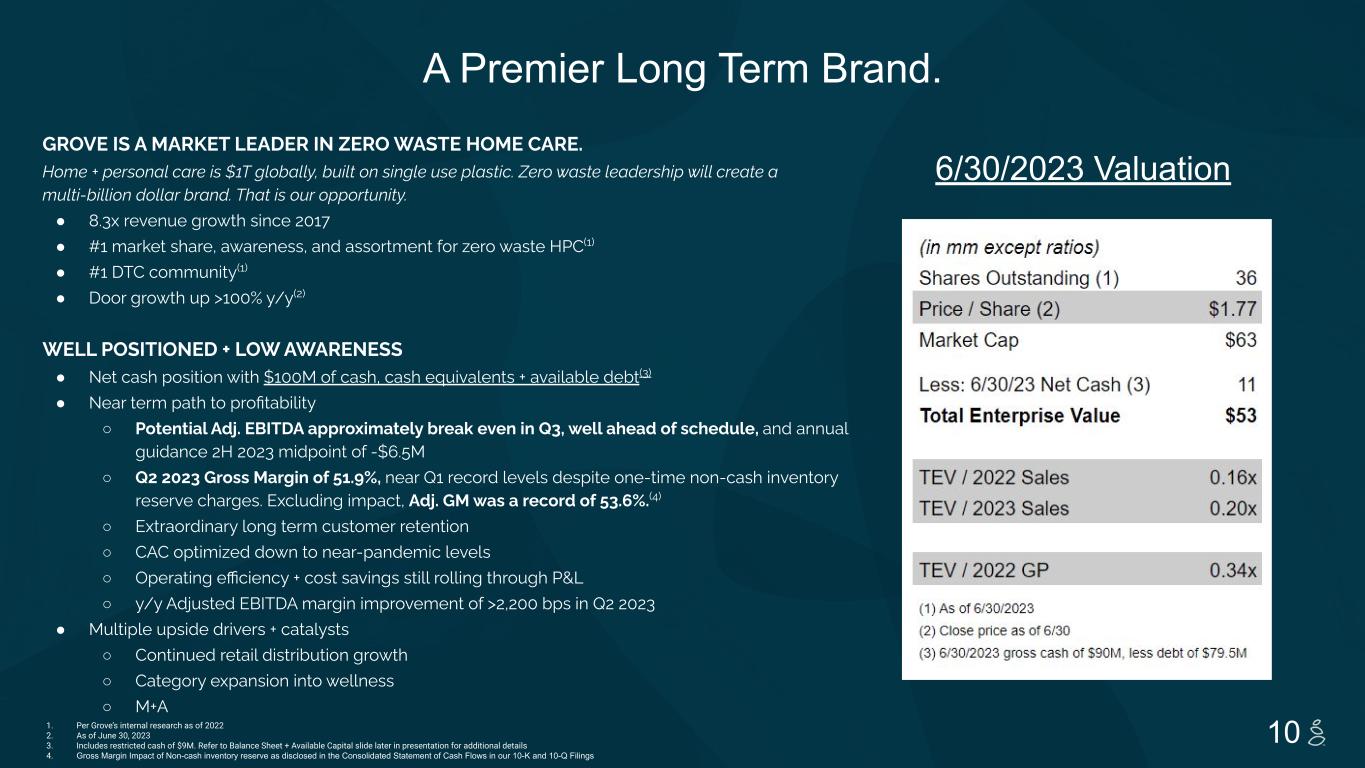

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 10 GROVE IS A MARKET LEADER IN ZERO WASTE HOME CARE. Home + personal care is $1T globally, built on single use plastic. Zero waste leadership will create a multi-billion dollar brand. That is our opportunity. ● 8.3x revenue growth since 2017 ● #1 market share, awareness, and assortment for zero waste HPC(1) ● #1 DTC community(1) ● Door growth up >100% y/y(2) WELL POSITIONED + LOW AWARENESS ● Net cash position with $100M of cash, cash equivalents + available debt(3) ● Near term path to profitability ○ Potential Adj. EBITDA approximately break even in Q3, well ahead of schedule, and annual guidance 2H 2023 midpoint of -$6.5M ○ Q2 2023 Gross Margin of 51.9%, near Q1 record levels despite one-time non-cash inventory reserve charges. Excluding impact, Adj. GM was a record of 53.6%.(4) ○ Extraordinary long term customer retention ○ CAC optimized down to near-pandemic levels ○ Operating efficiency + cost savings still rolling through P&L ○ y/y Adjusted EBITDA margin improvement of >2,200 bps in Q2 2023 ● Multiple upside drivers + catalysts ○ Continued retail distribution growth ○ Category expansion into wellness ○ M+A A Premier Long Term Brand. 6/30/2023 Valuation 1. Per Grove’s internal research as of 2022 2. As of June 30, 2023 3. Includes restricted cash of $9M. Refer to Balance Sheet + Available Capital slide later in presentation for additional details 4. Gross Margin Impact of Non-cash inventory reserve as disclosed in the Consolidated Statement of Cash Flows in our 10-K and 10-Q Filings

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 11 Photo w Drew B in it “Natural Products: Huge, High Growth TAM” Change the drew photo. SECTION 1 The Long Term Opportunity: A Billion Dollar Brand

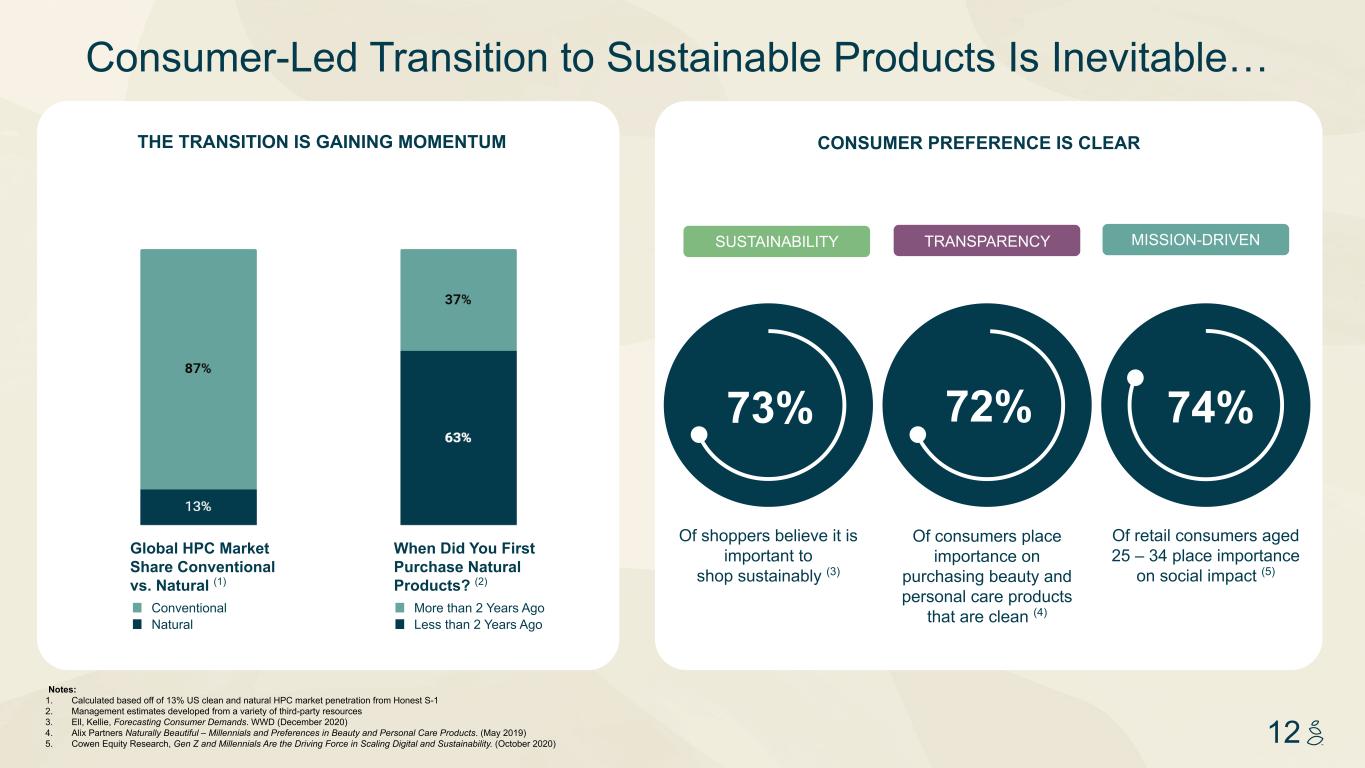

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 12 Notes: 1. Calculated based off of 13% US clean and natural HPC market penetration from Honest S-1 2. Management estimates developed from a variety of third-party resources 3. Ell, Kellie, Forecasting Consumer Demands. WWD (December 2020) 4. Alix Partners Naturally Beautiful – Millennials and Preferences in Beauty and Personal Care Products. (May 2019) 5. Cowen Equity Research, Gen Z and Millennials Are the Driving Force in Scaling Digital and Sustainability. (October 2020) THE TRANSITION IS GAINING MOMENTUM When Did You First Purchase Natural Products? (2) More than 2 Years Ago Less than 2 Years Ago Conventional Natural Global HPC Market Share Conventional vs. Natural (1) Consumer-Led Transition to Sustainable Products Is Inevitable… Of retail consumers aged 25 – 34 place importance on social impact (5) Of consumers place importance on purchasing beauty and personal care products that are clean (4) TRANSPARENCY Of shoppers believe it is important to shop sustainably (3) SUSTAINABILITY CONSUMER PREFERENCE IS CLEAR MISSION-DRIVEN 74%72%73%

