20107 VGAC II Proxy Card_CLASS-A_REV2—Back

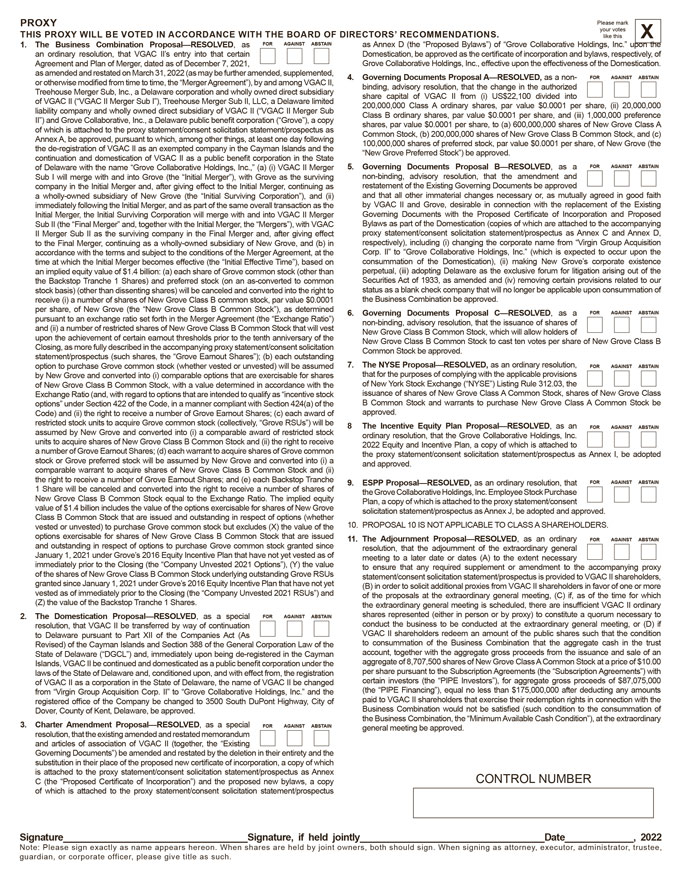

PROXY Please mark THIS PROXY WILL BE VOTED IN ACCORDANCE WITH THE BOARD OF DIRECTORS’ RECOMMENDATIONS. your votes like this X

1. The Business Combination Proposal—RESOLVED, as FOR AGAINST ABSTAIN as Annex D (the “Proposed Bylaws”) of “Grove Collaborative Holdings, Inc.” upon the

an ordinary resolution, that VGAC II’s entry into that certain Domestication, be approved as the certificate of incorporation and bylaws, respectively, of Agreement and Plan of Merger, dated as of December 7, 2021, Grove Collaborative

Holdings, Inc., effective upon the effectiveness of the Domestication. as amended and restated on March 31, 2022 (as may be further amended, supplemented, or otherwise modified from time to time, the “Merger Agreement”), by and among

VGAC II, 4. Governing Documents Proposal A—RESOLVED, as a non- FOR AGAINST ABSTAIN binding, advisory resolution, that the change in the authorized Treehouse Merger Sub, Inc., a Delaware corporation and

wholly owned direct subsidiary share capital of VGAC II from (i) US$22,100 divided into of VGAC II (“VGAC II Merger Sub I”), Treehouse Merger Sub II, LLC, a Delaware limited 200,000,000 Class A ordinary shares, par value $0.0001

per share, (ii) 20,000,000 liability company and wholly owned direct subsidiary of VGAC II (“VGAC II Merger Sub Class B ordinary shares, par value $0.0001 per share, and (iii) 1,000,000 preference II”) and Grove Collaborative, Inc., a

Delawarepublic benefit corporation (“Grove”), a copy shares, par value $0.0001 per share, to (a) 600,000,000 shares of New Grove Class A of which is attached to the proxy statement/consent solicitation statement/prospectus as Common

Stock, (b) 200,000,000 shares of New Grove Class B Common Stock, and (c) Annex A, be approved, pursuant to which, among other things, at least one day following 100,000,000 shares of preferred stock, par value $0.0001 per share, of New

Grove (the the de-registration of VGAC II as an exempted company in the Cayman Islands and the “New Grove Preferred Stock”) be approved. continuation and domestication of VGAC II as a public benefit

corporation in the State of Delaware with the name “Grove Collaborative Holdings, Inc.,” (a) (i) VGAC II Merger 5. Governing Documents Proposal B—RESOLVED, as a FOR AGAINST ABSTAIN Sub I will merge with and into Grove (the

