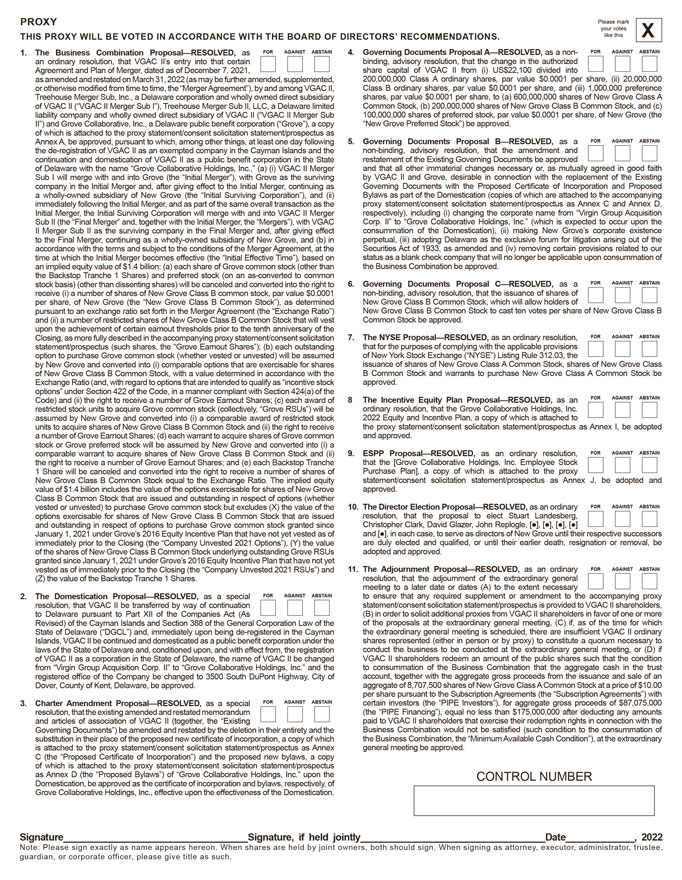

PROXY Please mark your votes

THIS PROXY WILL BE

VOTED IN ACCORDANCE WITH THE BOARD OF DIRECTORS’ RECOMMENDATIONS. like this X

1. The Business Combination Proposal—RESOLVED, as FOR AGAINST ABSTAIN 4.

Governing Documents Proposal A—RESOLVED, as a non- FOR AGAINST ABSTAIN an Agreement ordinary and resolution, Plan of Merger, that VGAC dated II’s as entry of December into that 7, certain 2021, binding, share capital advisory of

resolution, VGAC II from that the (i) change US$22,100 in the divided authorized into or as otherwise amended modified and restated from on time March to time, 31, the 2022 “Merger (as may Agreement”), be further amended, by and among

supplemented, VGAC II, 200,000,000 Class B ordinary Class shares, A ordinary par value shares, $0.0001 par value per share, $0.0001 and per (iii) share, 1,000,000 (ii) 20,000,000 preference of Treehouse VGAC II Merger (“VGAC Sub, II Merger

Inc., a Sub Delaware I”), Treehouse corporation Merger and Sub wholly II, LLC, owned a Delaware direct subsidiary limited Common shares, par Stock, value (b) $0.0001 200,000,000 per share, shares to (a) of New 600,000,000 Grove Class shares B

Common of New Grove Stock, Class and (c) A liability II”) and company Grove Collaborative, and wholly Inc. owned , a Delawarepublic direct subsidiary benefit of VGAC corporation II (“VGAC (“Grove”), II Merger a copy Sub

100,000,000 “New Grove Preferred shares of Stock”) preferred be stock, approved. par value $0.0001 per share, of New Grove (the of which is attached to the proxy statement/consent solicitation statement/prospectus as Annex A, be approved,

pursuant to which, among other things, at least one day following 5. Governing Documents Proposal B—RESOLVED, as a FOR AGAINST ABSTAIN continuation the de-registration and domestication of VGAC II as of an VGAC exempted II as company a public

benefit in the Cayman corporation Islands in the and State the restatement non-binding, ofadvisory the Existing resolution, Governing that Documents the amendment be approved and of Sub Delaware I will merge with with the name and into “Grove

Grove Collaborative (the “Initial Holdings, Merger”), Inc. with,” Grove (a) (i) VGAC as the IIsurviving Merger and by VGAC that all II other and Grove, immaterial desirable changes in connection necessary with or, as the mutually

replacement agreed of in the good Existing faith company a wholly-owned in the Initial subsidiary Merger of and, New after Grove giving (the effect “Initial to Surviving the Initial Corporation”), Merger, continuing and as (ii) Governing