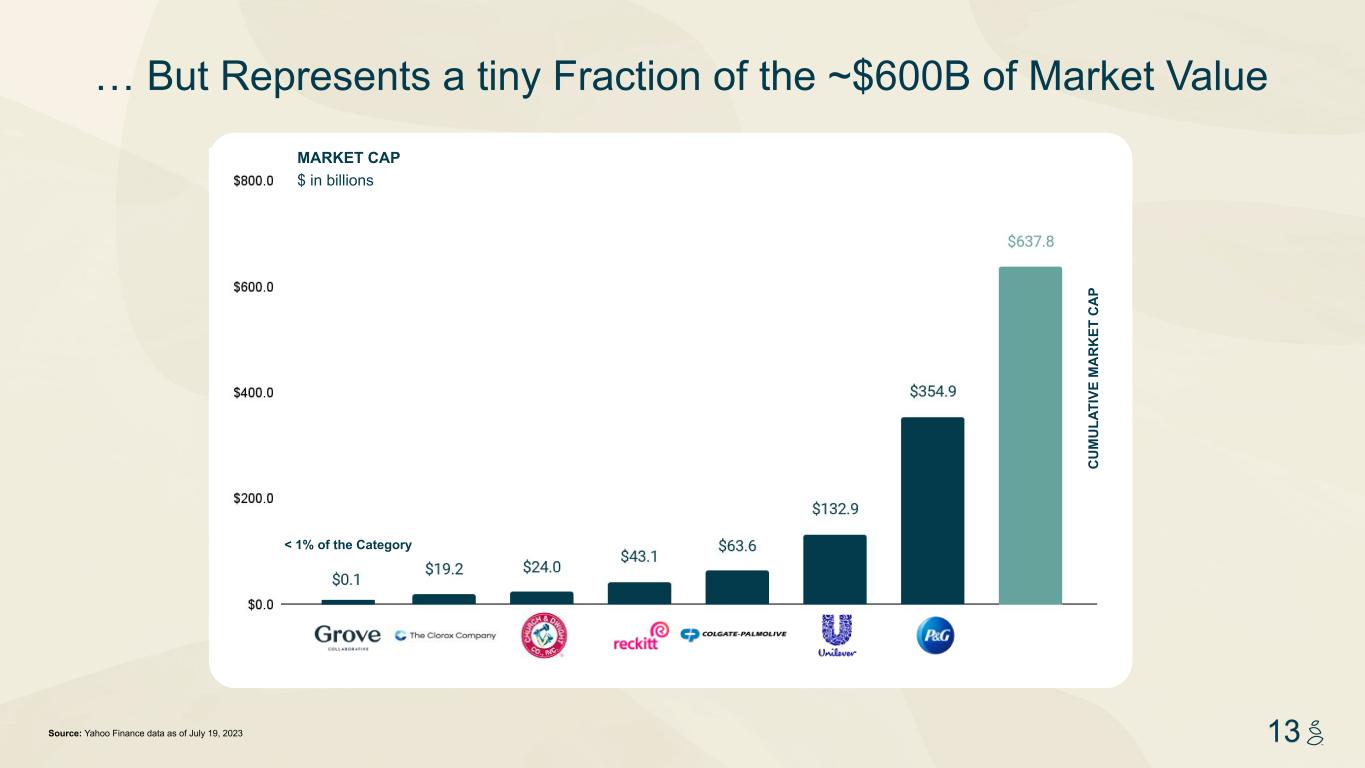

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 13Source: Yahoo Finance data as of July 19, 2023 … But Represents a tiny Fraction of the ~$600B of Market Value < 1% of the Category C U M U LA TI VE M A R K ET C A P MARKET CAP $ in billions

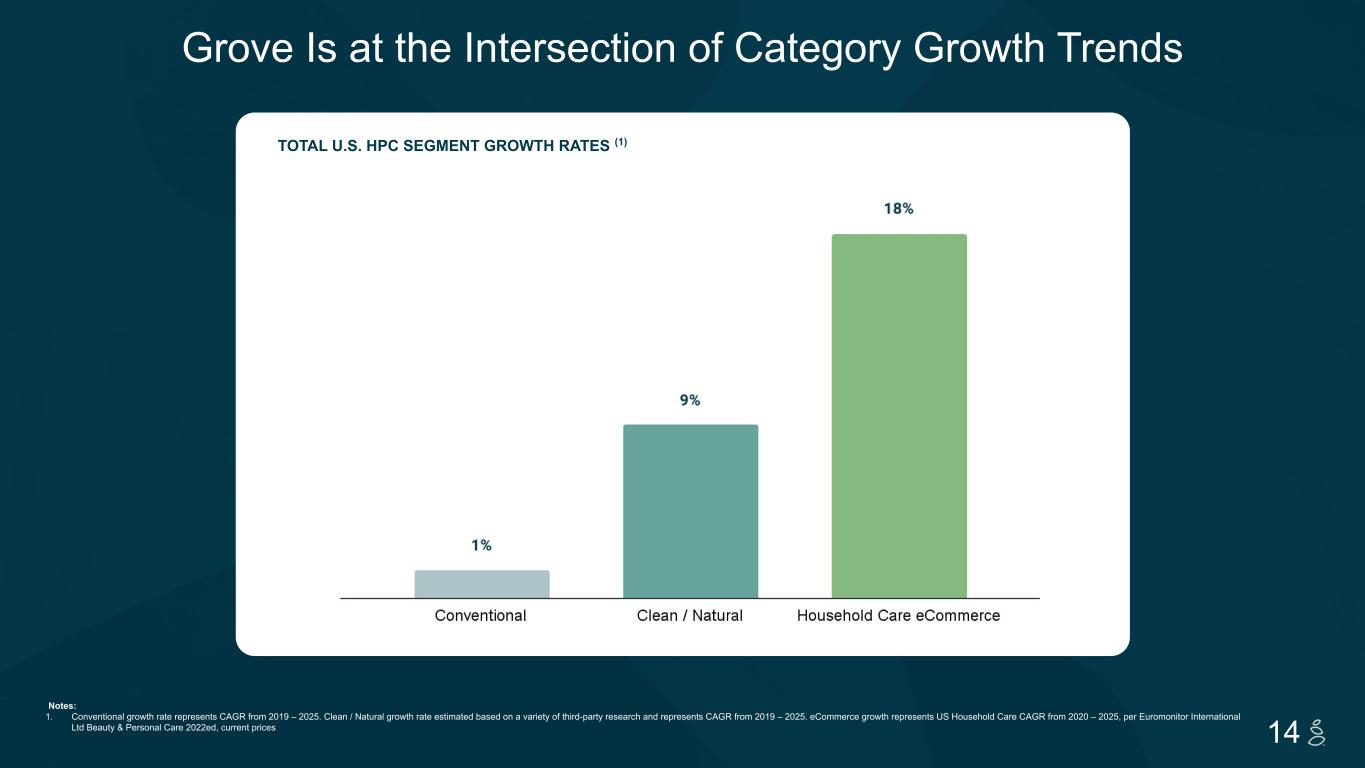

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 14 TOTAL U.S. HPC SEGMENT GROWTH RATES (1) Grove Is at the Intersection of Category Growth Trends Notes: 1. Conventional growth rate represents CAGR from 2019 – 2025. Clean / Natural growth rate estimated based on a variety of third-party research and represents CAGR from 2019 – 2025. eCommerce growth represents US Household Care CAGR from 2020 – 2025, per Euromonitor International Ltd Beauty & Personal Care 2022ed, current prices

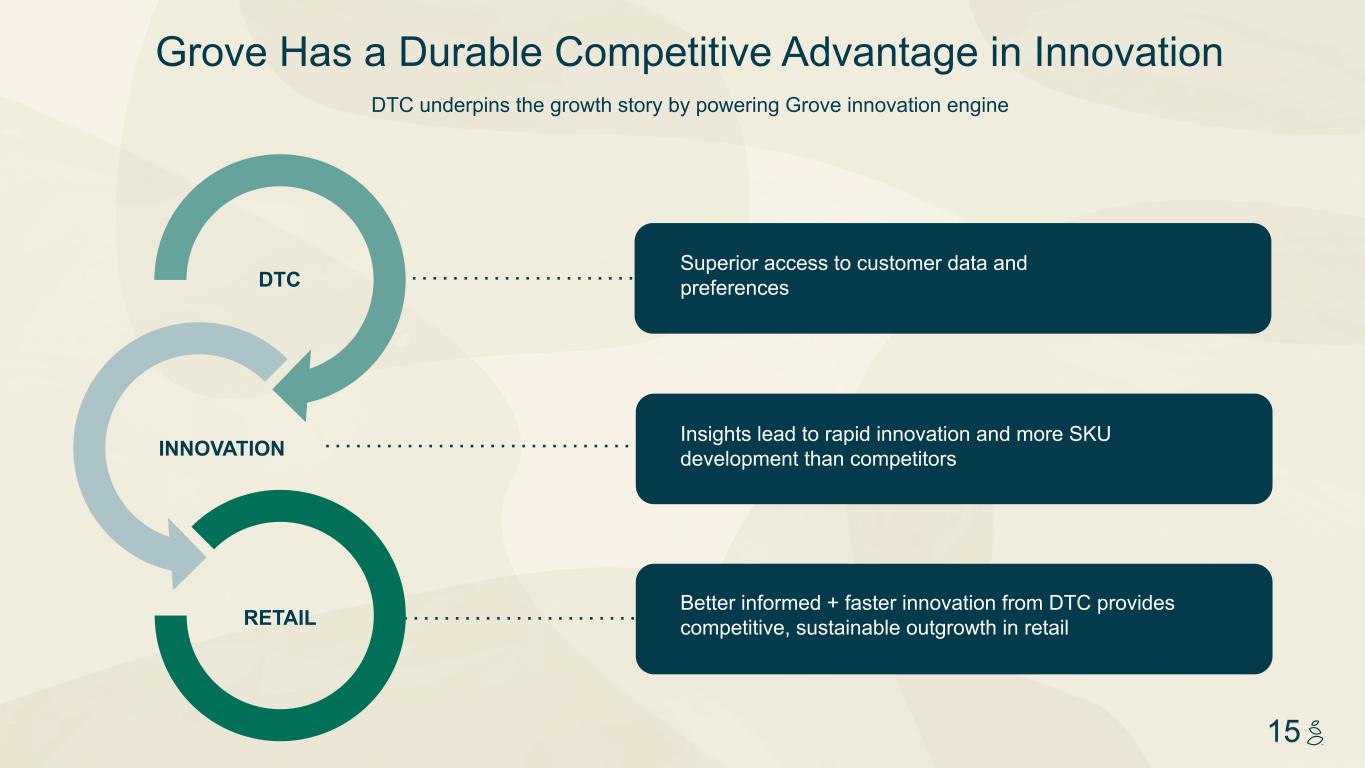

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 15 Superior access to customer data and preferences Insights lead to rapid innovation and more SKU development than competitors Better informed + faster innovation from DTC provides competitive, sustainable outgrowth in retail DTC underpins the growth story by powering Grove innovation engine Grove Has a Durable Competitive Advantage in Innovation DTC INNOVATION RETAIL