“Initial Merger”), with Grove as the surviving non-binding, advisory resolution, that the amendment and company in the Initial Merger and, after giving effect to the Initial Merger, continuing as

restatement of the Existing Governing Documents be approved a wholly-owned subsidiary of New Grove (the “Initial Surviving Corporation”), and (ii) and that all other immaterial changes necessary or, as mutually agreed in good faith

immediately following the Initial Merger, and as part of the same overall transaction as the by VGAC II and Grove, desirable in connection with the replacement of the Existing Initial Merger, the Initial Surviving Corporation will merge with and

into VGAC II Merger Governing Documents with the Proposed Certificate of Incorporation and Proposed Sub II (the “Final Merger” and, together with the Initial Merger, the “Mergers”), with VGAC Bylaws as part of the Domestication

(copies of which are attached to the accompanying II Merger Sub II as the surviving company in the Final Merger and, after giving effect proxy statement/consent solicitation statement/prospectus as Annex C and Annex D, to the Final Merger,

continuing as a wholly-owned subsidiary of New Grove, and (b) in respectively), including (i) changing the corporate name from “Virgin Group Acquisition accordance with the terms and subject to the conditions of the Merger Agreement,

at the Corp. II” to “Grove Collaborative Holdings, Inc.” (which is expected to occur upon the time at which the Initial Merger becomes effective (the “Initial Effective Time”), based on consummation of the Domestication),

(ii) making New Grove’s corporate existence an implied equity value of $1.4 billion: (a) each share of Grove common stock (other than perpetual, (iii) adopting Delaware as the exclusive forum for litigation arising out of the the

Backstop Tranche 1 Shares) and preferred stock (on an as-converted to common Securities Act of 1933, as amended and (iv) removing certain provisions related to our stock basis) (other than dissenting

shares) will be canceled and converted into the right to status as a blank check company that will no longer be applicable upon consummation of receive (i) a number of shares of New Grove Class B common stock, par value $0.0001 the

Business Combination be approved. per share, of New Grove (the “New Grove Class B Common Stock”), as determined 6. Governing Documents Proposal C—RESOLVED, as a FOR AGAINST ABSTAIN pursuant to an exchange ratio set forth in the

Merger Agreement (the “Exchange Ratio”) non-binding, advisory resolution, that the issuance of shares of and (ii) a number of restricted shares of New Grove Class B Common Stock that will vest New

Grove Class B Common Stock, which will allow holders of upon the achievement of certain earnout thresholds prior to the tenth anniversary of the New Grove Class B Common Stock to cast ten votes per share of New Grove Class B Closing, as

more fully described in the accompanying proxy statement/consent solicitation Common Stock be approved. statement/prospectus (such shares, the “Grove Earnout Shares”); (b) each outstanding as an resolution, option to purchase Grove common

stock (whether vested or unvested) will be assumed 7. The NYSE Proposal—RESOLVED, ordinary FOR AGAINST ABSTAIN by New Grove and converted into (i) comparable options that are exercisable for shares that for the purposes of complying with

the applicable provisions of New Grove Class B Common Stock, with a value determined in accordance with the of New York Stock Exchange (“NYSE”) Listing Rule 312.03, the Exchange Ratio (and, with regard to options that are intended to

qualify as “incentive stock issuance of shares of New Grove Class A Common Stock, shares of New Grove Class options” under Section 422 of the Code, in a manner compliant with Section 424(a) of the B Common Stock and

warrants to purchase New Grove Class A Common Stock be Code) and (ii) the right to receive a number of Grove Earnout Shares; (c) each award of approved. restricted stock units to acquire Grove common stock (collectively, “Grove

RSUs”) will be 8 The Incentive Equity Plan Proposal—RESOLVED, as an assumed by New Grove and converted into (i) a comparable award of restricted stock ordinary resolution, that the Grove Collaborative Holdings, Inc. FOR AGAINST

ABSTAIN units to acquire shares of New Grove Class B Common Stock and (ii) the right to receive 2022 Equity and Incentive Plan, a copy of which is attached to a number of Grove Earnout Shares; (d) each warrant to acquire shares of

Grove common the proxy statement/consent solicitation statement/prospectus as Annex I, be adopted stock or Grove preferred stock will be assumed by New Grove and converted into (i) a and approved. comparable warrant to acquire shares of New