Bylaws as part Documents of the Domestication with the Proposed (copies of Certificate which are of attached Incorporation to the and accompanying Proposed immediately Initial Merger, following the Initial the Surviving Initial Merger, Corporation

and as will part merge of the same with and overall into transaction VGAC II Merger as the respectively), proxy statement/consent including (i) solicitation changing the statement/prospectus corporate name from as “Virgin Annex Group C and

Acquisition Annex D,

II Sub Merger II (the Sub “Final II Merger” as the surviving and, together company with the in the Initial Final Merger, Merger the

and, “Mergers”), after giving with VGAC effect Corp. consummation II” to “Grove of the Collaborative Domestication), Holdings, (ii) making Inc.” (which New is Grove’s expected corporate to occur existence upon the to

accordance the Final Merger, with the continuing terms and subject as a wholly-owned to the conditions subsidiary of the Merger of New Agreement, Grove, and at (b) the in perpetual, Securities Act (iii) adopting of 1933, as Delaware amended as and

the exclusive (iv) removing forum certain for litigation provisions arising related out to of our the an time implied at which equity the value Initial of Merger $1.4 billion: becomes (a) each effective share (the of “Initial Grove Effective

common Time”), stock (other based than on the status Business as a blank Combination check company be approved. that will no longer be applicable upon consummation of the Backstop Tranche 1 Shares) and preferred stock (on an as-converted to

common stock basis) (other than dissenting shares) will be canceled and converted into the right to 6. Governing Documents Proposal C—RESOLVED, as a FOR AGAINST ABSTAIN receive (i) a number of shares of New Grove Class B common stock, par value

$0.0001 non-binding, New Grove Class advisory B Common resolution, Stock, that which the issuance will allow of holders shares of of pursuant per share, to of an New exchange Grove ratio (the set “New forth Grove in the Class Merger B Agreement

Common Stock”), (the “Exchange as determined Ratio”) New Grove Class B Common Stock to cast ten votes per share of New Grove Class B and (ii) a number of restricted shares of New Grove Class B Common Stock that will vest Common Stock

be approved. upon the achievement of certain earnout thresholds prior to the tenth anniversary of the Closing, as more fully described in the accompanying proxy statement/consent solicitation 7. The NYSE Proposal—RESOLVED, as an ordinary

resolution, FOR AGAINST ABSTAIN statement/prospectus (such shares, the “Grove Earnout Shares”); (b) each outstanding that of New for the York purposes Stock Exchange of complying (“NYSE”) with the Listing applicable Rule 312.03,

provisions the option by New to Grove purchase and Grove converted common into (i) stock comparable (whether options vested that or unvested) are exercisable will be for assumed shares issuance of shares of New Grove Class A Common Stock, shares of

New Grove Class of New Grove Class B Common Stock, with a value determined in accordance with the approved. B Common Stock and warrants to purchase New Grove Class A Common Stock be options” Exchange under Ratio Section (and, with 422 regard of

the to Code, options in a that manner are intended compliant to with qualify Section as “incentive 424(a) of stock the Code) and (ii) the right to receive a number of Grove Earnout Shares; (c) each award of 8 The Incentive Equity Plan

Proposal—RESOLVED, as an FOR AGAINST ABSTAIN restricted stock units to acquire Grove common stock (collectively, “Grove RSUs”) will be 2022 ordinary Equity resolution, and Incentive that the Plan, Grove a copy Collaborative of which

Holdings, is attached Inc. to assumed units to acquire by New shares Grove of New and converted Grove Class into B (i) Common a comparable Stock and award (ii) the of restricted right to receive stock the proxy statement/consent solicitation

statement/prospectus as Annex I, be adopted a number of Grove Earnout Shares; (d) each warrant to acquire shares of Grove common and approved. stock or Grove preferred stock will be assumed by New Grove and converted into (i) a comparable warrant to

acquire shares of New Grove Class B Common Stock and (ii) 9. ESPP Proposal—RESOLVED, as an ordinary resolution, FOR AGAINST ABSTAIN the right to receive a number of Grove Earnout Shares; and (e) each Backstop Tranche that Purchase the [Grove

Plan], Collaborative a copy of which Holdings, is attached Inc. Employee to the Stock proxy New 1 Share Grove will Class be canceled B Common and converted Stock equal into to the the right Exchange to receive Ratio. a number The implied of shares

equity of statement/consent solicitation statement/prospectus as Annex J, be adopted and value of $1.4 billion includes the value of the options exercisable for shares of New Grove approved.