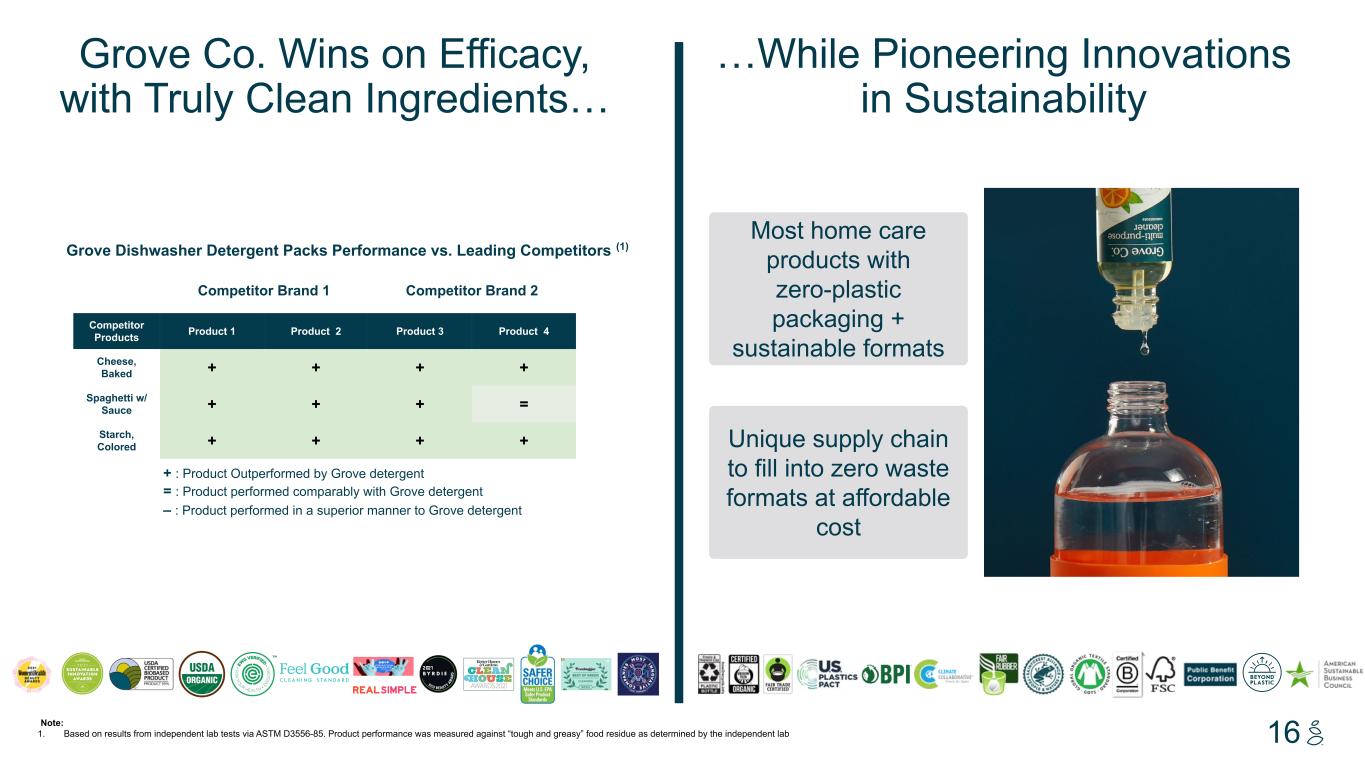

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 16 Grove Co. Wins on Efficacy, with Truly Clean Ingredients… Grove Dishwasher Detergent Packs Performance vs. Leading Competitors (1) Competitor Brand 1 Competitor Brand 2 Competitor Products Product 1 Product 2 Product 3 Product 4 Cheese, Baked + + + + Spaghetti w/ Sauce + + + = Starch, Colored + + + + + : Product Outperformed by Grove detergent = : Product performed comparably with Grove detergent – : Product performed in a superior manner to Grove detergent Note: 1. Based on results from independent lab tests via ASTM D3556-85. Product performance was measured against “tough and greasy” food residue as determined by the independent lab …While Pioneering Innovations in Sustainability Unique supply chain to fill into zero waste formats at affordable cost Most home care products with zero-plastic packaging + sustainable formats

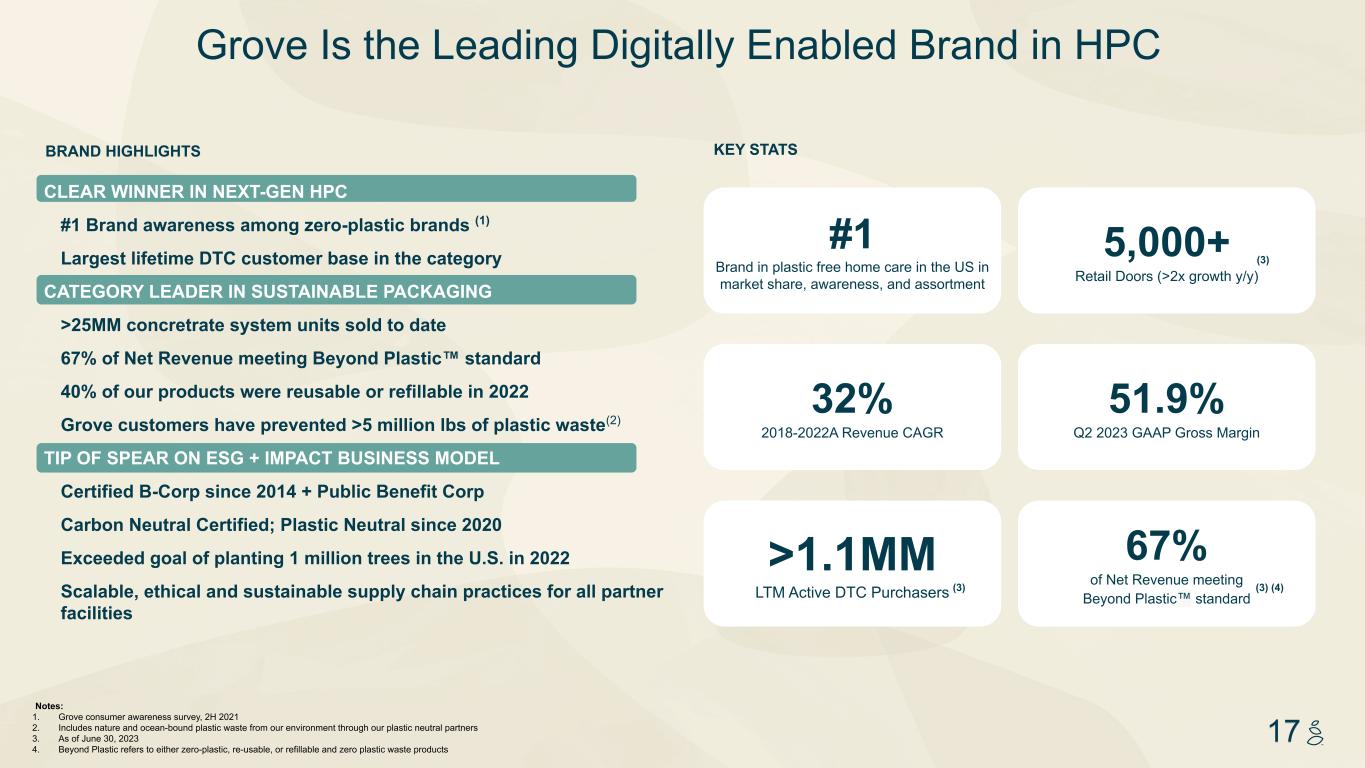

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 17 CLEAR WINNER IN NEXT-GEN HPC #1 Brand awareness among zero-plastic brands (1) Largest lifetime DTC customer base in the category CATEGORY LEADER IN SUSTAINABLE PACKAGING >25MM concretrate system units sold to date 67% of Net Revenue meeting Beyond Plastic™ standard 40% of our products were reusable or refillable in 2022 Grove customers have prevented >5 million lbs of plastic waste(2) TIP OF SPEAR ON ESG + IMPACT BUSINESS MODEL Certified B-Corp since 2014 + Public Benefit Corp Carbon Neutral Certified; Plastic Neutral since 2020 Exceeded goal of planting 1 million trees in the U.S. in 2022 Scalable, ethical and sustainable supply chain practices for all partner facilities Grove Is the Leading Digitally Enabled Brand in HPC 32% 2018-2022A Revenue CAGR >1.1MM LTM Active DTC Purchasers 51.9% Q2 2023 GAAP Gross Margin #1 Brand in plastic free home care in the US in market share, awareness, and assortment 67% of Net Revenue meeting Beyond Plastic™ standard 5,000+ Retail Doors (>2x growth y/y) KEY STATSBRAND HIGHLIGHTS Notes: 1. Grove consumer awareness survey, 2H 2021 2. Includes nature and ocean-bound plastic waste from our environment through our plastic neutral partners 3. As of June 30, 2023 4. Beyond Plastic refers to either zero-plastic, re-usable, or refillable and zero plastic waste products (3) (3) (3) (4)