Grove Class B Common Stock and (ii) the right to receive a number of Grove Earnout Shares; and (e) each Backstop Tranche 9. ESPP Proposal—RESOLVED, as an ordinary resolution, that FOR AGAINST ABSTAIN 1 Share will be canceled and

converted into the right to receive a number of shares of the Grove Collaborative Holdings, Inc. Employee Stock Purchase New Grove Class B Common Stock equal to the Exchange Ratio. The implied equity Plan, a copy of which is attached to the

proxy statement/consent value of $1.4 billion includes the value of the options exercisable for shares of New Grove solicitation statement/prospectus as Annex J, be adopted and approved. Class B Common Stock that are issued and outstanding

in respect of options (whether vested or unvested) to purchase Grove common stock but excludes (X) the value of the 10. PROPOSAL 10 IS NOT APPLICABLE TO CLASS A SHAREHOLDERS. options exercisable for shares of New Grove Class B Common Stock

that are issued 11. The Adjournment Proposal—RESOLVED, as an ordinary FOR AGAINST ABSTAIN and outstanding in respect of options to purchase Grove common stock granted since resolution, that the adjournment of the extraordinary general

January 1, 2021 under Grove’s 2016 Equity Incentive Plan that have not yet vested as of meeting to a later date or dates (A) to the extent necessary immediately prior to the Closing (the “Company Unvested 2021 Options”), (Y)

the value to ensure that any required supplement or amendment to the accompanying proxy of the shares of New Grove Class B Common Stock underlying outstanding Grove RSUs statement/consent solicitation statement/prospectus is provided to VGAC II

shareholders, granted since January 1, 2021 under Grove’s 2016 Equity Incentive Plan that have not yet (B) in order to solicit additional proxies from VGAC II shareholders in favor of one or more vested as of immediately prior to the

Closing (the “Company Unvested 2021 RSUs”) and of the proposals at the extraordinary general meeting, (C) if, as of the time for which (Z) the value of the BackstopTranche 1 Shares. the extraordinary general meeting is scheduled,

there are insufficient VGAC II ordinary 2. The Domestication Proposal—RESOLVED, as a special FOR AGAINST ABSTAIN shares represented (either in person or by proxy) to constitute a quorum necessary to resolution, that VGAC II be transferred by

way of continuation conduct the business to be conducted at the extraordinary general meeting, or (D) if to Delaware pursuant to Part XII of the Companies Act (As VGAC II shareholders redeem an amount of the public shares such that the

condition

Revised) of the Cayman Islands and Section 388 of the General Corporation Law of the to consummation of the Business Combination that the aggregate

cash in the trust State of Delaware (“DGCL”) and, immediately upon being de-registered in the Cayman account, together with the aggregate gross proceeds from the issuance and sale of an Islands, VGAC

II be continued and domesticated as a public benefit corporation under the aggregate of 8,707,500 shares of New Grove Class A Common Stock at a price of $10.00 laws of the State of Delaware and, conditioned upon, and with effect from, the

registration per share pursuant to the Subscription Agreements (the “Subscription Agreements”) with of VGAC II as a corporation in the State of Delaware, the name of VGAC II be changed certain investors (the “PIPE Investors”),

for aggregate gross proceeds of $87,075,000 from “Virgin Group Acquisition Corp. II” to “Grove Collaborative Holdings, Inc.” and the (the “PIPE Financing”), equal no less than $175,000,000 after deducting any amounts

registered office of the Company be changed to 3500 South DuPont Highway, City of paid to VGAC II shareholders that exercise their redemption rights in connection with the Dover, County of Kent, Delaware, be approved. Business Combination would not

be satisfied (such condition to the consummation of the Business Combination, the “Minimum Available Cash Condition”), at the extraordinary 3. Charter Amendment Proposal—RESOLVED, as a special FOR AGAINST ABSTAIN general meeting be

approved. resolution, that the existing amended and restated memorandum and articles of association of VGAC II (together, the “Existing Governing Documents”) be amended and restated by the deletion in their entirety and the substitution in

their place of the proposed new certificate of incorporation, a copy of which is attached to the proxy statement/consent solicitation statement/prospectus as Annex CONTROL NUMBER C (the “Proposed Certificate of Incorporation”) and the

proposed new bylaws, a copy of which is attached to the proxy statement/consent solicitation statement/prospectus Signature___________________________________Signature, if held jointly___________________________________Date_____________, 2022 Note:

Please sign exactly as name appears hereon. When shares are held by joint owners, both should sign. When signing as attorney, executor, administrator, trustee, guardian, or corporate officer, please give title as such.