Class B Common Stock that are issued and outstanding in respect of options (whether vested or unvested) to purchase Grove common stock but excludes (X) the value of the 10. The

Director Election Proposal—RESOLVED, as an ordinary FOR AGAINST ABSTAIN options exercisable for shares of New Grove Class B Common Stock that are issued resolution, Christopher that Clark, the David proposal Glazer, to John elect Replogle,

Stuart [●], Landesberg, [●], [●], [●] and January outstanding 1, 2021 under in respect Grove’s of options 2016 Equity to purchase Incentive Grove Plan common that have stock not yet granted vested since as of and

[●], in each case, to serve as directors of New Grove until their respective successors immediately prior to the Closing (the Company Unvested 2021 Options), (Y) the value are adopted duly and elected approved. and qualified, or until their

earlier death, resignation or removal, be of granted the shares since of January New Grove 1, 2021 Class under B Common Grove’s 2016 Stock Equity underlying Incentive outstanding Plan that Grove have not RSUs yet vested as of immediately prior

to the Closing (the Company Unvested 2021 RSUs) and 11. The Adjournment Proposal—RESOLVED, as an ordinary FOR AGAINST ABSTAIN (Z) the value of the BackstopTranche 1 Shares. meeting resolution, to that a later the date adjournment or dates of

(A) the to extraordinary the extent necessary general

2. The Domestication Proposal—RESOLVED, as a special FOR AGAINST ABSTAIN to ensure that any required

supplement or amendment to the accompanying proxy resolution, that VGAC II be transferred by way of continuation statement/consent (B) in order to solicit solicitation additional statement/prospectus proxies from VGAC II shareholders is provided to

in VGAC favor II of shareholders, one or more

Revised) to Delaware of the pursuant Cayman to Islands Part XII and of Section the Companies 388 of the Act General

(As Corporation Law of the of the proposals at the extraordinary general meeting, (C) if, as of the time for which State of Delaware (“DGCL”) and, immediately upon being de-registered in the Cayman the shares extraordinary represented

general (either meeting in person is scheduled, or by proxy) there to constitute are insufficient a quorum VGAC necessary II ordinary to laws Islands, of the VGAC State II be of Delaware continued and, and conditioned domesticated upon, as a and

public with benefit effect corporation from, the registration under the conduct the business to be conducted at the extraordinary general meeting, or (D) if of VGAC II as a corporation in the State of Delaware, the name of VGAC II be changed to VGAC

consummation II shareholders of the redeem Business an amount Combination of the that public the shares aggregate such that cash the in condition the trust registered from “Virgin office Group of Acquisition the Company Corp. be II”

changed to “Grove to 3500 Collaborative South DuPont Holdings, Highway, Inc.” and City the of account, together with the aggregate gross proceeds from the issuance and sale of an Dover, County of Kent, Delaware, be approved. aggregate per

share pursuant of 8,707,500 to the shares Subscription of New Grove Agreements Class A (the Common “Subscription Stock at Agreements”) a price of $10.00 with

3. Charter Amendment Proposal—RESOLVED, as a special FOR AGAINST ABSTAIN certain investors (the “PIPE Investors”), for aggregate gross proceeds of $87,075,000

resolution, that the existing amended and restated memorandum (the paid “PIPE to VGAC Financing”), II shareholders equal that no less exercise than their $175,000,000 redemption after rights deducting in connection any amounts with the

Governing and articles Documents”) of association be amended of VGAC and II (together, restated the by the “Existing deletion in their entirety and the

Business Combination would not be satisfied (such condition to the consummation of substitution in their place of the proposed new certificate of incorporation, a copy of which general the Business meeting Combination, be approved. the “Minimum

Available Cash Condition”), at the extraordinary is C attached (the “Proposed to the Certificate proxy statement/consent of Incorporation”) solicitation and the statement/prospectus proposed new bylaws, as aAnnex copy of as which

Annex is D attached (the “Proposed to the proxy Bylaws”) statement/consent of “Grove Collaborative solicitation Holdings, statement/prospectus Inc.” upon the CONTROL NUMBER

Grove Domestication, Collaborative be approved Holdings, as Inc. the, effective certificate upon of incorporation the effectiveness and bylaws, of the Domestication. respectively,

of

Signature___________________________________Signature, if held jointly___________________________________Date_____________, 2022

Note: Please sign exactly as name appears hereon. When shares are held by joint owners, both should sign. When signing as attorney, executor, administrator, trustee, guardian, or

corporate officer, please give title as such.