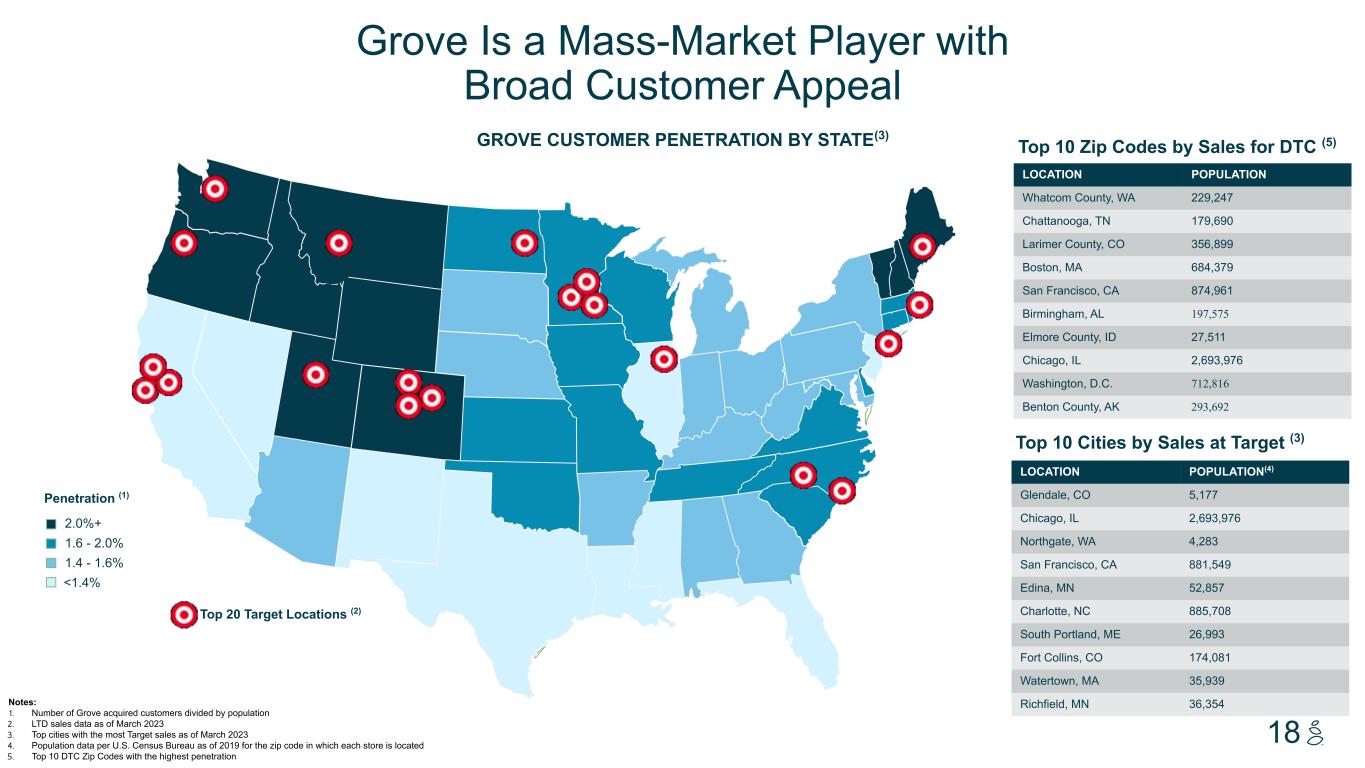

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 18 Grove Is a Mass-Market Player with Broad Customer Appeal Penetration (1) <1.4% 1.4 - 1.6% 1.6 - 2.0% 2.0%+ Top 20 Target Locations (2) Notes: 1. Number of Grove acquired customers divided by population 2. LTD sales data as of March 2023 3. Top cities with the most Target sales as of March 2023 4. Population data per U.S. Census Bureau as of 2019 for the zip code in which each store is located 5. Top 10 DTC Zip Codes with the highest penetration LOCATION POPULATION(4) Glendale, CO 5,177 Chicago, IL 2,693,976 Northgate, WA 4,283 San Francisco, CA 881,549 Edina, MN 52,857 Charlotte, NC 885,708 South Portland, ME 26,993 Fort Collins, CO 174,081 Watertown, MA 35,939 Richfield, MN 36,354 LOCATION POPULATION Whatcom County, WA 229,247 Chattanooga, TN 179,690 Larimer County, CO 356,899 Boston, MA 684,379 San Francisco, CA 874,961 Birmingham, AL 197,575 Elmore County, ID 27,511 Chicago, IL 2,693,976 Washington, D.C. 712,816 Benton County, AK 293,692 Top 10 Zip Codes by Sales for DTC (5) Top 10 Cities by Sales at Target (3) GROVE CUSTOMER PENETRATION BY STATE(3)

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 19 Section 2 Path to Profitability

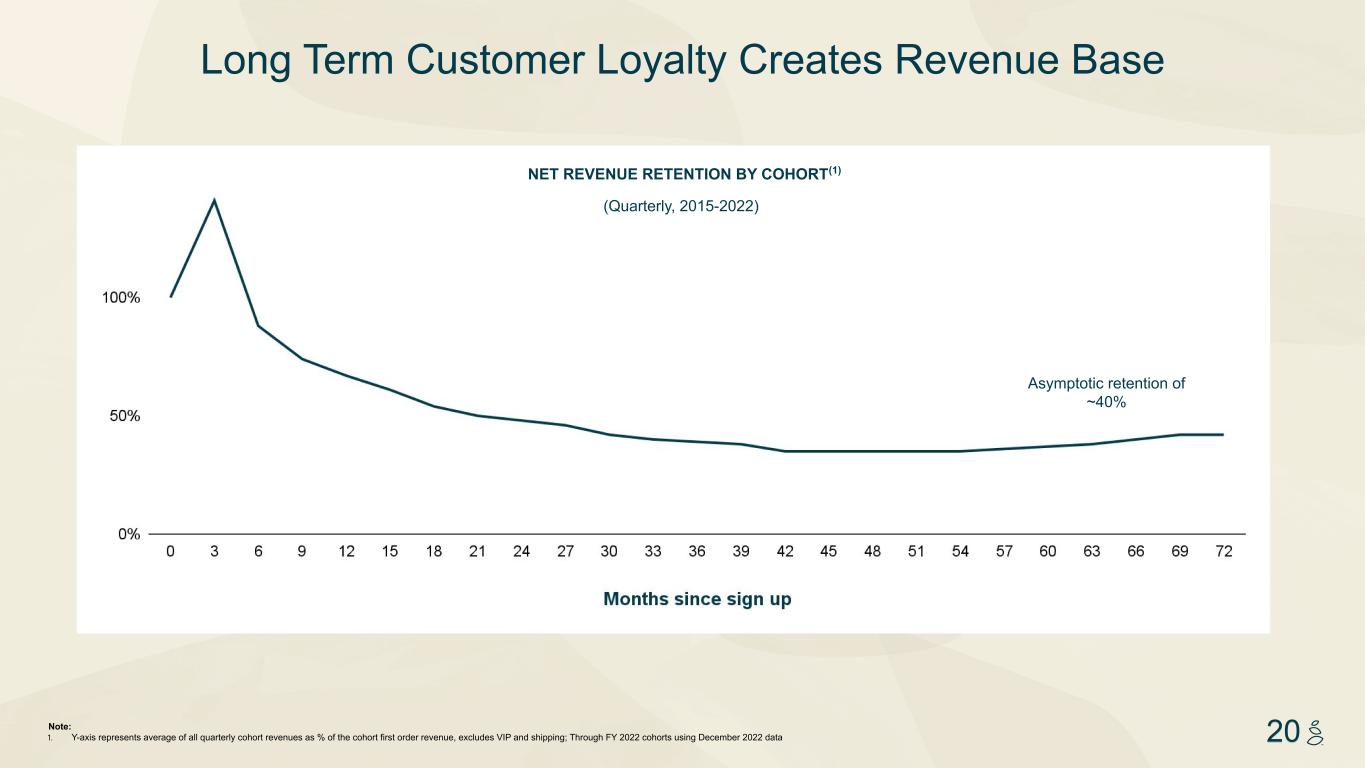

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 20Note: 1. Y-axis represents average of all quarterly cohort revenues as % of the cohort first order revenue, excludes VIP and shipping; Through FY 2022 cohorts using December 2022 data NET REVENUE RETENTION BY COHORT(1) (Quarterly, 2015-2022) Long Term Customer Loyalty Creates Revenue Base Asymptotic retention of ~40%

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 21 % OF TRAFFIC FROM ORGANIC SOURCES IN Q2 2023(1) Grove’s Strong Brand Drives Organic Traffic and Success Across Media Types 21 Note: 1. Organic sources defined as non-paid sources vs. paid brand and performance marketing sources; traffic measured by number of sessions; data is for Q2 ‘23 82% Non-Paid Paid 18%

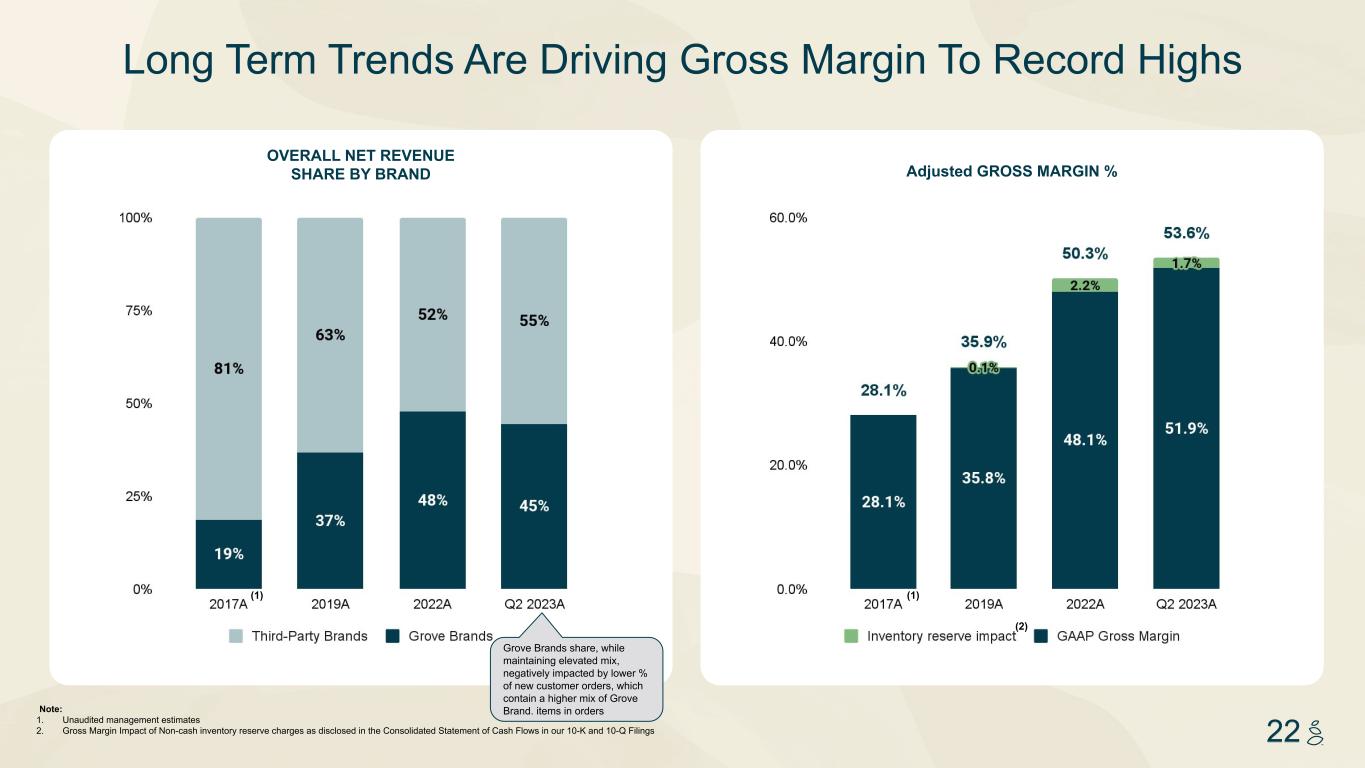

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 22 OVERALL NET REVENUE SHARE BY BRAND Long Term Trends Are Driving Gross Margin To Record Highs Adjusted GROSS MARGIN % Note: 1. Unaudited management estimates 2. Gross Margin Impact of Non-cash inventory reserve charges as disclosed in the Consolidated Statement of Cash Flows in our 10-K and 10-Q Filings (1) (1) (2) Grove Brands share, while maintaining elevated mix, negatively impacted by lower % of new customer orders, which contain a higher mix of Grove Brand. items in orders

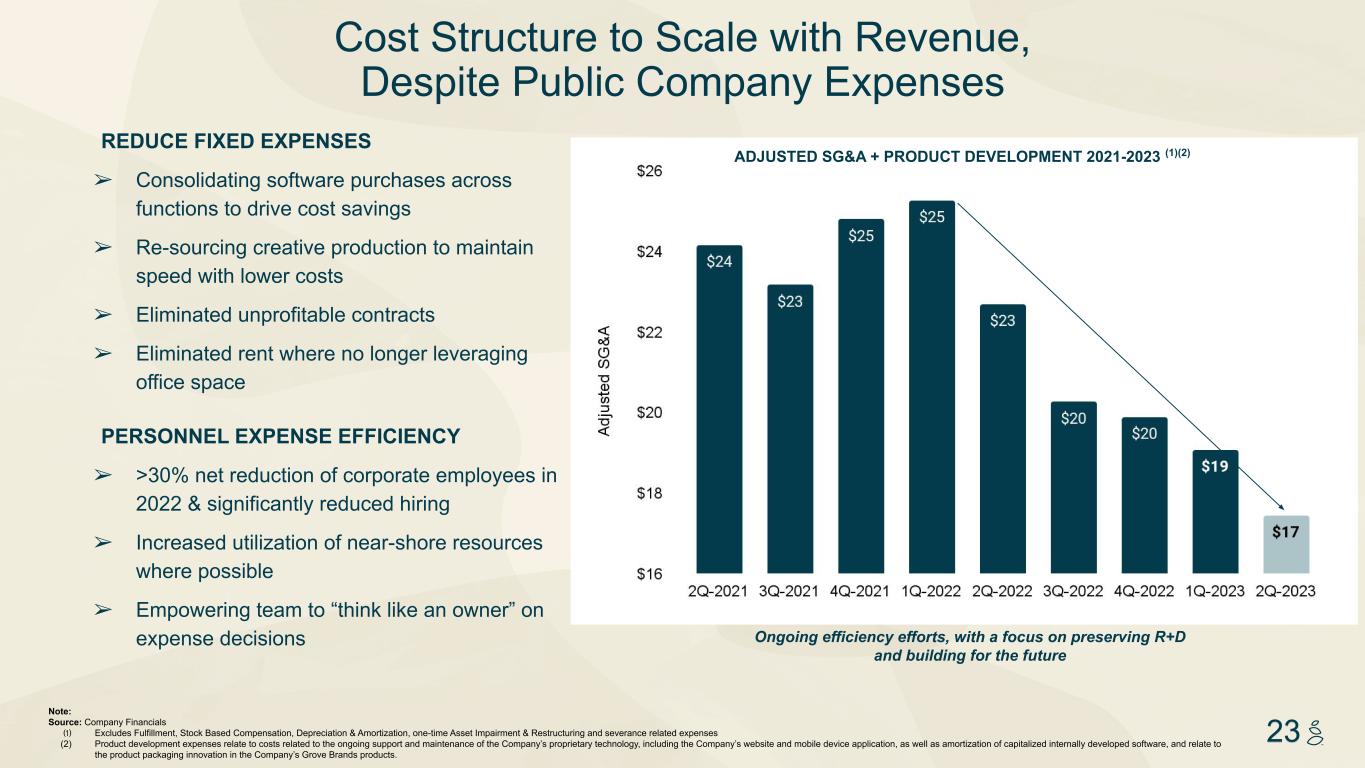

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 23 REDUCE FIXED EXPENSES ➢ Consolidating software purchases across functions to drive cost savings ➢ Re-sourcing creative production to maintain speed with lower costs ➢ Eliminated unprofitable contracts ➢ Eliminated rent where no longer leveraging office space PERSONNEL EXPENSE EFFICIENCY ➢ >30% net reduction of corporate employees in 2022 & significantly reduced hiring ➢ Increased utilization of near-shore resources where possible ➢ Empowering team to “think like an owner” on expense decisions Cost Structure to Scale with Revenue, Despite Public Company Expenses Note: Source: Company Financials (1) Excludes Fulfillment, Stock Based Compensation, Depreciation & Amortization, one-time Asset Impairment & Restructuring and severance related expenses (2) Product development expenses relate to costs related to the ongoing support and maintenance of the Company’s proprietary technology, including the Company’s website and mobile device application, as well as amortization of capitalized internally developed software, and relate to the product packaging innovation in the Company’s Grove Brands products. 1 Ongoing efficiency efforts, with a focus on preserving R+D and building for the future ADJUSTED SG&A + PRODUCT DEVELOPMENT 2021-2023 (1)(2)

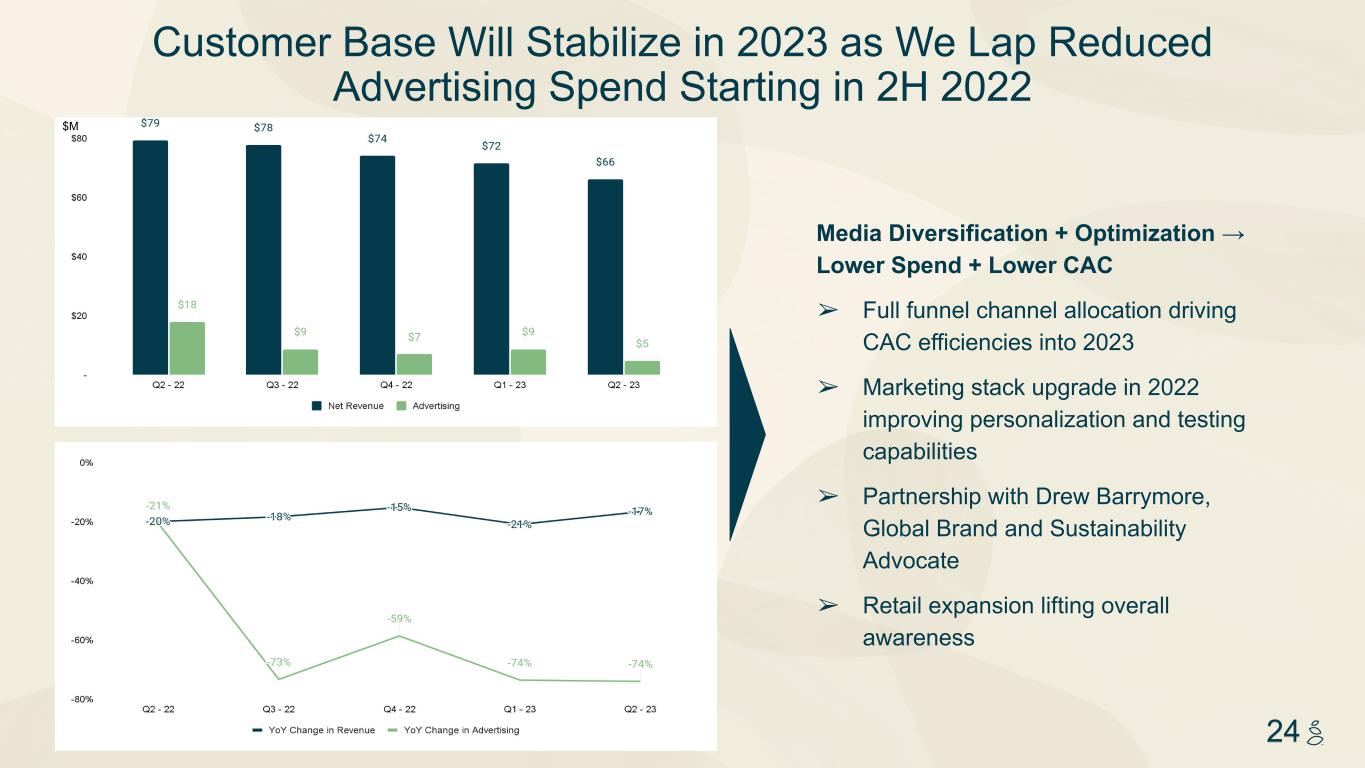

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 24 Customer Base Will Stabilize in 2023 as We Lap Reduced Advertising Spend Starting in 2H 2022 Media Diversification + Optimization → Lower Spend + Lower CAC ➢ Full funnel channel allocation driving CAC efficiencies into 2023 ➢ Marketing stack upgrade in 2022 improving personalization and testing capabilities ➢ Partnership with Drew Barrymore, Global Brand and Sustainability Advocate ➢ Retail expansion lifting overall awareness $M

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 25 SECTION 3 Catalysts for Growth

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 26 Bringing Grove Co. to Retail Distribution is a Game Changing Opportunity Sources: 1. Per Euromonitor International Ltd, Beauty & Personal Care 2022ed, Home Care 2022ed, Pet Care 2022ed, Consumer Health 2022ed, and Tissue & Hygiene 2022ed; aggregation of beauty, personal care, home care, pet care (excluding food), baby care (diapers and wipes), and vitamins and dietary supplements 2. Management estimates developed from a variety of third-party resources CURRENT SALES CHANNEL U.S. Vertical HPC eCommerce Sales: <$20.0Bn (2) 2021-2025 FOCUS $180Bn (1) U.S. HPC Retail Industry 2023-2030 FOCUS ~$1 Trillion (1) Global HPC Retail Industry The Retail Opportunity is Still Early Days

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 27 Our Retail Footprint is Large + Growing Grove Co. Is a Highly Attractive Brand for Retail Partners: • Attracts coveted and eco-conscious customers to store • Drives increased basket size / spend per trip and profit dollars • Promotes use of retail partners’ online presence, helping create a vibrant omnichannel ecosystem Select Retail Partners Rapid Growth in Points of Distribution 5,000+ Retail Doors(1) (>2x growth y/y) 150 Unique SKUs with Retail partners in 2023(2) Grove Co Launched Q1 2023 Grove’s Leading Sustainable Personal Care Brand Grove’s Flagship Sustainable Home Supplies Brand Just Kicking Off Amazon Notes: 1. As of June 30, 2023 2. Includes Seasonal SKUs, Amazon bundles and forecasted SKU launches

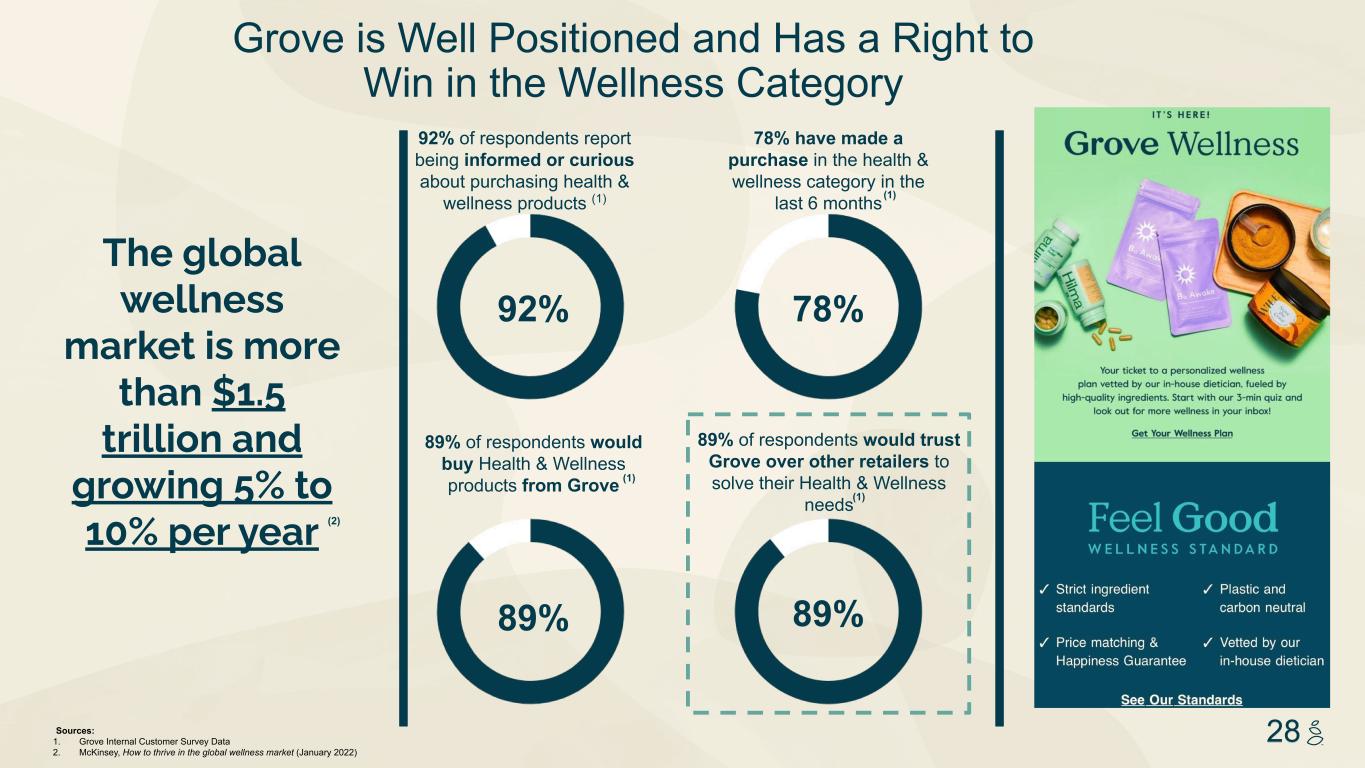

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 28 89% of respondents would trust Grove over other retailers to solve their Health & Wellness needs Grove is Well Positioned and Has a Right to Win in the Wellness Category 89% 92% of respondents report being informed or curious about purchasing health & wellness products (1) 89% 89% of respondents would buy Health & Wellness products from Grove 92% 78% 78% have made a purchase in the health & wellness category in the last 6 months Sources: 1. Grove Internal Customer Survey Data 2. McKinsey, How to thrive in the global wellness market (January 2022) The global wellness market is more than $1.5 trillion and growing 5% to 10% per year (2) (1) (1) (1)

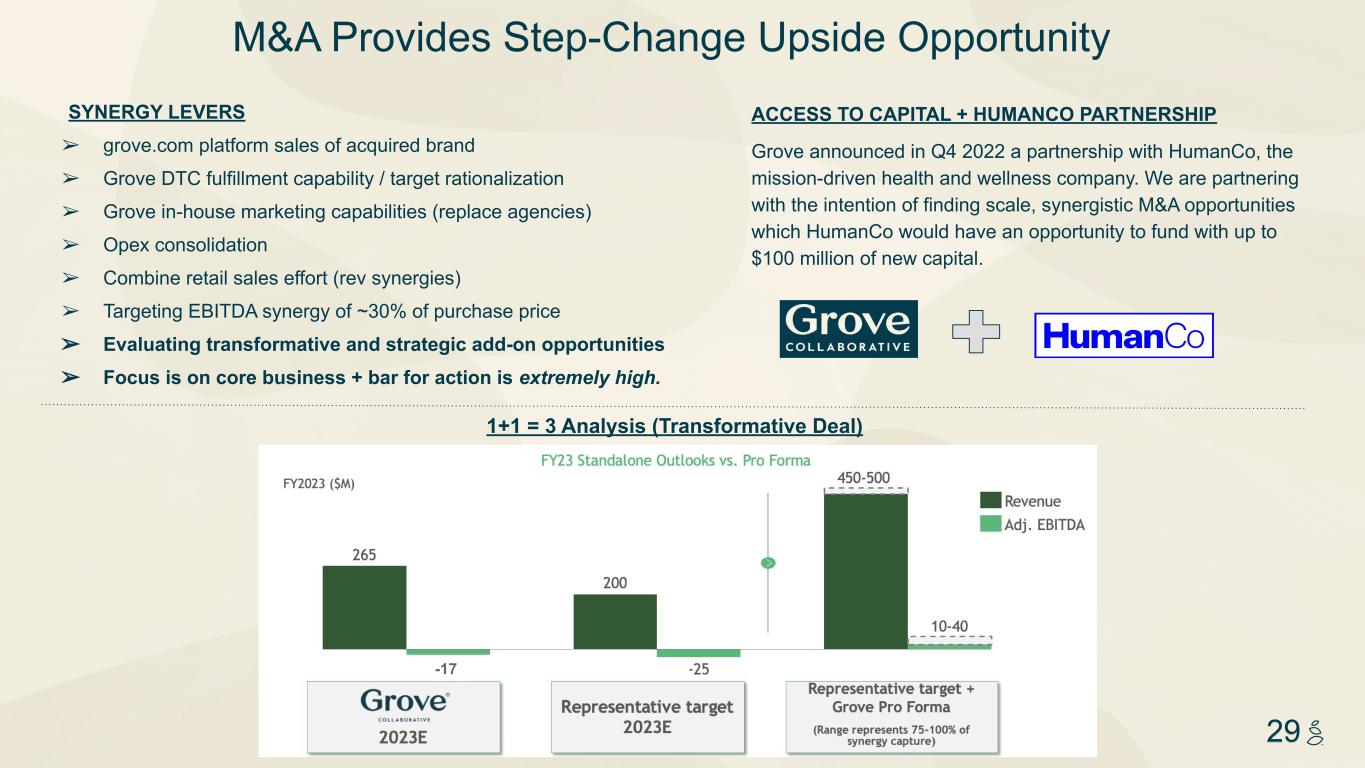

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 29 SYNERGY LEVERS ➢ grove.com platform sales of acquired brand ➢ Grove DTC fulfillment capability / target rationalization ➢ Grove in-house marketing capabilities (replace agencies) ➢ Opex consolidation ➢ Combine retail sales effort (rev synergies) ➢ Targeting EBITDA synergy of ~30% of purchase price ➢ Evaluating transformative and strategic add-on opportunities ➢ Focus is on core business + bar for action is extremely high. M&A Provides Step-Change Upside Opportunity ACCESS TO CAPITAL + HUMANCO PARTNERSHIP Grove announced in Q4 2022 a partnership with HumanCo, the mission-driven health and wellness company. We are partnering with the intention of finding scale, synergistic M&A opportunities which HumanCo would have an opportunity to fund with up to $100 million of new capital. 1+1 = 3 Analysis (Transformative Deal) -17

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 30 Large Players Have a History of Buying Leading Natural / Sustainable Brands SELECT NATURAL HPC M&A ACQ. ACQ. ACQ. ACQ. ACQ. THERE IS ONE INDEPENDENT, PURE PLAY, $100MM+ REVENUE HOME CARE BRAND FOCUSED ON HEALTH + SUSTAINABILITY

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 31 SECTION 4 Financials

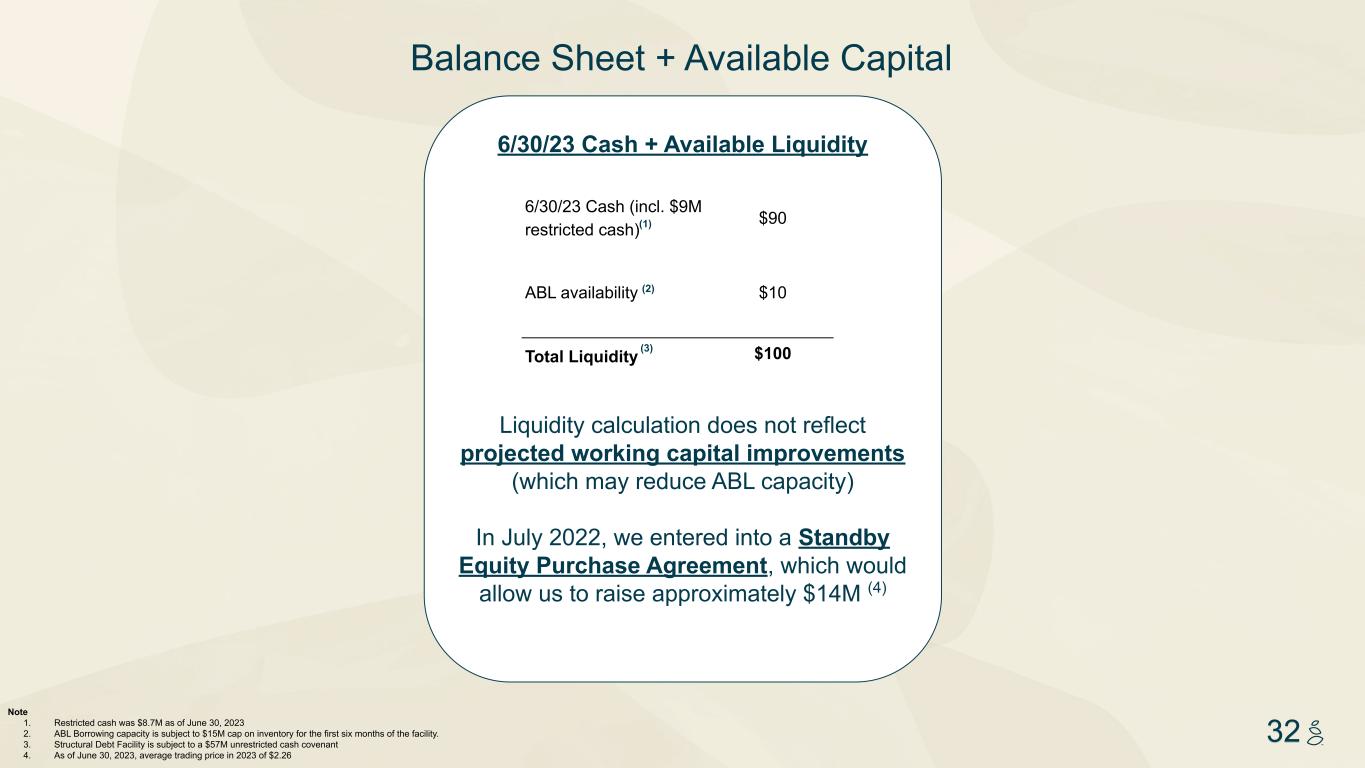

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 32 6/30/23 Cash + Available Liquidity Liquidity calculation does not reflect projected working capital improvements (which may reduce ABL capacity) In July 2022, we entered into a Standby Equity Purchase Agreement, which would allow us to raise approximately $14M (4) 6/30/23 Cash (incl. $9M restricted cash) $90 ABL availability $10 Total Liquidity $100 Balance Sheet + Available Capital Note 1. Restricted cash was $8.7M as of June 30, 2023 2. ABL Borrowing capacity is subject to $15M cap on inventory for the first six months of the facility. 3. Structural Debt Facility is subject to a $57M unrestricted cash covenant 4. As of June 30, 2023, average trading price in 2023 of $2.26 (2) (3) (1)

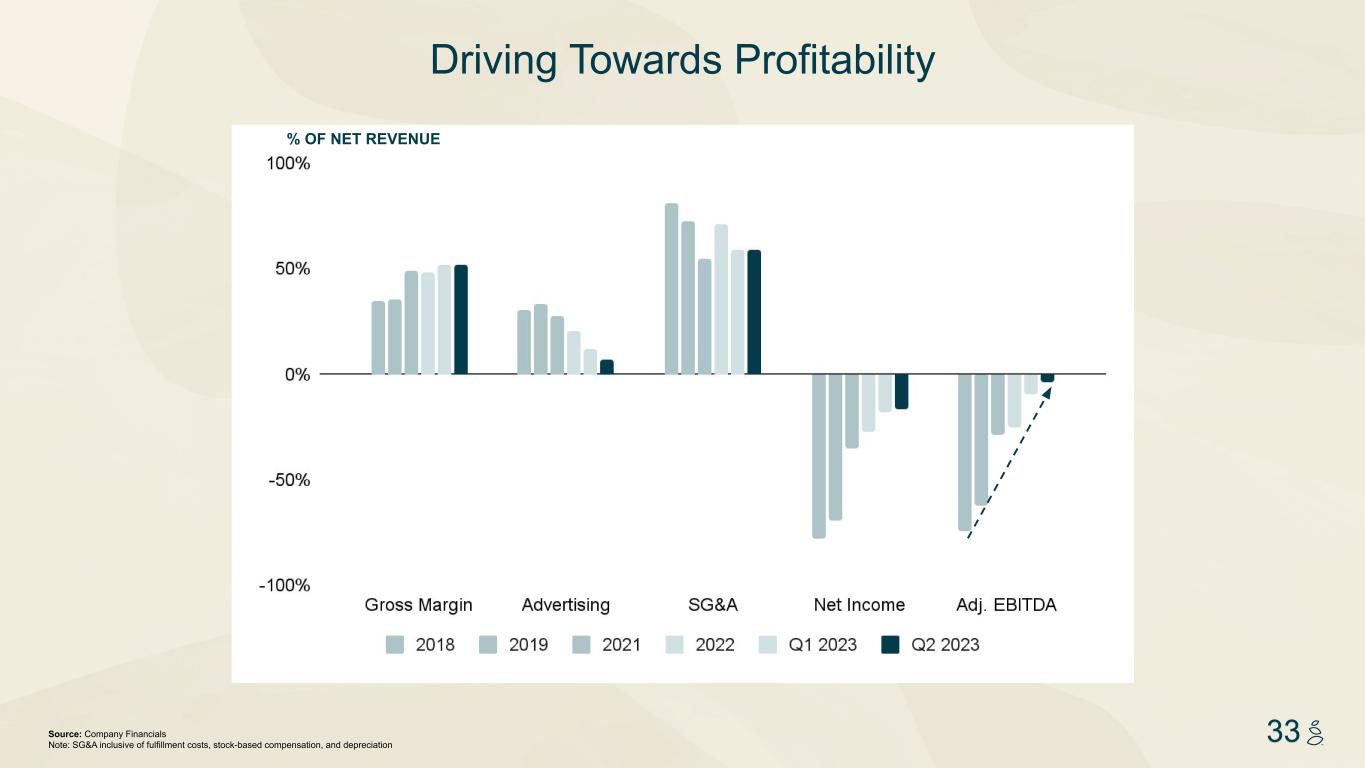

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 33Source: Company Financials Note: SG&A inclusive of fulfillment costs, stock-based compensation, and depreciation % OF NET REVENUE Driving Towards Profitability

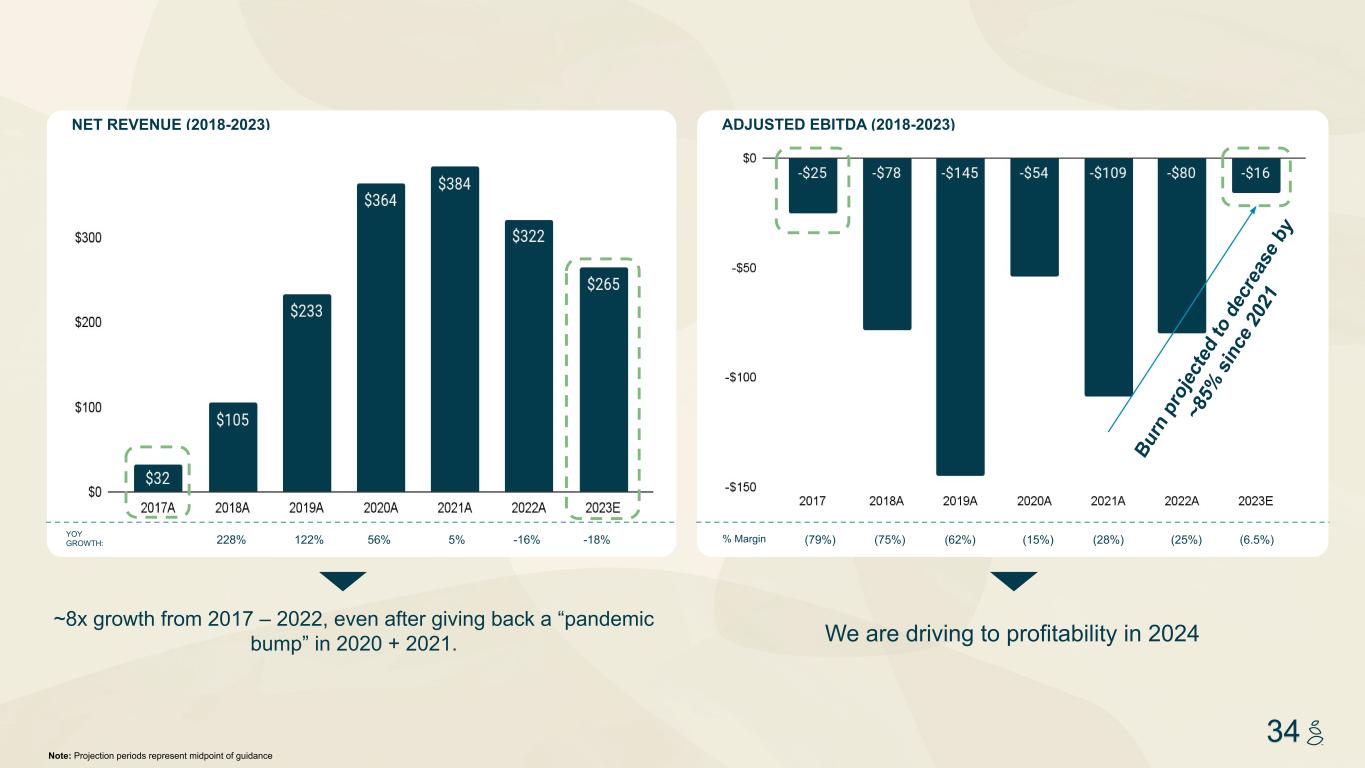

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 34 NET REVENUE (2018-2023) ($MM) Note: Projection periods represent midpoint of guidance ~8x growth from 2017 – 2022, even after giving back a “pandemic bump” in 2020 + 2021. ADJUSTED EBITDA (2018-2023) (75%)% Margin (62%) (15%) (28%) (25%) (6.5%) Bu rn p ro je ct ed to d ec re as e by ~8 5% s in ce 2 02 1 We are driving to profitability in 2024 228%YOY GROWTH: 122% 56% 5% -16% -18% (79%)

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 35 DTC NET REVENUE PER ORDER (2018-2023) Notes: 1. Gross margin excludes the impact of Non-cash inventory reserve charges as disclosed in the Consolidated Statement of Cash Flows in our 10-K Filings We continue to increase our wallet share with customers ADJUSTED GROSS MARGIN (2018-2023) While being margin accretive YOY GROWTH: (1) 16% 12% 27% 7% 5% 660bps 120bps 1,290bps 160bps (10bps) 340bps11% Record high in Q2 2023

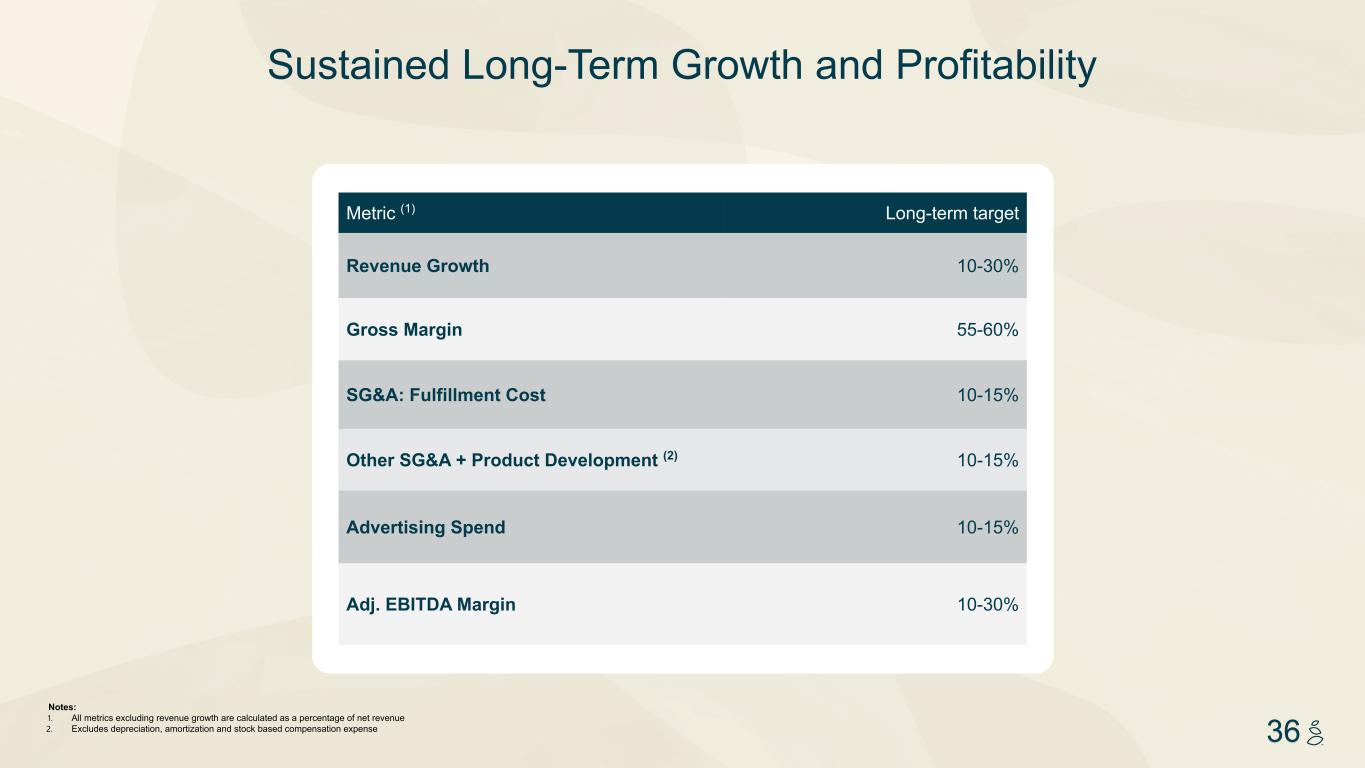

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 36 Sustained Long-Term Growth and Profitability Notes: 1. All metrics excluding revenue growth are calculated as a percentage of net revenue 2. Excludes depreciation, amortization and stock based compensation expense Metric (1) Long-term target Revenue Growth 10-30% Gross Margin 55-60% SG&A: Fulfillment Cost 10-15% Other SG&A + Product Development (2) 10-15% Advertising Spend 10-15% Adj. EBITDA Margin 10-30%

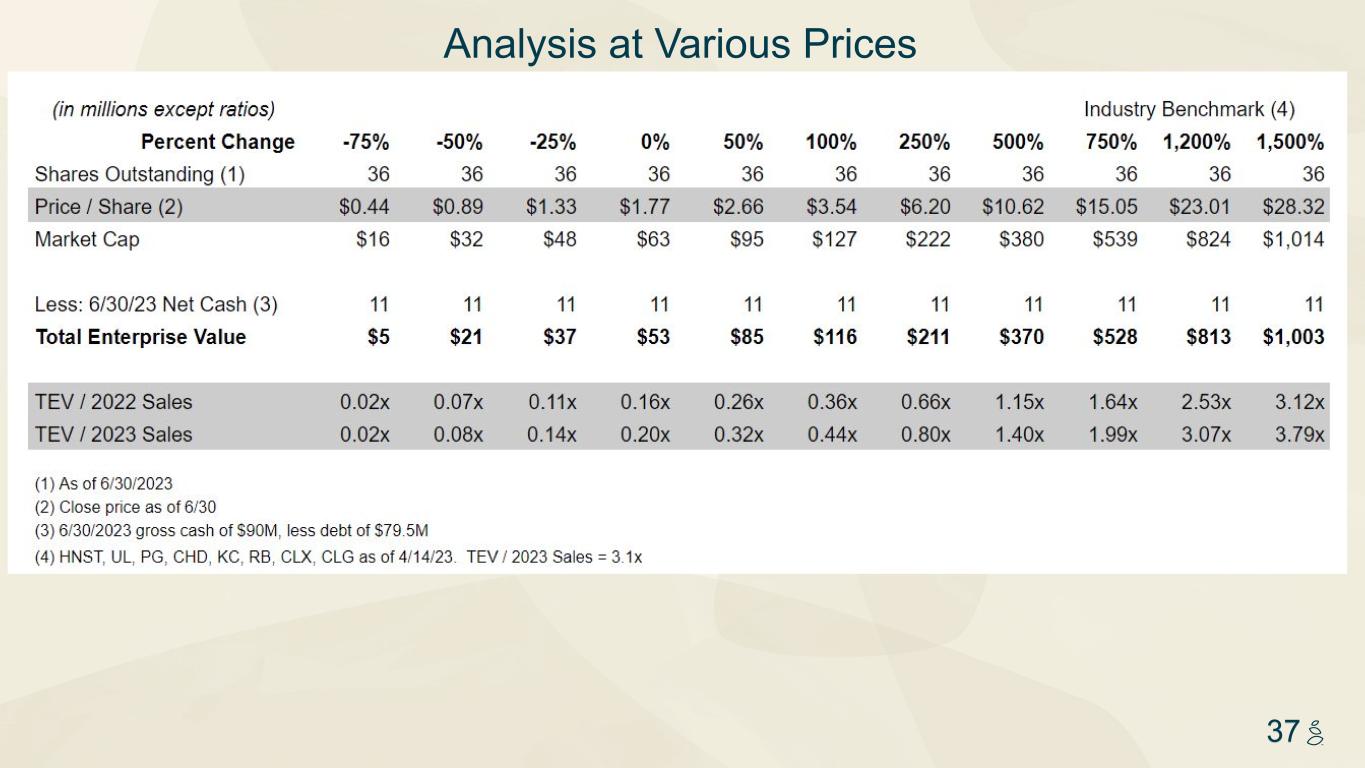

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 37 Analysis at Various Prices

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 38 APPENDIX Supplemental Materials

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 39 Adjusted EBITDA Reconciliation $MM (1) Note: 1. Totals in table may not sum due to rounding 2019A 2020A 2021A 2022A Q2-2022A Q2-2023A Net Loss ($161) ($72) ($136) ($88) ($35) ($11) Stock-Based Compensation $12 $8 $15 $46 $20 $5 Depreciation and Amortization $2 $4 $5 $6 $1 $1 Remeasurement of Convertible Preferred Stock Warrant Liability — $1 $1 ($2) $0 — Change in Fair Value of Additional Shares liability — — — $1 $2 $0 Change in Fair Value of Earn-Out Liability — — — ($66) ($17) ($1) Change in Fair Value of Public and Private Placement Warrants Liability — — — ($6) ($1) ($1) Change in Fair Value of Structural Derivative Liability — — — — — $0 Transaction Costs Allocated to Derivative Liabilities upon Business Combination — — — $7 $7 — Interest Income — — — ($1) — ($1) Interest Expense $2 $6 $5 $10 $2 $4 Restructuring and Severance Related Expenses — — — $9 — $1 Loss on Extinguishment of Debt — — $1 $5 — — Provision for Income Taxes $0 $0 $0 $0 $0 $0 Adjusted EBITDA ($145) ($54) ($109) ($80) ($21) ($3)

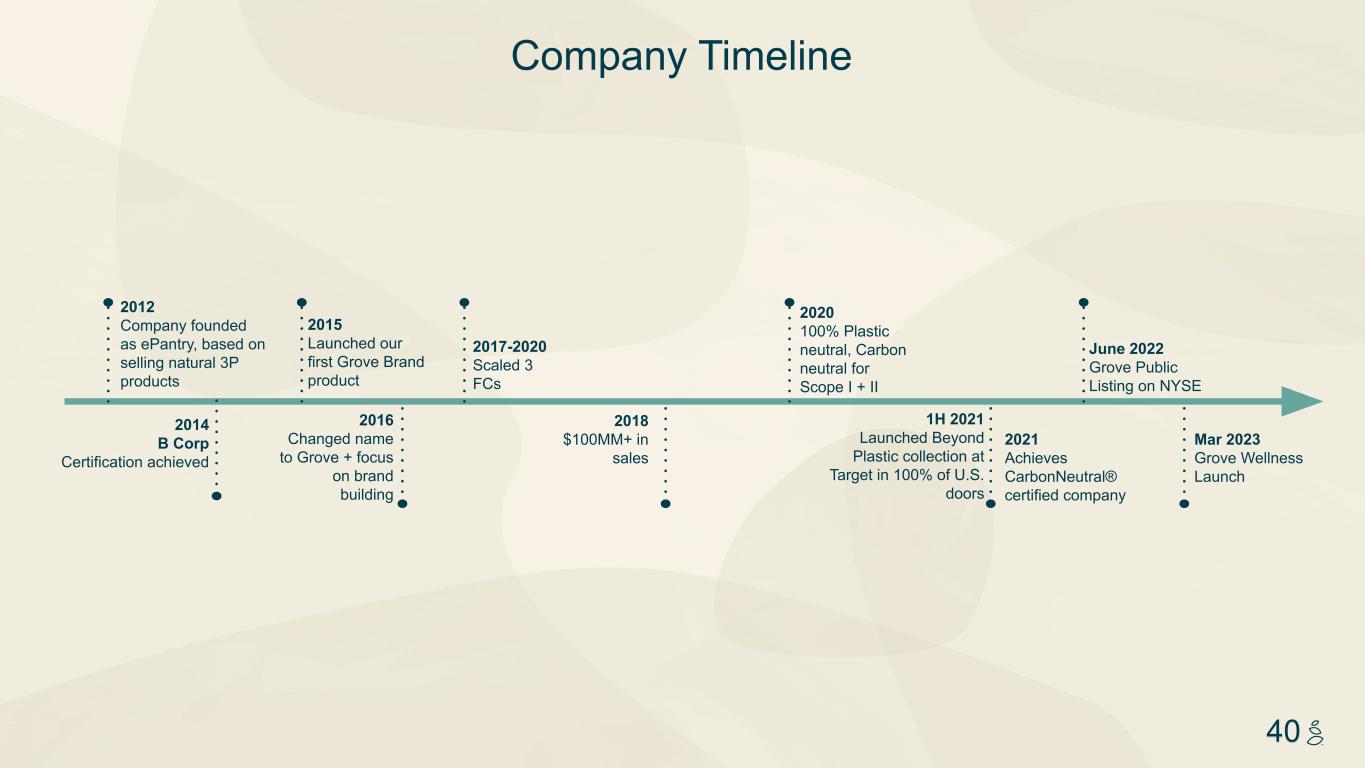

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 40 Company Timeline 2016 Changed name to Grove + focus on brand building 1H 2021 Launched Beyond Plastic collection at Target in 100% of U.S. doors 2012 Company founded as ePantry, based on selling natural 3P products 2014 B Corp Certification achieved 2015 Launched our first Grove Brand product 2017-2020 Scaled 3 FCs 2020 100% Plastic neutral, Carbon neutral for Scope I + II June 2022 Grove Public Listing on NYSE 2018 $100MM+ in sales 2021 Achieves CarbonNeutral® certified company Mar 2023 Grove Wellness Launch

NOTES START FROM HERE AND GROW UP NO CONTENT BELOW THIS LINE CONTENT BELOW THIS LINE SUBTITLE BELOW THIS LINE TITLE CAN NOT GO ABOVE THIS LINE 3 59 76 0 114 88 120 159 144 130 186 128 102 163 157 172 196 200 255 255 255 0 0 0 247 243 228 3 59 76 247 243 228 41 Stu to pick Update copy Grove is creating the change in CPG that the world needs.